TLDRs:

- Reddit stock jumps 18.3% to $190.03 after a stellar $500M Q2 earnings report.

- Net income hits $89M, flipping from a loss last year; gross margin surges to 90.8%.

- AI-powered ad optimization drives 84% YoY ad revenue growth, hitting $465M.

- International users now make up over 50% of Reddit’s daily active audience.

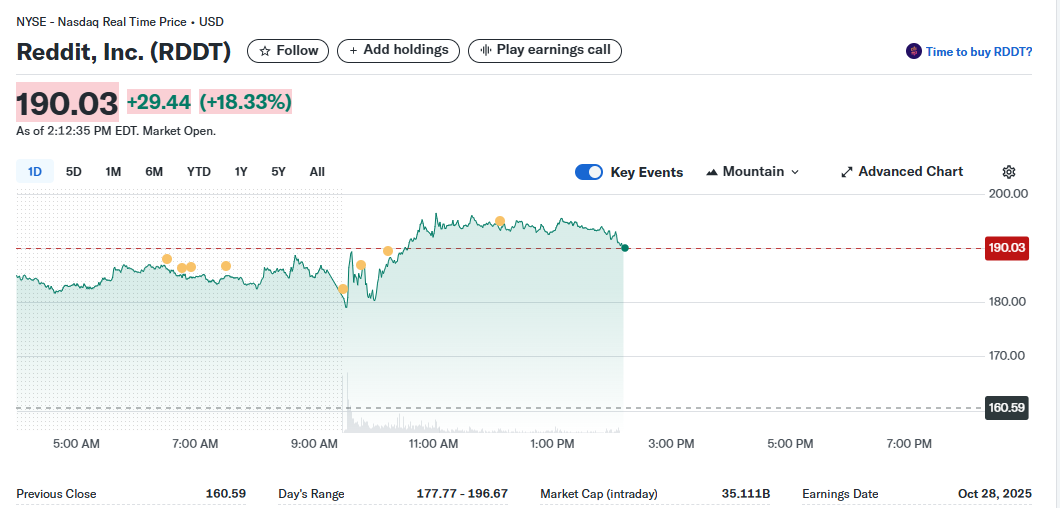

Reddit, Inc. ($RDDT) saw its stock surge 18.3% to close at $190.03 on Thursday after reporting blockbuster second-quarter earnings for 2025.

The social media platform posted a 78% year-over-year revenue increase to $500 million, powered by significant growth in ad revenue and daily active users.

The company swung to a net profit of $89 million, reversing a loss from the same period last year, while operating cash flow reached $111 million. Reddit also reported a staggering 90.8% gross margin, reinforcing investor confidence in its monetization strategy.

Following the earnings report, Reddit’s market cap climbed to $35.11 billion as shares leaped from a previous close of $160.59 to a high of $196.67 during trading hours.

AI-Driven Tools Take Center Stage

A major contributor to Reddit’s Q2 success was its 84% year-on-year surge in advertising revenue, totaling $465 million. The platform attributed much of this growth to its integration of artificial intelligence in ad optimization.

According to company data, AI-driven features improved click-through rates by 10%, boosting advertiser performance and return on investment.

Reddit is uniquely positioned in the ad market, with approximately 40% of posts having commercial intent. This makes the platform a valuable resource for targeted, context-rich ad placements. These performance improvements, coupled with Reddit’s strong community engagement, continue to make it an attractive environment for brands.

User Growth Accelerates

Reddit’s daily active uniques (DAUq) jumped 21% to 110.4 million, with international users now comprising 50.41% of that audience, a shift from its traditionally U.S.-dominant user base. This growth is attributed to Reddit’s machine translation capabilities in 23 languages and strategic expansion into markets such as France and Brazil.

International revenue also showed strong momentum, increasing 71% year-over-year. Although still trailing domestic ad growth (79%), this marks meaningful progress in Reddit’s effort to diversify its revenue streams and reduce reliance on U.S. advertisers.

Reddit now forecasts Q3 revenue between $535 million and $545 million, with adjusted EBITDA expected between $185 million and $195 million.

Age Verification in the UK Reflects Compliance Push

In parallel with its financial momentum, Reddit is also focusing on regulatory compliance. The platform recently introduced age verification for U.K. users in line with the Online Safety Act. Partnering with third-party provider Persona, Reddit will now require identity verification for users to access adult content, marking a significant step in aligning with global content safety standards.

The verification process includes submitting government-issued ID or a selfie, though Reddit clarified it will not store this sensitive data, only the verification status and birthdate.

While this move aligns Reddit with evolving regulatory frameworks, privacy advocates continue to express concern over the broader implications of digital identity checks.

Looking Ahead

With its Q2 earnings beat, Reddit has firmly positioned itself among high-growth tech stocks in 2025. The company’s effective use of AI, global expansion, and strong financial discipline appear to be paying off, at least according to Wall Street’s reaction.

Reddit’s next earnings report is scheduled for October 28, 2025.