TLDR

- XRP posted a 10% weekly gain, its largest recovery in 14 weeks, with the price hovering above $2.63

- The Rex Osprey XRP ETF reached $100 million in assets under management within its first four weeks of launch

- XRP has gained 355% over the past 52 weeks, outperforming Bitcoin and Ethereum since the 2024 election

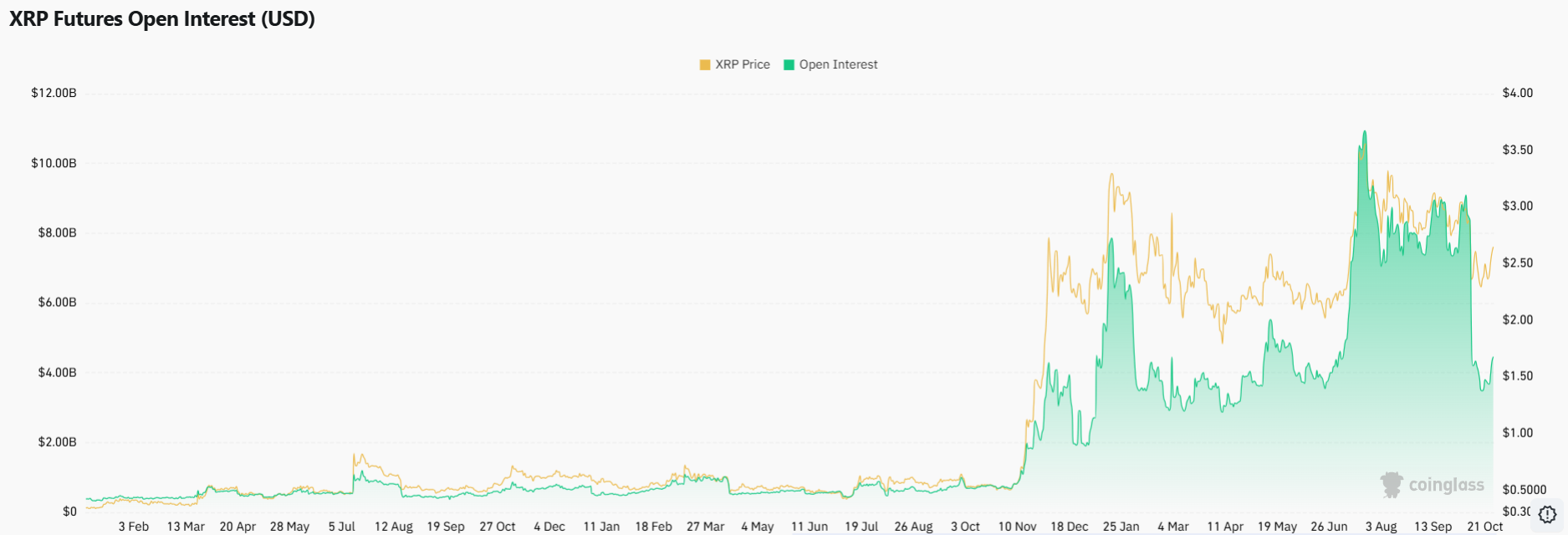

- Open interest increased from $3.49 billion to $4.26 billion, though whale activity remains weak with net short positions

- Ripple rebranded Hidden Road to Ripple Prime as part of efforts to make digital assets more accessible to institutions

XRP recorded its best weekly performance in over three months. The cryptocurrency climbed more than 10% in the last seven days. This marked the biggest weekly upside since late July 2025.

The price reached $2.63 at press time. XRP also saw its dominance spike to 4.22%. The token outperformed all other cryptocurrencies in the top 10 by market cap during this period.

The Rex Osprey XRP ETF hit a major milestone this week. The fund accumulated over $100 million in assets under management. This happened within just four weeks of its launch in the United States.

We are proud to announce that the REX-Osprey™ XRP ETF, $XRPR has surpassed $100 million in AUM as of 10/23/2025.$XRPR is the first U.S. ETF to provide investors with spot exposure to $XRP.

For more information on $XRPR click here:https://t.co/fZMaqJhPfD pic.twitter.com/vQopao0Y3G

— REX Shares (@REXShares) October 24, 2025

The ETF milestone showed strong institutional interest. It represented the first spot XRP ETF available to American investors. The achievement came as XRP continued its year-long rally.

Over the past 52 weeks, XRP has gained 355%. This performance beat both Bitcoin and Ethereum. Much of these gains came after the 2024 U.S. election results.

The election created optimism around cryptocurrency regulation. The SEC lawsuit against Ripple was dismissed. Many investors expected a more crypto-friendly regulatory environment under the new administration.

Regulatory Landscape Remains Unclear

The Trump administration has not yet delivered a full regulatory framework for cryptocurrencies. The Genius Act provided some clarity for stablecoins. However, the broader Clarity Act remains stalled due to the ongoing government shutdown.

The Clarity Act would define the roles of the SEC and CFTC in regulating cryptocurrency trading. XRP was also not included in the Strategic Bitcoin Reserve. Some investors had anticipated this inclusion would boost demand.

Ripple announced the rebranding of its recent acquisition. Hidden Road is now called Ripple Prime. CEO Brad Garlinghouse said the move aims to make digital assets more accessible to institutional clients.

Garlinghouse stated that XRP plays a critical role in all company efforts. This statement may have boosted confidence among XRP holders.

Market Activity Shows Mixed Signals

Open interest in XRP derivatives rose during the week. It increased from $3.49 billion to $4.26 billion. This growth indicated rising trader interest.

However, whale activity told a different story. Net spot flows across major exchanges were negative. Coinbase, Binance, and OKX showed combined outflows of $2.82 million.

Perpetual futures markets showed net short positions worth over $36 million. This suggested that large holders were not driving the rally. Retail investors appeared to be the main participants.

Net spot inflows remained relatively weak at less than $20 million. This raised questions about the sustainability of the price recovery.

Open interest levels were still far below peak levels from earlier this year. In July, open interest exceeded $10 billion. In October, it reached above $9 billion before the flash crash. The crash wiped out over $6 billion in open interest.

The Federal Reserve was scheduled to hold an FOMC meeting on October 28 and 29. Rate cut expectations could serve as the next catalyst for XRP. Fresh reports indicated that the U.S. and China were ready to secure a trade deal.

The potential end of the trade war might encourage risk-on market sentiment. This could favor further upside for cryptocurrencies including XRP.