As the number three cryptocurrency by market cap, it’s impossible for Ripple (XRP) to escape the limelight. With rumors of bribing exchanges for listings and a heated lawsuit with R3, it’s easy to see why so many people dislike the project. But, does Ripple deserve the flak it’s been receiving?

In our second edition of CoinCentral court, we put Ripple on trial, breaking down the most substantial claims against the project and coin.

Before we begin, though, we need to clarify something. Although commonly used interchangeably (even sometimes by us), Ripple is not the same as XRP. RippleNet is the blockchain network created by Ripple Labs, a company. And, XRP is a digital asset on RippleNet.

For the sake of this article, we’ll be referring to the Ripple Labs company as Ripple, the blockchain network as RippleNet, and the cryptocurrency as XRP. Now that that’s out of the way, let’s dive in.

Case #1: XRP is an illegally sold security.

Evidence

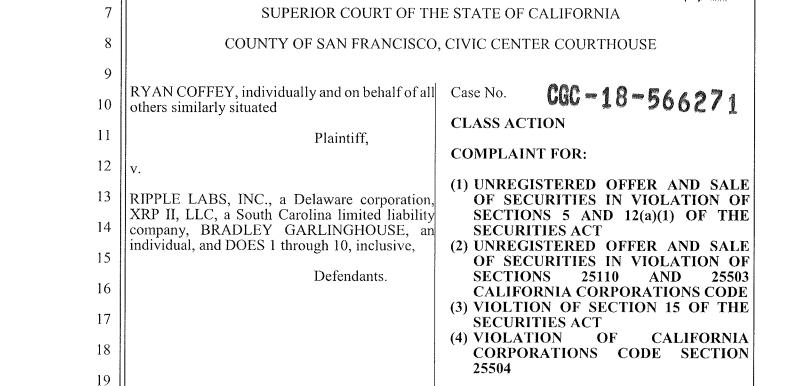

Lawsuit after lawsuit seem to be popping out of the woodwork in an attempt to take Ripple to (actual) court regarding XRP’s status as a security. The lawsuits claim that Ripple CEO Brad Garlinghouse and his team sold XRP to investors as an unregistered security in the United States. The prosecutors argue that “XRP purchasers reasonably expected to derive profits from their ownership of XRP and defendants themselves have frequently highlighted this profit motive.”

While Ripple Labs claims that XRP is a utility token, that may not be the case. Financial institutions aren’t required to use XRP to participate in the RippleNet ecosystem. Instead, “banks and payment providers can use the digital asset XRP to further reduce their costs and access new markets.” So, although XRP can have utility, it’s classification as a security token is really in a gray area.

Furthermore, Ripple consistently markets and promotes XRP outside of its intended use. The company website has a section devoted to an XRP Buying Guide, and the official Twitter account touts new exchange listings. Additionally, the website highlights the market performance of XRP.

If the target market for XRP consists of financial institutions, why is the company aggressively marketing to individual traders?

We’re happy to see $XRP added to @abraglobal‘s new mobile wallet app and exchange and the continued momentum for XRP’s growing global liquidity. https://t.co/Dr7TKrRD31

— Ripple (@Ripple) March 15, 2018

Opponents say this marketing effort stems from a reliance on XRP sales as a revenue generator for the company. They claim that the majority of Ripple’s revenue is currently due to these sales which without the company would flounder. If this claim is valid, then a security classification isn’t so farfetched.

Defense

It should come as no surprise that Ripple and its supporters believe that XRP is not a security. XRP is entirely separate from Ripple, the company. While Ripple is a centralized corporation, XRP is out of the control of any one entity. Even if Ripple disappeared tomorrow, XRP could theoretically still exist.

Ripple also never held an initial coin offering (ICO) to distribute XRP. Instead, the project raised funds from venture capitalists to cover operational costs. ICOs have typically been a red flag to the SEC when it comes to looking at securities. So, with no ICO, Ripple should be in the clear.

