TLDR

- Pi Network (PI) faces a major 156 million token unlock in August worth $68 million, adding pressure to the already weak price

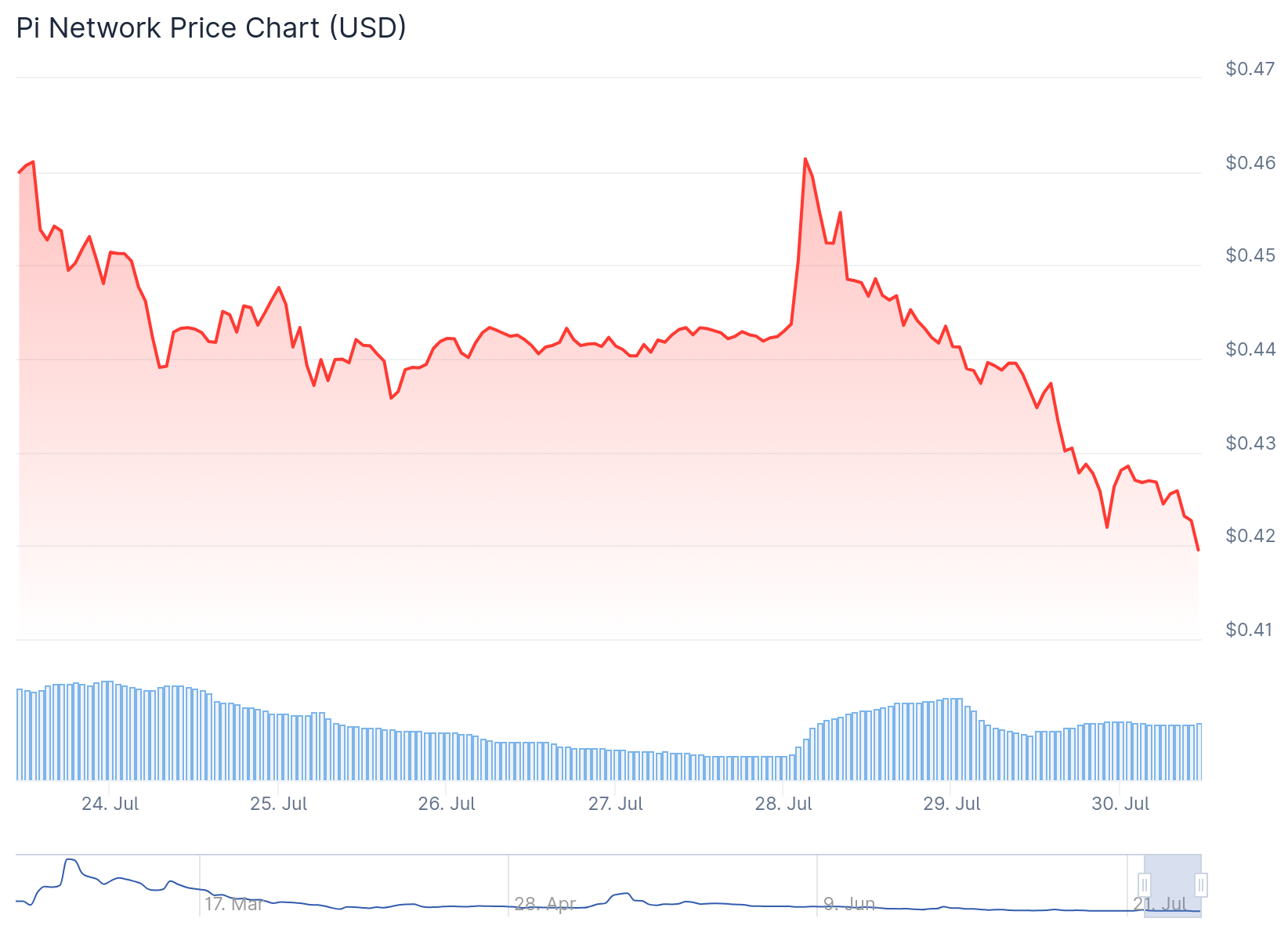

- The cryptocurrency is trading near $0.43, close to its all-time low of $0.40, struggling with heavy supply and weak demand

- Technical indicators show bearish momentum with RSI at 38.92 and declining Accumulation/Distribution line

- Analysts predict Pi Network won’t list on Binance until 2026-2027 due to KYB requirements and transparency issues

- Price needs to break above $0.65-$0.70 zone for a healthy breakout according to technical analysis

Pi Network price remains under pressure as the cryptocurrency prepares for a massive token unlock event in August. Trading at $0.43, PI sits dangerously close to its all-time low of $0.40.

The upcoming month brings fresh challenges for the struggling altcoin. Data from PiScan shows 156 million PI tokens will be unlocked throughout August. This represents approximately $68 million worth of tokens at current prices.

The token unlock adds to existing supply pressures. Over 250 million PI tokens have already entered circulation this month. With minimal buying demand to absorb this supply, the price has remained trapped in a tight trading range.

PI network price has failed to participate in the broader crypto market rally that pushed many assets to new highs. The cryptocurrency peaked at $2.98 in February but has declined sharply since then.

Technical indicators paint a bearish picture for August. The Accumulation/Distribution line has fallen to -1.01 million, representing an 85% decline since June 26. This metric measures buying versus selling volume pressure.

The declining A/D line shows selling volume continues to outweigh buying interest. This trend suggests weakening demand from market participants and increases the risk of further price drops.

RSI Signals Mounting Pressure

The Relative Strength Index currently stands at 38.92 and continues falling. After failing to break above the 50-neutral line on July 22, the RSI has trended downward consistently.

RSI values below 30 typically indicate oversold conditions while readings above 70 suggest overbought levels. At 38.92, PI shows mounting bearish momentum as sellers dominate spot markets.

The technical setup suggests PI price could test its all-time low of $0.40 if current trends continue. A break below this level would mark new territory for the cryptocurrency.

However, some analysts remain optimistic about longer-term prospects. Crypto analyst Crypto Jex identifies a symmetrical triangle formation on daily charts. Equal bottom support appears to be holding the price around $0.45.

Exchange Listing Timeline Remains Uncertain

Community expert Dr Altcoin recently discussed Pi Network’s potential listing on major exchanges like Binance. The analyst believes listings won’t occur until 2026 or 2027.

Question Asked: Are the rumours about Pi listing on Binance true?

My Answer: Pi Network has a mandatory KYB (Know Your Business) requirement that centralized exchanges (CEXs) must complete before they can officially list Pi. For major exchanges like Binance or Coinbase, this…

— Dr Altcoin (@Dr_Picoin) July 27, 2025

Several factors delay the listing process. Major exchanges appear hesitant to comply with Pi Network’s mandatory Know Your Business requirements. The lack of transparency regarding tokenomics and post-Open Network roadmap creates additional hurdles.

Despite these challenges, Pi Network maintains strong trading volume. Daily volume averages around $100 million on exchanges like OKX and MEXC. This demonstrates market demand exists for the cryptocurrency.

The analyst predicts listings will eventually happen once Pi Network achieves key milestones. These include mass migration completion, Pi AI App Studio maturity, and deployment of the $100 million venture fund.

For a healthy breakout, Crypto Jex notes PI needs strong volume and a daily close above $0.65-$0.70. Above this level, the Fair Value Gap zone of $1.05-$1.25 becomes a target area.

Current price action shows PI gained 1.5% to trade at $0.4488. Trading volume increased 195% to $86.88 million in the past 24 hours, suggesting renewed interest from traders.