TLDR

- 21Shares filed with SEC to launch ETF tracking ONDO token, potentially opening access to traditional investors

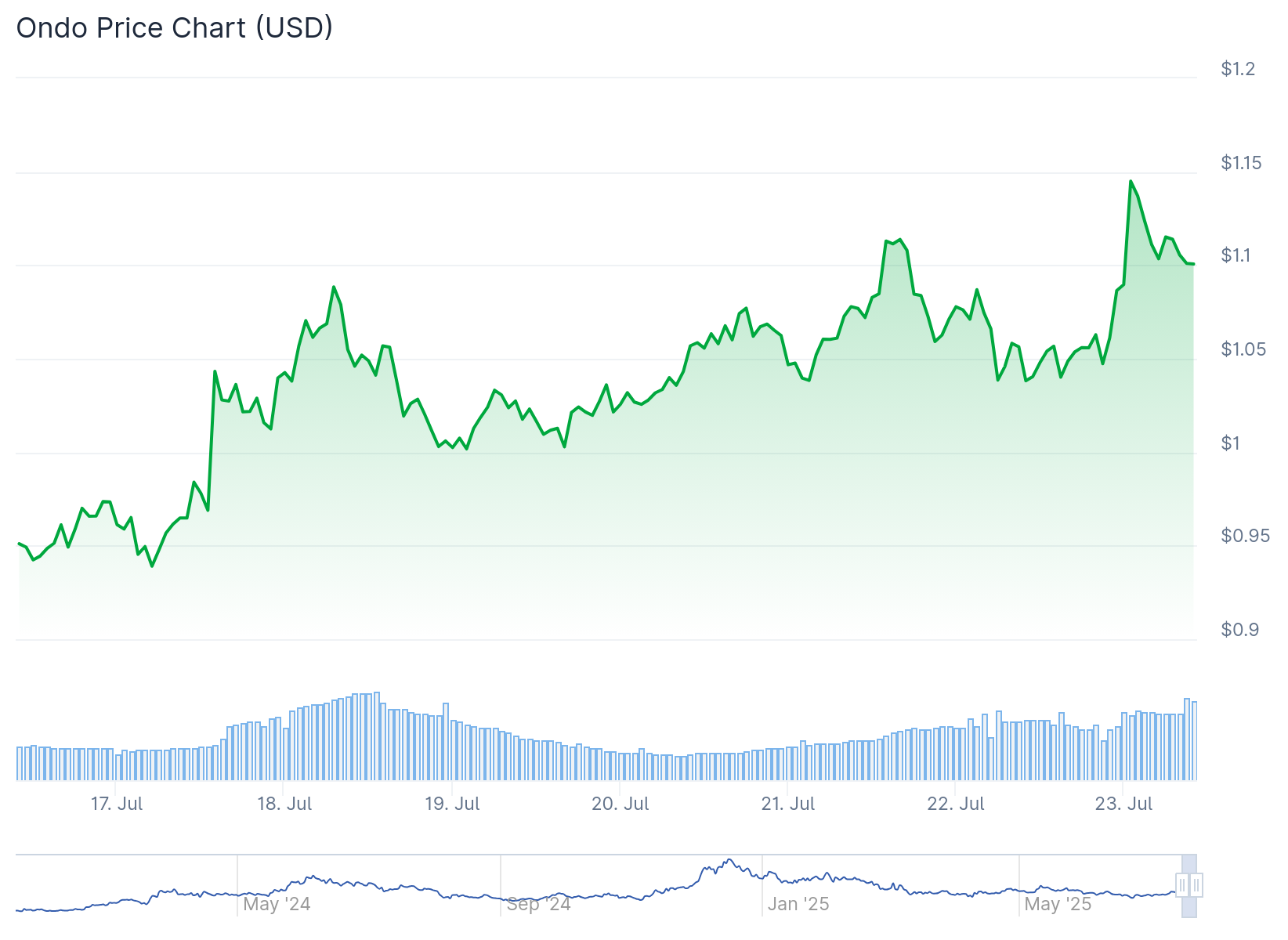

- ONDO surged 20% over past week to $1.12, breaking above major moving averages with strong technical momentum

- Key resistance level at $1.13-$1.15 could trigger 70% rally to $1.75 if broken, according to analyst Ali Martinez

- On-chain metrics show 35% surge in new wallet addresses and 16% increase in daily active users

- Long-term holders increased by 12% while short-term traders jumped 15%, indicating growing confidence

21Shares has officially filed with the U.S. Securities and Exchange Commission to launch an exchange-traded product tracking ONDO, the native token of Ondo Finance. The filing could make the token more accessible to traditional investors seeking exposure to real-world assets through cryptocurrency.

MASSIVE ALERT: $ONDO is the next institutional darling!