Ripple’s primary defense against the previously stated marketing arguments is that more XRP holders create a healthier Ripple ecosystem. By selling XRP in set intervals, Ripple incentivizes market makers and increases token liquidity. This increased liquidity leads to fewer costs for the institutions utilizing the tokens for payments.

Several smart (and deep-pocketed) backers support Ripple. These supporters wouldn’t risk their hard-earned money and reputation if they thought there was even the slightest chance of XRP being an illegally sold security.

Verdict – Appeal to Higher Court

There’s a simple test, the Howey Test, that describes four attributes of a security. Applying it to XRP, it says that a security is:

- An investment of money. Yes, purchasing XRP requires a clear investment of funds.

- In a common enterprise. This point is slightly less clear than the previous one. XRP is closely related to the common Ripple enterprise. However, they are separate entities. This attribute is more black and white with a cryptocurrency like Bitcoin in which there’s no central authority you can point to.

- With an expectation of profit. Once again, yes, it’s fairly obvious that the majority of XRP holders expect to profit from their investment.

- Through the efforts of the common enterprise. Another yes. Ripple’s actions are directly in line with increasing the value of XRP.

XRP hits three out of the four required criteria of securities. However, even the lack of just one of the requirements removes the classification. In the end, it boils down to whether the courts agree that XRP is as separated from Ripple as the company claims it is.

Case #2: RippleNet is centralized.

Evidence

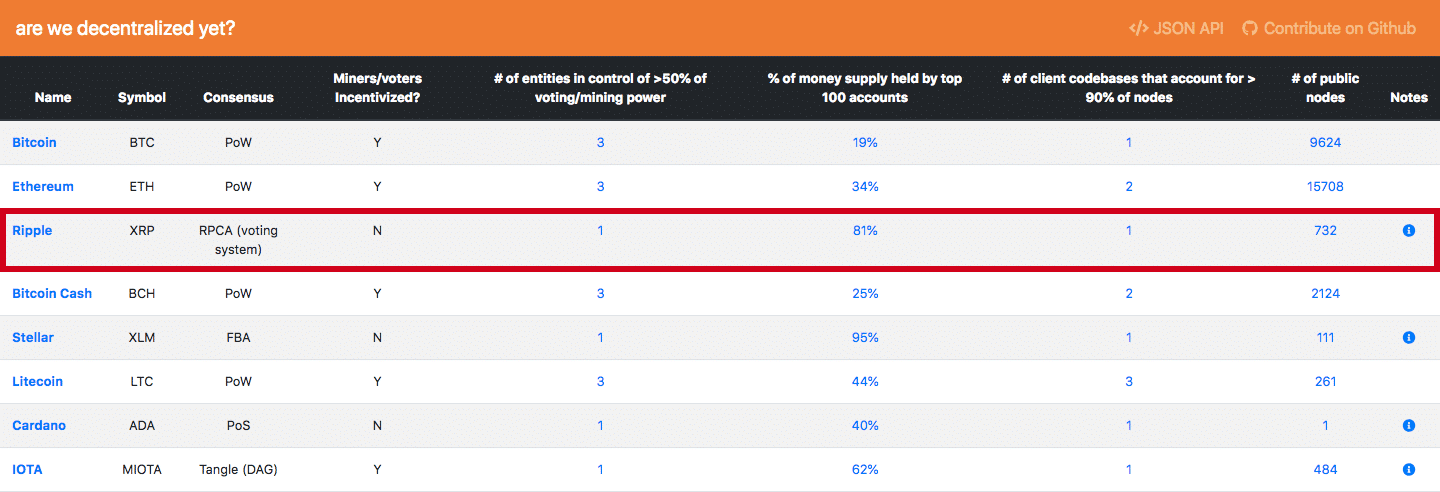

Other than the fact that a company entity created it, there are quite a few different reasons why Ripple’s blockchain has been called one of the most centralized in the industry.

Let’s start with the XRP distribution. At the time of creation, Ripple minted 100 billion XRP. Of those 100 billion, the company kept 80 billion, and the remaining 20 billion were split among the founders. The idea was that, over time, Ripple would either give away XRP or sell it to fund company operations.

