For years, XRP has been the token associated with disrupting banks, and its community has fought alongside Ripple in reshaping global settlements.

But a new wave of interest is forming around PayDax Protocol (PDP), a project that many XRP holders say is taking the fight against banks even further. While XRP focuses on cross-border payments, PayDax has designed a system that replaces core banking functions outright.

From lending to borrowing to insurance, PDP uses peer-to-peer smart contracts that redistribute profits back to the users. With XRP holders already familiar with the flaws of the traditional financial system, it is no surprise that many are looking to PDP as the next best crypto to buy now.

How PayDax Replaces Banks Altogether

Banks thrive on spreads, fees, and control. They collect deposits, pay out interests at less than 1%, and lend out the same money at up to 20%.

What’s more, they then decide who gets access to crucial credit and under what terms, often excluding millions of people entirely. However, PayDax Protocol (PDP) eliminates that model by turning lending, borrowing, and insuring into a shared economy.

Savers can lend directly to borrowers and earn up to 15.2% APY instead of scraps from banks. But what makes PayDax’s model stand out is that lenders have access to institutional-level insurance through a novel P2P Redemption Pool.

Profitable Lending With P2P Insurance

Let’s take Bob, who has $50,000 he wants to earn interest on, for example. Traditionally, Bob locks away his savings for a year with a bank, earning an average of 0.5% annual interest in the U.S. However, instead of watching banks lend out his $50k for 10-20% interest while pocketing the spread, he turns to PayDax Protocol (PDP).

On PayDax, Bob becomes the bank. He lends out his $50,000 on his own terms to a borrower on PayDax, earning him up to 15.2% APY. And through a novel Redemption Pool, Bob does so with a similar level of security and insurance that traditionally banking institutions offer.

When Bob gives out a loan to Jane, for example, a PayDax insurer like Jack steps in to underwrite the loan for a premium. When Jane pays back, Jack pockets his premium. However, if Jane defaults, the Redemption Pool steps in to cover the losses, while stakers also earn up to 20% APY.

Borrowing With Unprecedented Flexibility

Just as for lenders, PayDax is equally as transformative for borrowers. Forget about outdated credit scores, requirements for specific collateral types, location preference, and terms that don’t favour a person or their business. With PayDax, borrowers get unprecedented flexibility when it comes to loan terms and collateral types.

On PayDax Protocol (PDP), anyone from anywhere can access a loan as long as they have cryptocurrencies or physical valuables that can be tokenized. Jane, who has 1 Bitcoin (BTC) worth $100,000, or Steve, who owns a substantial amount of gold, can access instant liquidity at fixed LTV’s of 50%, 75%, 90%, and 95%.

Jane can collateralize her BTC and unlock stablecoin loans (USDT/USDC), while retaining ownership of her appreciating Bitcoin. Likewise, through collaborations with verification and custodian services from Sotheby’s and Brinks with Chainlink Oracle integrations for real-time pricing, PayDax allows users to collateralize RWA and collect loans without selling them.

Why XRP Holders Are Joining the PDP Presale

For XRP holders, the story is all too familiar. Just as Ripple aimed to make cross-border payments faster and cheaper, PayDax is cutting the bank out of daily finance.

But what makes PDP even more attractive is the direct participation it offers. Users are not just holders of a token; they are lenders, borrowers, and insurers in an economy that thrives on their involvement.

This dynamic is why XRP investors are moving into the presale. At Stage 1 of the PayDax presale, PDP tokens are available for just $0.015, and analysts predict gains of up to 65x in Q4 and up to 300x after CEX listing. Just as the XRP price is up over 500x since it was indexed on CoinMarketCap.