BlackRock didn't align with $XRP and $ONDO by accident – they see what's coming 👀

21Shares ETF filing = institutional floodgates about to OPEN

Smart money is positioning NOW before retail catches up! 🚀 pic.twitter.com/qdHxgsq9R4

— Jeff Cook 🪐 (@jeffiscooking) July 22, 2025

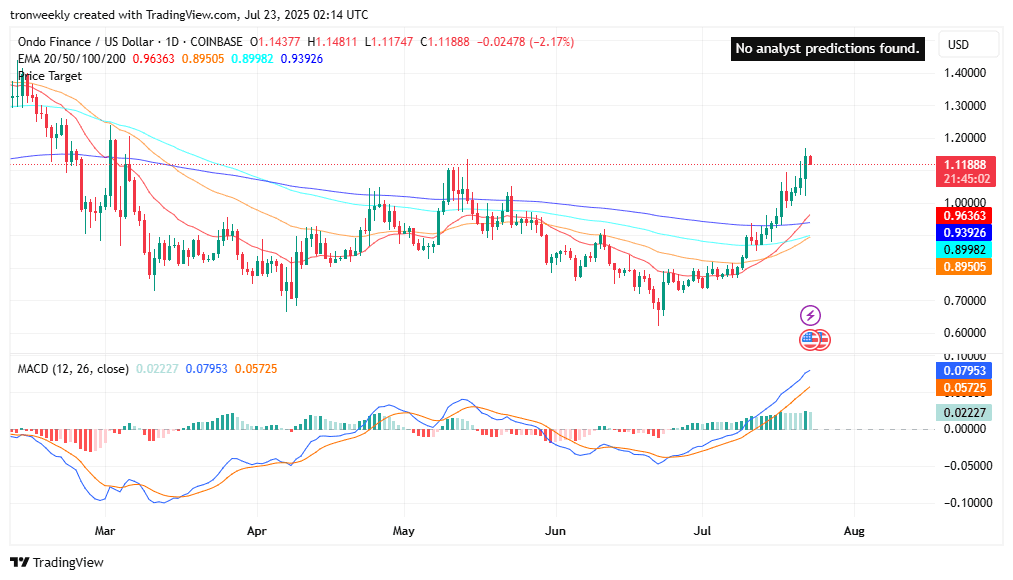

ONDO traded at $1.1188 as of July 23, representing a 3% gain over 24 hours and capping a strong seven-day period with a 20% increase. The token has broken out from a prolonged trading range between $0.50 and $0.70, surging above its 200-day exponential moving average in early July.

Ondo Finance specializes in integrating traditional financial assets like U.S. Treasury bonds and money market funds into blockchain infrastructure. The platform’s tokenized products have gained attention as the intersection of traditional finance and decentralized finance expands.

The World Liberty Financial DeFi project, which has ties to Donald Trump, purchased approximately $500,000 worth of ONDO tokens. This investment supports a multi-asset treasury and highlights connections between financial innovation and political spheres.

Technical Analysis Points to Continued Momentum

The token now trades above all major exponential moving averages including the 20, 50, 100, and 200-day levels, which are all trending upward. The 20-day EMA sits around $0.96, while the 200-day EMA is near $0.93, confirming strong upward momentum.

The MACD indicator shows the MACD line at approximately 0.079 and the signal line at 0.057. The histogram remains positive and rising, indicating continued buying interest, though both lines have reached elevated levels suggesting potential overbought conditions.

Support levels are clearly defined with the first important level at $1.00, which previously acted as resistance. Below that, the zone between $0.93 and $0.96 contains multiple moving averages that could provide additional support if prices decline.

Crypto analyst Ali Martinez identifies $1.15 as a critical resistance level based on daily candlestick charts for the ONDO/USDT perpetual contract on Binance. The token previously failed to break through this resistance in early March and again in April 2025.

$ONDO is pressing against a crucial resistance at $1.15. A confirmed breakout here could ignite a 70% rally! pic.twitter.com/N9t4iQjOqY

— Ali (@ali_charts) July 21, 2025

A confirmed break above the $1.13-$1.15 resistance zone could launch ONDO toward a new short-term target of $1.75, representing a potential 70% upside from current levels. Martinez suggests this breakout would mark a major technical achievement and could open the door for a sustained rally.

Long-Term Pattern Suggests Parabolic Move

Analysis from Solberg Invest reveals ONDO has recently broken out of a long-term descending triangle pattern, typically associated with bullish reversal potential. The breakout has been supported by strong volume and price structure, indicating the move extends beyond a temporary rally.

$ONDO update:

Full steam ahead with no turning back – new ATH on the horizon this year! Momentum’s insane – your thoughts? 🚀📊🔥

#ONDO #CryptoTrading #MarketAnalysis pic.twitter.com/nqSUwwZaKr— Solberg Invest 🧢 (@SolbergInvest) July 21, 2025

The triangle pattern began forming in early 2025 during ONDO’s downtrend, and its recent invalidation signals a major shift in market dynamics. Solberg’s projected price path indicates a potential parabolic rise toward $3.40, which would establish a new all-time high for ONDO.

On-chain data from IntoTheBlock shows a 35% surge in new wallet addresses over the past week, signaling strong influx of first-time users or investors. Active addresses increased by 16.46%, suggesting rising day-to-day transaction volume and user participation.

Zero balance addresses grew by more than 20%, indicating continued onboarding interest. These metrics reflect robust organic growth and expanding network usage, often early indicators of sustainable bullish trends in digital assets.

The structure of ONDO’s holder base is evolving positively. Long-term holders who have kept assets for over a year increased by 12.25%, highlighting growing confidence in the token’s long-term potential.

Short-term traders holding ONDO for less than a month surged by 14.94%, indicating building speculative interest around recent price movements and breakout potential. The cruiser segment, holders between one and twelve months, saw a modest 0.87% gain.

Near-term targets include the $1.20 to $1.25 area, which would provide the next resistance level. If momentum continues, the token could retrace back to earlier highs around $1.40 experienced earlier this year.