TLDR

- PEPE experienced a 300% surge in Google search interest on July 22, reaching the maximum search popularity level of 100

- The memecoin broke its long-term downtrend from December 2024 and double-bottomed at $0.00000568 in March

- PEPE has gained over 28% this month, closely following Ethereum’s 40% rally over 30 days

- Technical analysis shows a double golden cross pattern with both 20-day and 50-day EMAs crossing above the 200-day EMA

- Open interest for PEPE crossed $1 billion for the first time, indicating growing derivatives trading activity

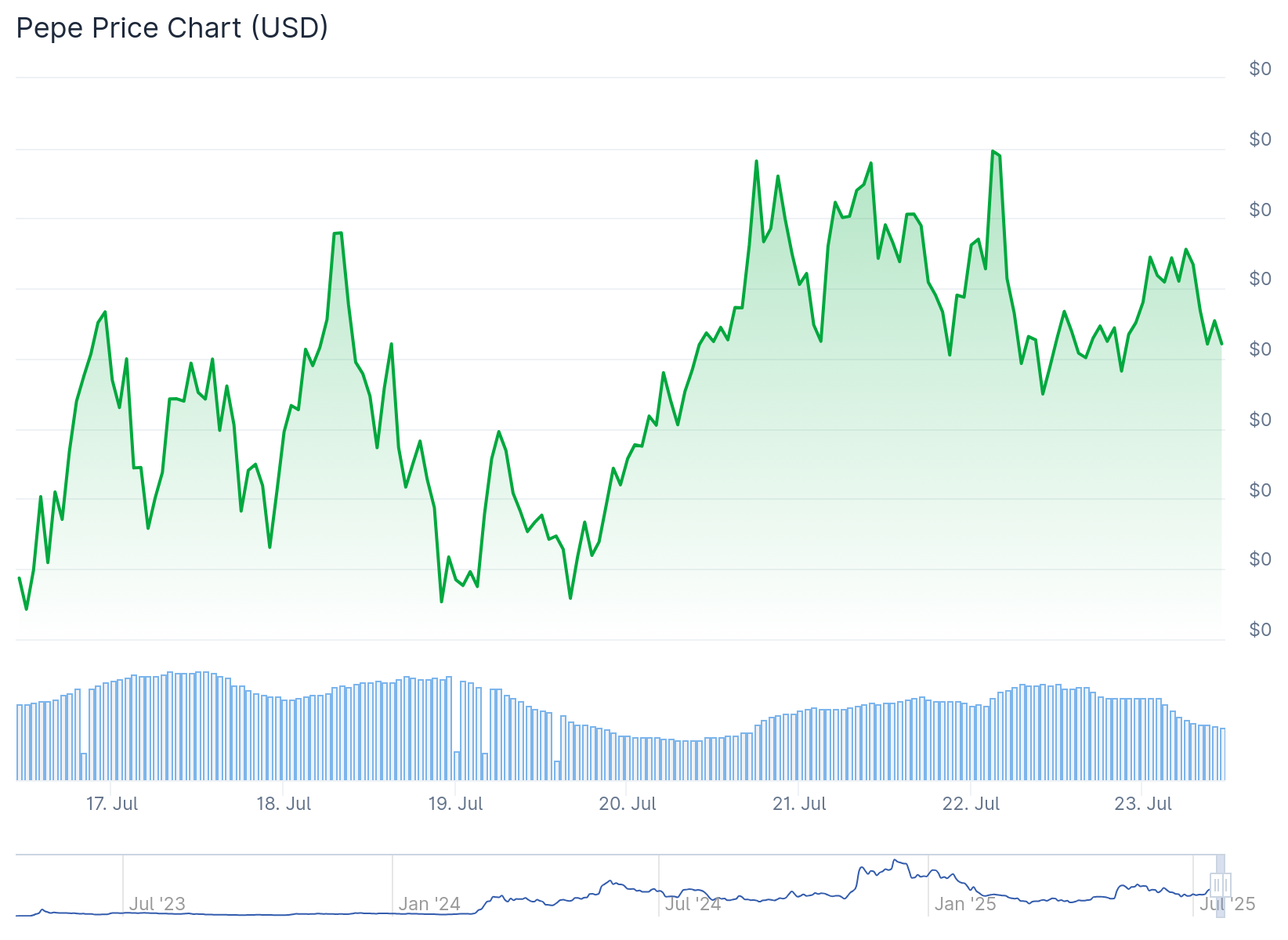

Pepe (PEPE) has captured attention in the cryptocurrency market with a sharp rise in both price and search interest. The memecoin gained over 28% this month as it rides alongside Ethereum’s momentum.

On July 22, Google search interest for PEPE spiked from 25 to 100, marking a 300% increase. This surge placed the token at the top of trending searches for the day.

The price movement comes as PEPE broke its long-term downtrend that began on December 9, 2024. The token had double-bottomed at $0.00000568 in March before piercing the trendline on July 10.

PEPE price retested the breakout level five days later, confirming the technical pattern. The token currently trades around $0.00001413, up 1.01% in the last 24 hours.

Ethereum’s performance has played a key role in PEPE’s recent gains. The leading altcoin has rallied 40% over the past 30 days, with nearly 13.75% gained since July 16 alone.

Crypto analyst Jake Gagain noted the correlation between the two assets. He observed that PEPE tends to spike when Ethereum moves beyond $3,100 toward $4,000.

Technical Patterns Signal Bullish Momentum

PEPE’s chart displays a double golden cross formation, where both the 20-day and 50-day exponential moving averages crossed above the 200-day EMA. This pattern coincided with a breakout from a symmetrical triangle formation.

The breakout projects a potential price target around $0.00002425, matching PEPE’s previous high from November 2024. Some resistance appears around the $0.00001460 level.

Technical analyst ChandlerCharts pointed to the momentum behind PEPE, with the RSI hovering around 72. While a brief pullback remains possible, the overall structure stays bullish.

Very similar to late 2023 / early 2024 — $ETH is steadily climbing toward a new ATH, while $PEPE (so far pretty restrained) just keeps coiling until it can’t hold it anymore… then it rips almost vertically. This could be our last peaceful Sunday, my friends. 🐸 pic.twitter.com/QxciiRvO6W

— Chandler⚡️ (@ChandlerCharts) July 20, 2025

At the beginning of July, PEPE price stood around $0.00000926. The 28.77% surge since then has pushed it above $0.000012.

Derivatives Interest Reaches New Heights

PEPE’s open interest crossed $1 billion for the first time, according to Coinglass data. This milestone reflects growing speculative interest and derivatives trading activity.

The altcoin market index jumped from 20 to 53 this month, showing capital rotation from Bitcoin into alternative assets like PEPE. Trading volume has reached nearly $5 billion in 24 hours.

Market cap for PEPE currently sits above $5.5 billion, establishing it as a major player in the memecoin sector. The token boasts over 400,000 on-chain holders.

Immediate support for PEPE price lies around $0.00001325. If that level fails, the next support zone could be around $0.00001230, which coincides with the upper boundary of the previous triangle pattern.

Despite strong bullish indicators, analysts note that the current RSI above 70 suggests PEPE may be slightly overbought. A short-term correction could help reset market volatility.

If PEPE holds above the $0.00000568 support level, the next target remains $0.000016, last seen in Q4 2024. However, a break below this line could trap recent buyers and drag the price lower.

Trading volume data showed sellers were in control during the two days leading up to the current rally. Now buy-side pressure has returned as bulls attempt to maintain the upward momentum.

PEPE’s current market position reflects both community-driven excitement and technical breakout patterns, with open interest crossing $1 billion for the first time.