The Pi network price has struggled to gain momentum, holding near $0.36 after a steady decline through recent months. While Pi coin faces pressure with weak volume and limited breakouts, investors are shifting focus toward projects showing clearer adoption.

Rollblock (RBLK) has surged 500% in its presale and raised $11.7 million from over 55,000 backers, making it a standout. As Pi coin battles resistance, Rollblock’s rapid growth highlights where smarter money is flowing in 2025.

Rollblock Emerges as the Altcoin With Real Utility and Adoption

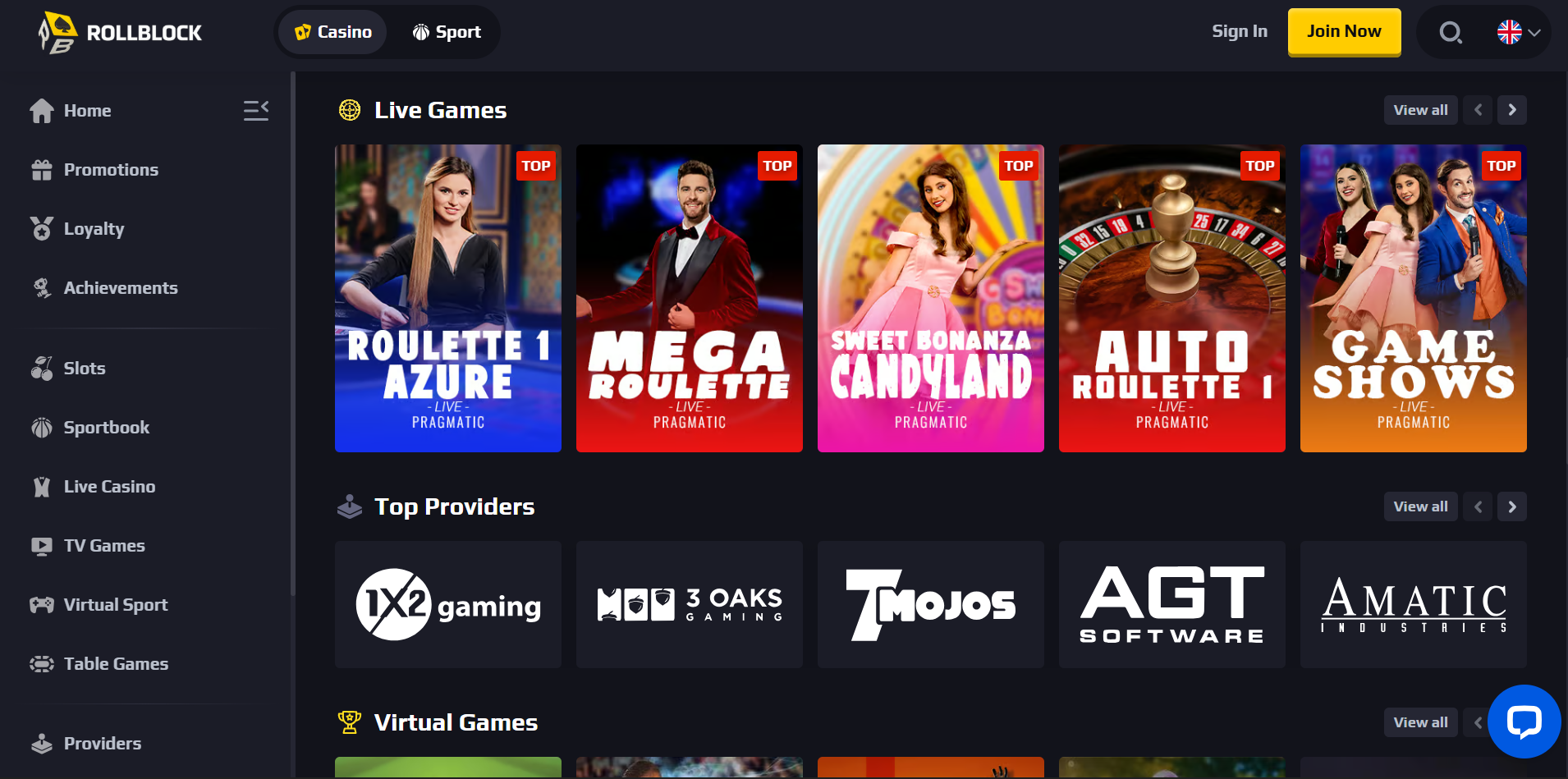

Rollblock (RBLK) has quickly become a standout in the crypto market, appealing to both players and investors with a model that blends entertainment and rewards. Before even hitting its first exchange listing, Rollblock had already processed millions in wagers across 55,000 users, proving it has traction in a space where many projects still lack real adoption.

The project’s strength lies in how it combines gaming engagement with attractive investment mechanics. With more than 12,000 games available, players stay active and entertained, while investors are drawn to staking returns of up to 30% APY. Monthly prize pools worth over $2 million add further incentives, creating demand on both sides of the ecosystem.

A weekly buyback-and-burn program strengthens token value by shrinking supply and rewarding stakers consistently. This cycle of demand and scarcity has made Rollblock one of the more credible tokens to watch as 2025 approaches.

Key factors driving Rollblock’s momentum:

- Over 12,000 live games fostering consistent engagement.

- Daily, weekly, and monthly rakeback rewards.

- Prize pools above $2 million every month.

- Staking rewards reaching up to 30% APY.

With $11.7 million raised so far and tokens priced at $0.068, Rollblock is positioning itself as a more innovative alternative, offering clearer utility growth than many speculative projects dominating headlines.

Pi Network Price Weakens Further as Selling Pressure Grows

The Pi network price has been sliding, with the token closing near $0.36 after weeks of muted movement. Since touching lows around $0.32 in late July, Pi coin has struggled to break higher, instead drifting sideways with little volume support. The chart shows a long downtrend since early June, with lower highs and heavy selling pressure keeping momentum capped.

The price is being smacked down by moving averages, indicating that the sellers remain in control. Although Pi coin has been able to stick above the $0.32 marker, bounces have been very brief, with buyers not able to go beyond resistance points.

The volume of daily trading is also thinning in relation to previous months, which indicates less participation and reduced trader interest.

Despite these challenges, Pi coin remains active on exchanges, with consistent liquidity that allows regular trading. Still, the current structure shows a token consolidating near the bottom of its recent range.

For now, the Pi network price reflects caution, with the market waiting for signs of renewed strength before momentum can shift. In the meantime, Pi coin continues to face pressure in a market that demands clearer catalysts for recovery.

Pi Network Price Weakness Highlights Rollblock’s Stronger Path

The Pi network price continues to drift near $0.36, with Pi coin showing limited strength as selling pressure dominates. In contrast, Rollblock has raised $11.7 million in presale funding and surged 500%, proving investor appetite for projects with real traction. With its deflationary model and gaming adoption, Rollblock is being framed as a contender that could outshine even Ethereum. At the same time, Pi coin struggles to spark fresh demand in a utility-driven market.

Discover the Opportunities of the RBLK Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.