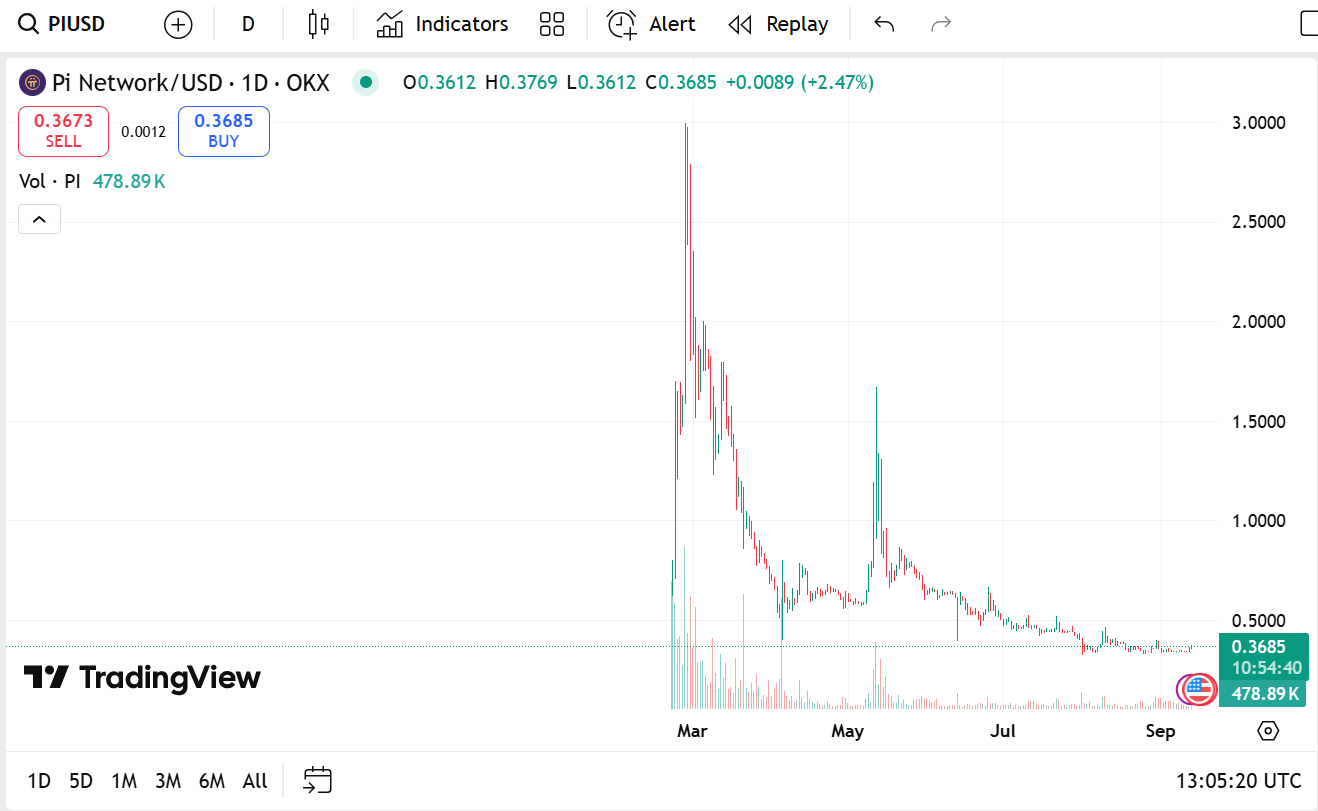

The Pi Network price prediction debate has been gaining momentum over the past few months, especially with the token losing more than 80% from all-time highs. This has been raising very serious long-term stability issues for Pi Coin or whether there could be more drops in the future by the year 2026.

As more investors are looking at early-stage transactions, so is the spotlight cast on upcoming projects like Remittix (RTX), which is making waves in the presale space with a token value of $0.1080 at the time of writing.

Pi Network Price Prediction and Market Performance

Pi Coin is now trading at $0.3700, an increase of 4.47% for the previous session. Its market capitalization of $2.99 billion points to continued interest, with the $62.82 million trade volume indicating a 33.42% increase, pointing towards short-term buying interest. However, most analysts point out that there has been considerable volatility and the larger debate about Pi Network Price Prediction remains skewed towards doubt.

One of the largest issues with Pi is that there are no direct adoption channels outside of speculation trading. Without strong real-world utility, the network keeps depreciating and investors are not happy to hold Pi Coin in the long term. That’s why others are setting sights on future crypto projects that offer real-world utility to users.

Remittix: A DeFi Project With Real-World Use

As Pi hovers with utility, Remittix (RTX) is making its entry into the spotlight as a cross-chain DeFi solution designed for global payments. At $0.1080 per token, RTX has already garnered more than $25,5 million in presale alone, selling more than 661 million tokens. Its vision is more potent than rumors, as it enables users to push crypto straight into conventional bank accounts in over 30 nations.

Some of the key highlight features of Remittix are:

- Beta Wallet Release: Remittix beta wallet coming September 15th, including real-time FX conversion.

- Referral Program: 15% USDT per referral, claimable every day via the dashboard.

- Exchange Listings: BitMart and LBank have been announced as upcoming partners after significant milestones.

- $250,000 Giveaway: Meant to reward and motivate early supporters.

These utilities put RTX not just as another presale token, but among the strongest DeFi projects 2025, with a concrete roadmap and operational products.

Why Remittix Is Getting Noticed

Remittix is trying to solve the $19 trillion remittance issue globally through cost reduction, reducing transaction time and empowering individuals and businesses. This makes it a low gas fee cryptocurrency project with an adoption case. Remittix has a set future application and is building the infrastructure for cross-border payment, while Pi Coin’s future application is not certain.

Its appeal lies in being one of the top crypto sub-$1 with high growth potential. With the combination of a deflationary token mechanism, centrally-verified exchange listings and the upcoming wallet beta, RTX is shaping up to be a new altcoin to watch out for in 2025.

Discover the future of PayFi with Remittix by checking out their project here:

Website: https://remittix.io/

Socials: https://linktr.ee/remittix

$250,000 Giveaway: https://gleam.io/competitions/nz84L-250000-remittix-giveaway