Trust Signals That Matter for Investors

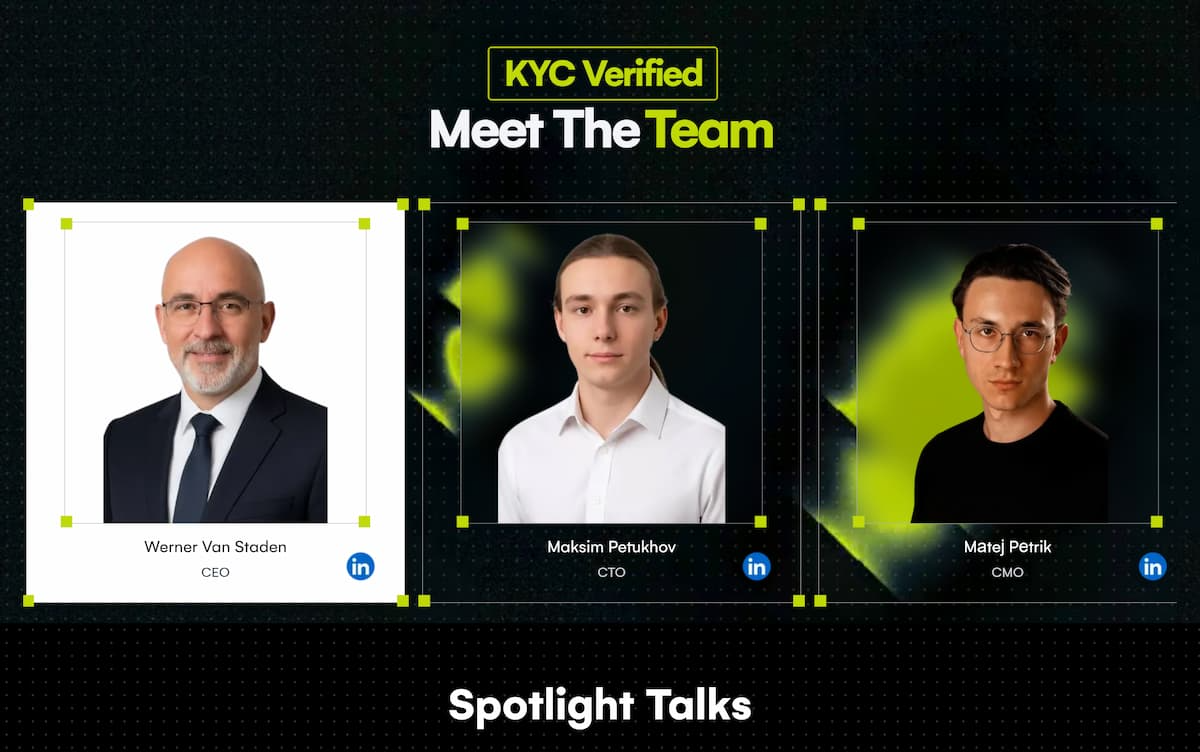

Presales are often risky, but PayDax has gone above and beyond to create trust. CEO Werner Van Staden and his team are fully doxxed, standing behind the project with their identities and reputations. The smart contracts have been audited by Assure DeFi, providing an added layer of security for investors.

Experts say these efforts can significantly impact the PDP price projections, as these trust signals open the doors to easier VC backing, institutional investments, and major DeFi collaborations and app integrations. Already, over 20% of Stage 1 tokens have been acquired in just two weeks, signaling strong early demand.

PDP Presale: Final Window To Get Best Crypto To Buy at Lowest Price

XRP may have opened the door by challenging the banks’ control of global payments, but PayDax Protocol (PDP) is blowing it wide open by replacing the banks entirely. For lenders, borrowers, and insurers, PDP is building a financial model where the profits flow back to the people.

For XRP holders, it represents a natural evolution of the fight they already believe in and an early-stage opportunity with asymmetric upside they recognize. Just as XPR shot over 50,000%, PDP is preparing to surge 6,500% in this quarter, before its CEX listing triggers another massive surge.

Understandably, investors are rushing to acquire at just $0.015 in round 1 of the PDP presale with a 25% bonus code PD25BONUS, understanding that the token price will never be this low. However, with over 20% of the Stage 1 allocation scooped up in under two weeks, this also means this window for the highest gains on possibly the best crypto to buy now will disappear.

Join the Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.