Although Robinhood is particularly famous for the GameStop debacle from 2021, its presence in the crypto space only became strong since the meme coin craze that started around September 2021.

Today, the exchange is evolving and expanding its services after launching a crypto wallet last month and announcing the arrival of its non-custodial wallet today.

Robinhood Brings Another Crypto Wallet

In a press release, the cryptocurrency exchange stated that it is developing a new cryptocurrency wallet that is set to launch sometime after the end of quarter two of 2022.

This wallet will be a non-custodial wallet, which basically allows users to be the sole owner of the private keys, which are critical to accessing their wallet and conducting transactions on any blockchain.

Just last month, Robinhood had also launched its very own cryptocurrency wallet.

Being the first on the platform, Robinhood stated during the launch that the crypto wallet would enable its users to use the assets they trade on the exchange for multiple purposes instead of selling them for money upon requirement.

However, the way the non-custodial wallet differs from the cryptocurrency wallet is that the user will no longer be dependent on Robinhood in any way.

Non-custodial wallets, for example, would not be affected should Robinhood’s system shut down.

But this independence also opens up the user to the possibility of losses since the wallet’s private keys will solely be the wallet holder’s responsibility. Losing it might cause the user to lose their funds completely.

Further commenting on the launch of the wallet, Robinhood’s co-founder and Chief Executive Officer (CEO), Vlad Tenev, said,

“By offering the same low cost and great design that people have come to expect from Robinhood, our web3 wallet will make it easier for everyone to hold their own keys and experience all the opportunities that the open financial system has to offer.”

Robinhood’s Focus on Cryptocurrency

In order to push itself beyond the boundaries of its current reach, Robinhood has been active lately. Just last month, in April, Robinhood finalized a purchase deal to acquire a London-based fintech platform, Ziglu. This allowed the crypto exchange to establish its presence in the United Kingdom as well.

The reason why these efforts are critical is that Robinhood’s revenues have declined this year.

As the quarter one 2022 reports reveal, Robinhood’s total net revenue decreased by 43%, from $522 million in Q1 2021 to just $299 million in Q1 2022.

Furthermore, despite the market rallies of mid-February and later March, the cryptocurrency revenue of the platform decreased by 39% to just $54 million in the first quarter of this year, from $88 million in the first quarter of 2021.

Although the overall net loss did reduce to just $392 million from $1.4 billion in Q1 2021, it did not do much for Robinhood.

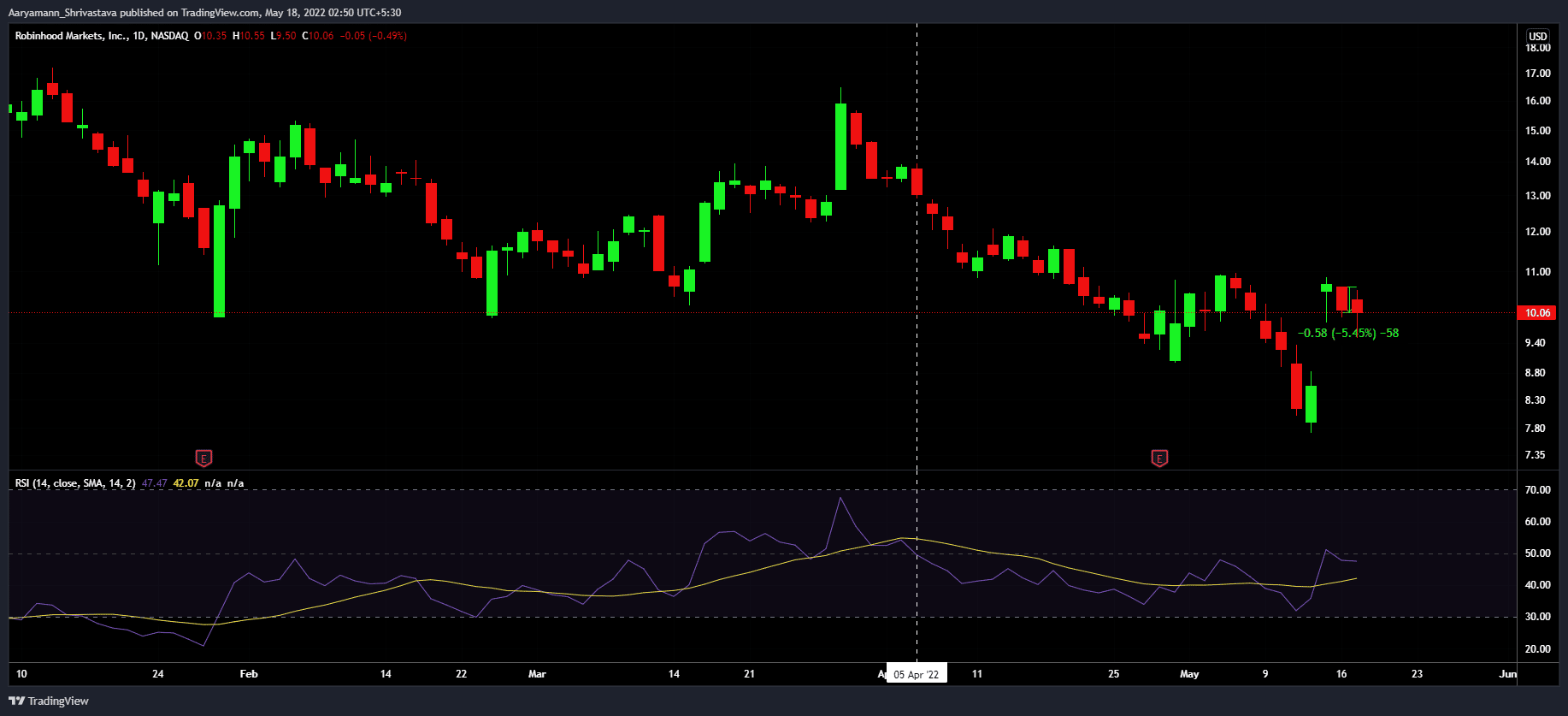

Even at the time of writing on May 18, Robinhood’s ticker HOOD declined by 5.45% in the span of 48 hours, keeping its RSI restrained in the bearish, neutral zone for a month and a half straight.

Thus, to counter these negatives, Robinhood is doing the most it can to attract more users and trading volume on its exchange.

To bolster these efforts, it even extended the trading hours for its stock market exchange by 4 hours. Robinhood aims to eventually offer equity trading services 24 hours a day, every day.

In conclusion, while Robinhood is taking the right steps by leaning on the crypto market for its growth, it needs to also keep the current condition of the market in mind before depending on it.

The crash of May 9 impacted a lot of investors, and the bearishness that ensued might keep newer investors at bay for a while.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.