TLDR

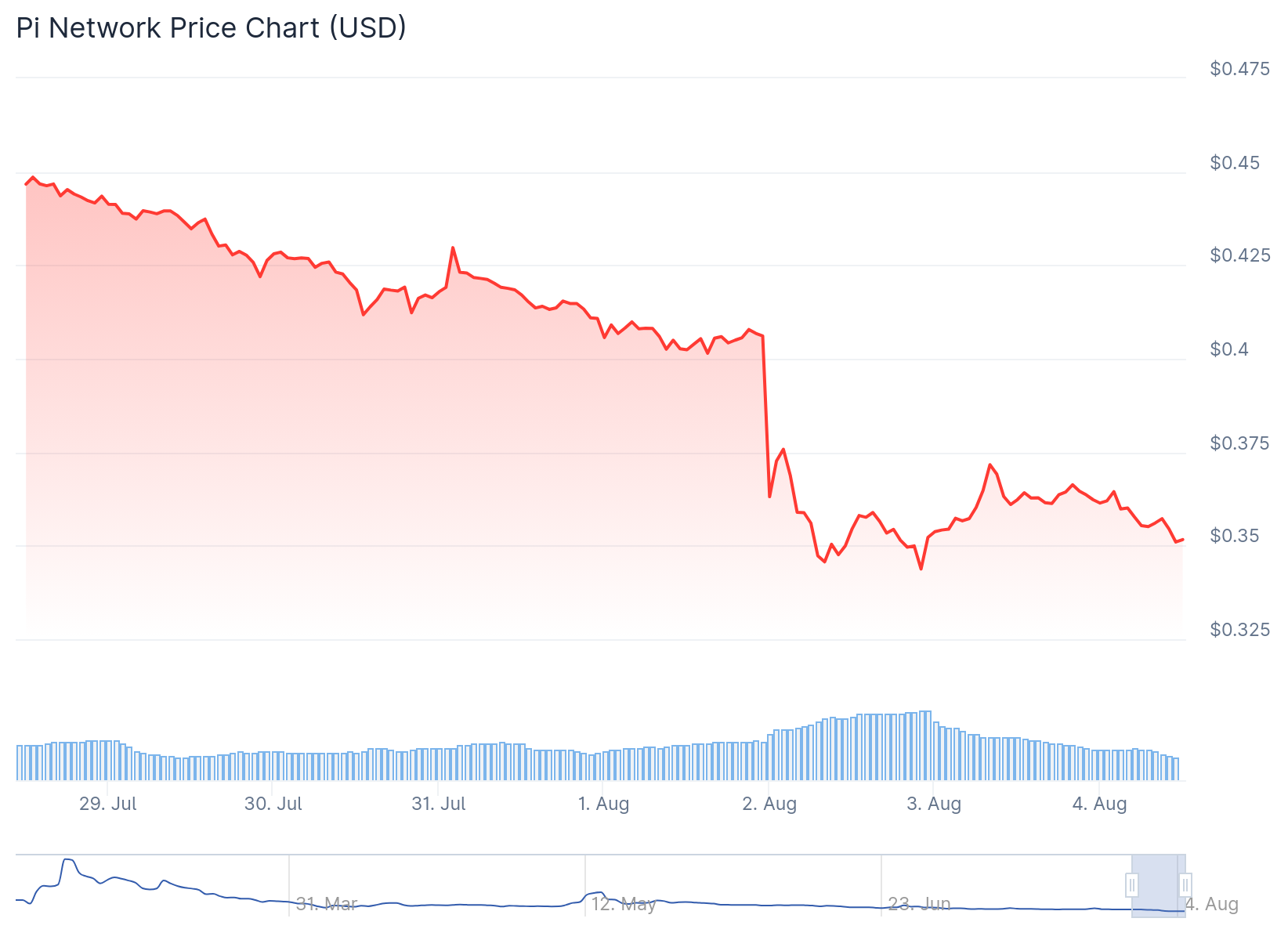

- Pi Network price dropped over 11% to hit a new all-time low of $0.32 before recovering slightly to $0.36

- Trading volume surged 86% to $168 million, indicating heavy selling pressure from whales or institutions

- Binance listing delay frustrates investors despite 87% community support for the exchange listing

- 160.35 million Pi tokens worth $56.78 million are scheduled to unlock over the next 30 days

- Technical indicators show negative divergence with declining volume despite modest price recovery

Pi Network price crashed to a new all-time low of $0.32 on August 1, marking one of the worst performances in the cryptocurrency market. The token has since recovered modestly to $0.36, representing a 4% bounce from the cycle low.

The steep decline caught many investors off guard as Pi Network lost over 11% of its value in a single day. Trading volume spiked dramatically by 86% to reach $168 million, suggesting intense selling activity dominated the market.

According to Coinalyze data, Pi Coin Open Interest dropped 8% to $10.4 million from the previous day. This decline in derivatives activity reflects reduced market confidence in the token’s short-term prospects.

The Relative Strength Index (RSI) for Pi Network currently sits at 33, approaching oversold territory. This technical indicator suggests the cryptocurrency might attract bargain hunters looking to enter at discounted prices.

Whale Selling and Exchange Delays Drive Selloff

Market analysts point to large whale or institutional selling as a primary catalyst for the price decline. The sudden large-scale selloff triggered panic among retail investors, leading to cascading stop-loss orders and liquidations.

Pi community enthusiast “The Times of PiNetwork” highlighted several factors contributing to the downturn. The analyst emphasized that institutional rather than retail selling appears to be driving the market weakness.

The delayed Binance listing has also frustrated the Pi Network community. Despite 87% of the community voting in favor of a Binance listing, the exchange has yet to make any official announcement regarding Pi Network.

This listing delay has caused panic selling among investors who expected the major exchange addition to boost prices. The absence of a timeline for the potential listing continues to weigh on market sentiment.

Token Unlocks Loom Large

Pi Network faces pressure from upcoming token unlocks scheduled over the next 30 days. According to PiScan data, 160.35 million Pi tokens worth $56.78 million at current prices are set to be released.

The largest unlock events are scheduled for August 8 and August 16, with 8.3 million tokens being released on each date. These unlocks represent potential selling pressure that could further depress prices.

Critics also point to the centralized nature of the Pi ecosystem as a concern. The concentration of Pi coins among a small group of users has raised fears about possible price manipulation.

Expert Kim H Wong identifies two major problems facing Pi Network: the lack of available decentralized applications for bartering and limited Pi coin availability due to locked wallets. Wong suggests that opening up available apps and conducting a second Pi migration could help address these issues.

The Pi Network ecosystem currently lacks robust decentralized applications and real-world use cases. This limitation restricts demand for the token and contributes to downward price pressure.

Technical Outlook Remains Bearish

Technical analysis reveals concerning patterns for Pi Network’s price action. The decline in trading volume while prices recovered creates negative divergence, indicating weak momentum behind the recent uptick.

The Parabolic Stop and Reverse (SAR) indicator shows dots positioned above the current price at $0.47, providing dynamic resistance. This configuration suggests bearish momentum could continue unless fresh buying interest emerges.

Pi Network price currently trades between support at $0.32 and resistance at $0.40. A break below the all-time low could signal further declines, while a move above $0.40 might target $0.46.

Trading volume has declined nearly 30% over the past 24 hours to approximately $112 million. This volume decrease during a price recovery typically signals unsustainable momentum.

The token faces a critical juncture where fresh demand is essential to prevent a deeper downtrend. Without new buying interest, Pi Network may revisit or break below its recent all-time low of $0.32.