TLDR

- Peter Brandt believes Bitcoin will prove to be the ultimate store of value.

-

Brandt claims Bitcoin’s value will outperform traditional stores like gold.

-

Bitcoin is recovering from recent lows, showing resilience in the market.

-

Brandt’s view contrasts with those who support gold as the primary store of value.

Peter Brandt has shared his thoughts on Bitcoin’s potential as a store of value. Brandt believes that Bitcoin will prove to be the ultimate store of value, surpassing even gold in the long run. He emphasized that while gold has traditionally been seen as a hedge against inflation, Bitcoin has unique advantages that make it a more viable option for wealth preservation.

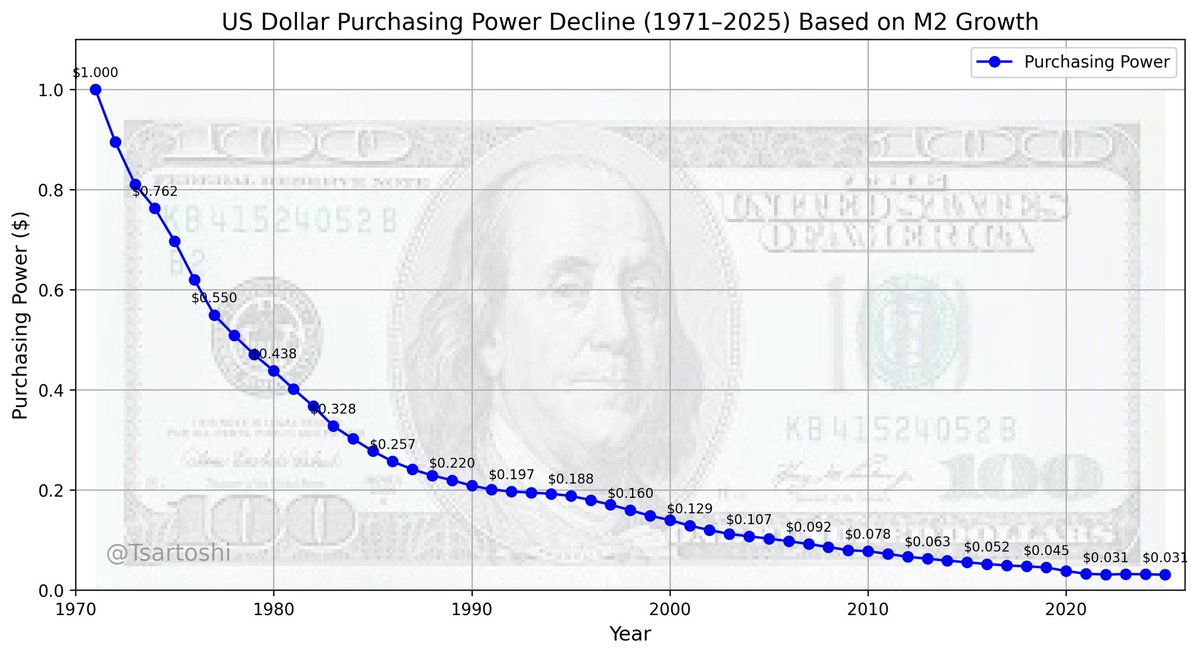

The cryptocurrency market has experienced volatility over the years, but Brandt remains confident in Bitcoin’s future. He noted that Bitcoin’s limited supply and decentralized nature give it an edge over traditional fiat currencies. As the U.S. dollar continues to lose purchasing power, Brandt predicts that Bitcoin will become an increasingly attractive investment for those seeking a safe haven.

Bitcoin’s Recovery and Market Sentiment

Recently, Bitcoin has shown signs of recovery, bouncing back from a recent pullback that saw its price dip below $112,000. As of August 7, the cryptocurrency was trading at over $117,000, reflecting a 4.5% rise from its recent lows.

This recovery comes in the wake of shifting market expectations surrounding U.S. Federal Reserve policies, with market sentiment improving and the U.S. dollar losing some strength.

In his tweet, Peter Brandt mentioned that the current market conditions, including a weaker U.S. dollar and positive developments in the crypto space, have contributed to Bitcoin’s recent price action. Additionally, the signing of an executive order by former President Donald Trump, aimed at allowing 401(k) investors to access alternative assets like Bitcoin, has further boosted investor confidence.

Bitcoin’s Advantages Over Gold

In his analysis, Brandt draws attention to Bitcoin’s key advantages when compared to gold. While gold has long been seen as a reliable store of value, it is limited by factors such as physical storage and transport costs. Bitcoin, on the other hand, is digital, making it easier to store and transfer without the same logistical challenges.

Brandt points out that Bitcoin’s fixed supply of 21 million coins makes it a deflationary asset, unlike gold or fiat currencies, which can be devalued through inflation.

This characteristic of Bitcoin positions it well to protect against inflation and potential currency devaluation. As the U.S. dollar faces ongoing challenges, including inflationary pressures and trade imbalances, Bitcoin’s potential to preserve wealth becomes more evident.

Contrasting View of Peter Schiff

While Peter Brandt is bullish on Bitcoin’s future, there are other prominent figures in the finance world who maintain different perspectives. Peter Schiff, a long-time critic of Bitcoin and advocate for gold, has frequently warned about the decline of the U.S. dollar and the rise of emerging economies, particularly within the BRICS nations. Schiff argues that the U.S. dollar is on the verge of collapse, which he believes will impoverish the majority of Americans, while enriching consumers in emerging markets.

Schiff has also criticized Bitcoin as a store of value, emphasizing the role of gold in protecting against economic uncertainty. In his view, Bitcoin remains too volatile and speculative to function as a stable store of value. Schiff’s warnings of a dollar collapse are rooted in his belief that the U.S. government’s fiscal policies, including high deficits and rising inflation, will erode the dollar’s purchasing power.

Despite their differing opinions, both Brandt and Schiff agree that traditional fiat currencies, like the U.S. dollar, are facing significant challenges. However, their paths to wealth preservation diverge, with Brandt placing his trust in Bitcoin and Schiff continuing to back gold as the ultimate hedge.