At the time of this writing, Ripple still owns over 60 percent of the XRP supply, and just one hundred accounts hold over 80 percent of the total. When looking at XRP distribution, RippleNet is most definitely centralized.

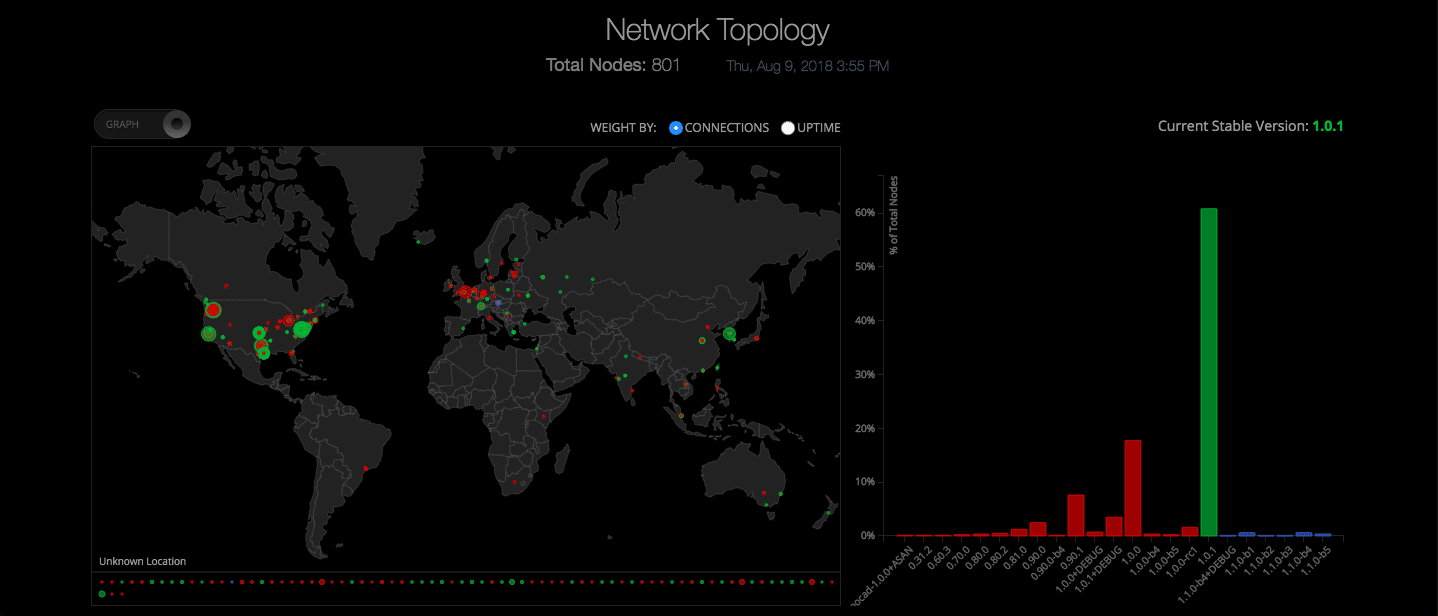

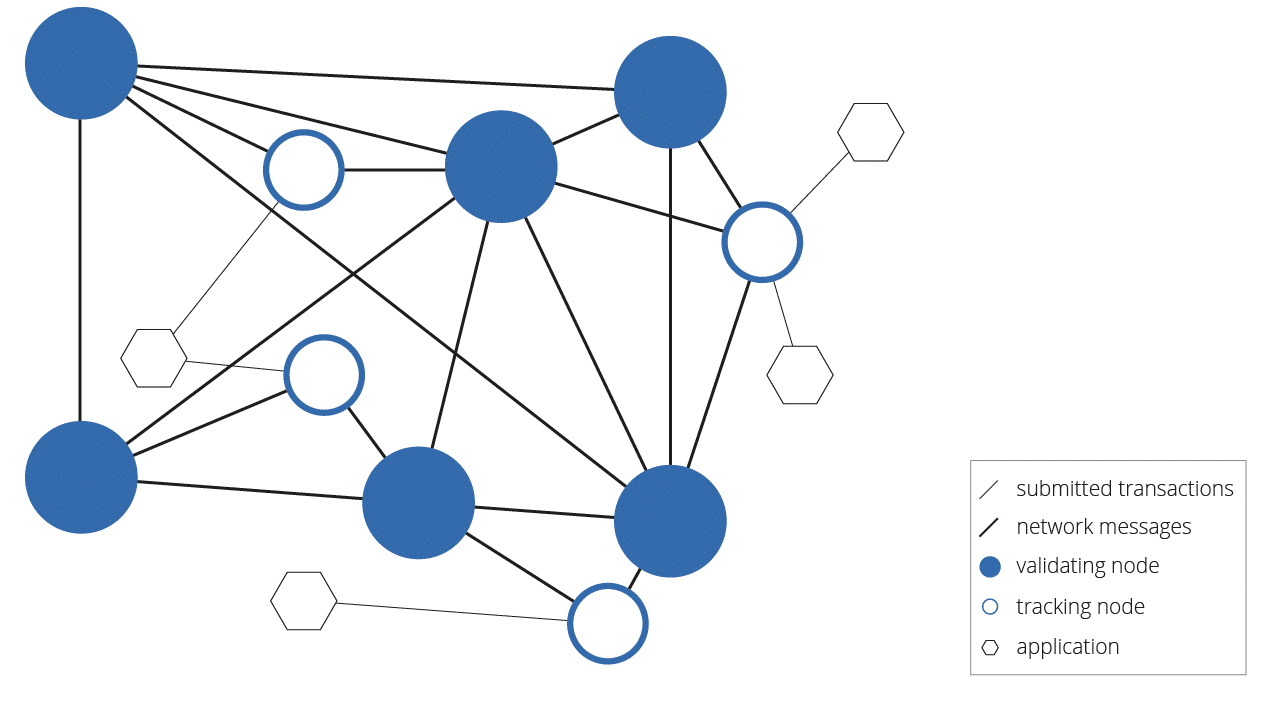

How about nodes? RippleNet’s consensus mechanism is unlike that of other cryptocurrencies. Instead of relying on Proof-of-Work or Proof-of-Stake, RippleNet uses a voting system to reach consensus. Without going into too much detail, nodes on the network rely on trusted validators, which determine the state of the blockchain and transactions.

Currently, RippleNet has over 700 public nodes but just 21 trusted validators. Out of the 21 trusted validators, Ripple operates 10 of them (48%). Additionally, the trusted validators set by default when running a node are all operated by Ripple. Therefore, unless you change your defaults when running a node, the system relies entirely on Ripple.

Lastly, RippleNet includes a function in which gateways can freeze issued currencies. The company claims that this function is in place so a client can follow regulatory procedure or inspect suspicious activity if they need to. But capabilities like this one are fairly unique in the blockchain world. Although Ripple themselves can’t freeze XRP, this does give gateways an unusual amount of control in what’s supposed to be a censorship-resistant network.

Defense

Ripple and most supporters agree that RippleNet is currently not as decentralized as it could or should be. And the company has laid out an extensive decentralization strategy to improve this attribute. The first part involves including a more substantial number of nodes across countries, entities, and software platforms on the network. That part has mostly been accomplished.

The next step is to expand on the number of trusted validator nodes. Ripple is currently in the process of adding additional third-party validators and replacing the ones that they now operate. Ripple operated 100% of the validators at launch but now only operate 48% – a significant improvement.

Yes, Ripple holds the majority of XRP, but 55 billion of those tokens are/were in escrow. Ripple only has access to one billion XRP each month. This control is necessary to create supply predictability as the network grows. You don’t have to worry about Ripple suddenly dumping their entire bankroll on the market.

