TLDR

- Rigetti Computing forged partnerships with India’s Centre for Development of Advanced Computing and Montana State University to expand quantum research reach

- Stock climbed 9.4% year-to-date in 2025 but faces expected 19.7% revenue decline and continued losses

- Company advances Cepheus platform with chiplet-based architecture to improve quantum computing scalability and reduce error rates

- Analysts maintain Buy rating despite high price-to-book ratio of 9.77x and very high volatility warnings

- Global collaborations strengthen long-term positioning while commercial adoption remains slow

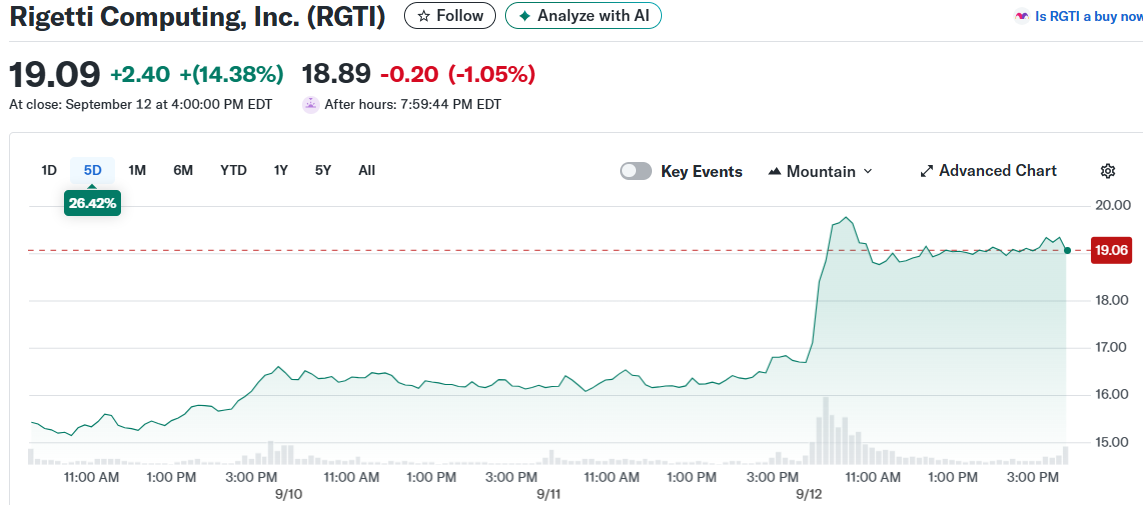

Rigetti Computing stock gained over 3% following new partnership announcements that expand the company’s global quantum computing footprint. The quantum technology firm secured agreements with India’s Centre for Development of Advanced Computing and Montana State University.

These collaborations mark Rigetti’s strategic push beyond domestic markets. The India partnership targets hybrid quantum system development for government and academic applications in one of the world’s fastest-growing tech markets.

The Montana State University deal provides researchers direct access to Rigetti’s Novera quantum system. This academic partnership helps nurture quantum talent while advancing research capabilities.

RGTI shares have posted 9.4% gains year-to-date in 2025. The stock has experienced choppy performance compared to quantum computing peers like IonQ and D-Wave Quantum.

Technical Innovation Meets Financial Reality

Rigetti continues developing its hybrid quantum computing approach through the Cepheus platform. The chiplet-based architecture aims to reduce error rates while improving system scalability.

The company’s modular systems combine quantum and classical computing elements. This hybrid strategy addresses near-term commercial applications while quantum technology matures.

However, financial challenges persist despite technical progress. Revenue is projected to decline 19.7% in 2025 with continued losses expected.

Earnings per share losses should narrow by 86.1% year-over-year. This improvement reflects better financial discipline while the company invests in growth.

Valuation and Market Position

RGTI trades at a price-to-book ratio of 9.77x, well above the industry average of 6.79x. The premium valuation suggests investors are pricing in significant future growth potential.

Analysts assign Rigetti a Zacks Rank #2 Buy rating. The recommendation reflects the stock’s high-growth, high-risk profile suitable for patient investors.

The stock carries a “very high risk” designation due to large daily price swings. Technical analysis shows resistance around $16.56 and support near $13.86.

Rigetti competes against diverse quantum computing approaches. IonQ focuses on trapped-ion technology while D-Wave advances annealing-based solutions for enterprise optimization.

Each company pursues distinct strategies as quantum computing edges closer to commercial viability. Rigetti’s hybrid approach targets both near-term applications and long-term scalability.

The partnerships with India’s C-DAC and Montana State University provide credibility and expand research opportunities. These collaborations position Rigetti as a serious quantum ecosystem player despite current commercialization challenges.

Trading volume has increased alongside partnership announcements. The stock is expected to move within a 7.52% range from recent closing prices, indicating continued volatility ahead.