Verdict – Guilty

As it currently stands, RippleNet is centralized. There is an insurmountable amount of evidence that supports this. The vast majority of XRP is in the hands of Ripple, and the same can be said for the trusted validators. Although Ripple can’t directly freeze funds, they can easily toss their influence around to encourage gateways to do so (which they have before).

All that said, Ripple has publicly posted their strategy for decentralizing the network. If RippleNet becomes decentralized over time, then this verdict will change. However, it remains to be seen whether the company will follow through on their statements or how successful those efforts will be.

Case #3: Financial institutions aren’t using XRP.

Evidence

Ripple fans commonly spout out a list of partnerships when praising the project. But, are these institutions actually using the blockchain tech on live accounts? And, if so, are they utilizing the XRP token? Most opponents don’t believe so. Even Ripple CTO David Schwartz clarifies that RippleNet participation doesn’t require XRP.

To explain further, it’s essential we define the difference between the products that Ripple offers:

- xCurrent, a software solution for cross-border payments, is Ripple’s primary product. It does not use XRP.

- xVia is a payments interface and API for corporations, payment providers, and banks. It isn’t available yet but also does not use XRP.

- xRapid, a liquidity solution, is currently the only product that does use XRP.

Financial institutions can use these products in combination with each other, but they aren’t. As of July, only ten companies have implemented xRapid with seven of those doing so on a trial basis. Additionally, Hikmet Ersek, Western Union (pilot company) CEO, has stated that they haven’t seen any costs savings in testing yet.

According to a Bloomberg report, executives at seven global financial institutions declared that they aren’t even considering implementing XRP in their systems. They state that the youth of the cryptocurrency industry and unclear regulatory issues create too much risk for their clients’ funds. Some of these institutions, although kept anonymous, are Ripple partners.

[thrive_leads id=’5219′]

Defense

Although there isn’t significant XRP adoption right now, there will be shortly. Ripple’s strategy is first to get partners implementing xCurrent, and then, warm them up to xRapid (and XRP) as the product matures. The over 100 banking partners is already a strong signal that these institutions are open to working with blockchain companies. It shouldn’t be difficult to onboard them onto xRapid once the value proposition is clear and XRP has a definitive, legal classification.

Western Union had transacted a total of just ten payments before claiming that xRapid isn’t useful. Ten transactions do not provide enough data to produce significant results. In fact, Cuallix, who has been using xRapid on live transactions reported the opposite. The company saw 1000 percent efficiency over their current system.

Nicolas Palacios, CFO of @Cuallix, shared with our team: “We ran the costs on our end and see that this is 1000 percent more efficient than what we’re doing now. The xRapid pilots all went perfectly.”

— Ripple (@Ripple) January 25, 2018

As the cryptocurrency market grows, banks and other institutions will become more comfortable using xRapid and the associated XRP token.

Verdict – Guilty With Chance of Parole

Plain and simple, most financial institutions, even those partnered with Ripple, aren’t utilizing XRP. With the current regulatory landscape, there is an immense amount of risk for banks to support XRP. As with most bureaucratic issues, XRP’s legal status may not be settled for years. And adoption may take even longer.

However, an SEC declaration of XRP as not a security could quickly change everything. And down the road, once cryptocurrency use is mainstream, XRP could become the preferred liquidity solution of financial institutions around the world. Until then, though, Ripple sits behind CoinCentral bars.

Court Dismissed

With two guilty verdicts and one still open for debate, the strong words against Ripple may be justified. It’s surprising that a cryptocurrency with such little adoption continually sits at the number three spot by market cap. Then again, EOS is somehow number five.

Although we’ve found Ripple guilty on almost all cases, their roadmap to decentralization and increased comfortability with cryptocurrencies among banks could turn the ship around. And these verdicts aren’t to say that Ripple has done no good. The company has donated to numerous charities including a $29 million XRP donation to public schools in America. And part of the company’s mission is to make cross-border payments more affordable for those who need them most.

So, centralized villain or force for good – in the end, the final verdict is yours to make.