- Sei Coin broke out of a falling wedge, setting a target of $1.15.

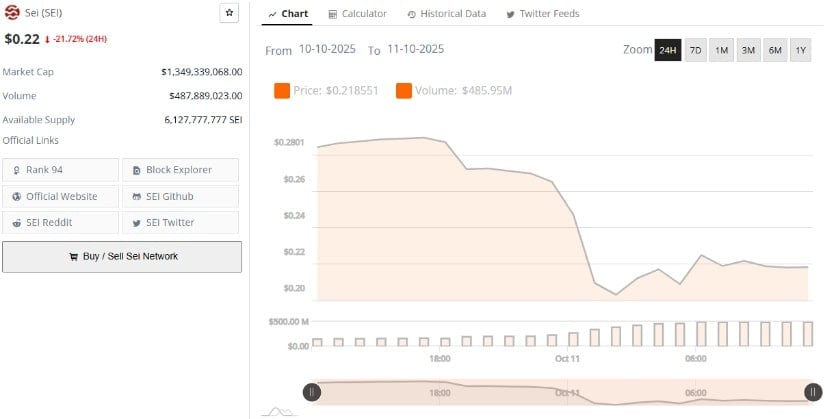

- A 21.7% drop in 24 hours could be a healthy pullback for Sei Coin.

- Key support at $0.26 is critical for Sei Coin’s bullish structure.

- Sei Coin’s market cap remains strong at $1.34 billion despite volatility.

Sei Coin (SEI) is gaining attention after breaking out of a significant falling wedge pattern, signaling potential for bullish continuation. The asset recently retested key levels, raising hopes for a shift in market momentum. While the price has experienced a short-term pullback, technical analysts are optimistic about a rebound. With a target of $1.15 in sight, all eyes are on SEI as it navigates key support zones and consolidation phases.

Falling Wedge Breakout Signals Potential Reversal

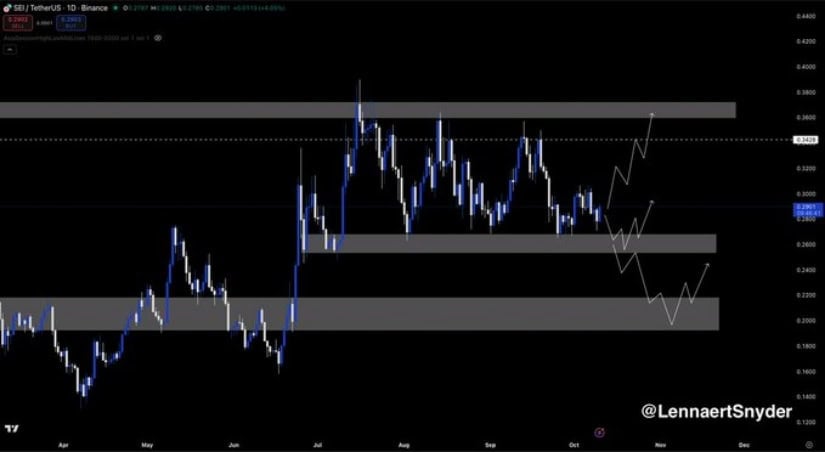

Sei Coin has successfully broken out of a large falling wedge pattern on its weekly chart, a move seen as a bullish signal. Falling wedge formations often indicate trend exhaustion, and their breakouts are typically followed by price reversals to the upside.

The recent breakout saw SEI climb above the upper trendline, suggesting that the token could experience a change in market momentum after months of declining price action and reduced volatility.

The breakout was followed by a retest of the former resistance, which now acts as support. This behavior supports the case for continued upward momentum. Analyst Bitcoinsensus stated that the next technical target for SEI sits at $1.15, if the bullish structure holds. The market is watching closely to see if SEI can maintain this positive trajectory and fulfill the breakout’s potential.

Short-Term Pullback and Healthy Consolidation

After the breakout, SEI has experienced a 21.7% drop in the past 24 hours, which some market observers view as a natural post-breakout pullback. Such price corrections are common after significant breakouts, allowing the market to consolidate before the next potential move. Despite this decline, SEI’s market capitalization remains solid at $1.34 billion, showing that traders are still engaged in the asset.

The decline in price could be a healthy sign that the market is adjusting to the new market structure. Analysts argue that a pullback is not necessarily a reversal but a normal phase in the price action of assets following a breakout. It is crucial for SEI to hold key support levels to confirm the continuation of the bullish trend.

Critical Support Levels and Key Price Zones

Technical analysis suggests that SEI must maintain its support levels to avoid further downside risks. Lennaert Snyder, another analyst, identified $0.26 as a strong support zone. This level is critical for preserving the bullish structure. If SEI manages to hold above $0.26, it could confirm the positive outlook and set the stage for future gains.

Should SEI break below $0.22, the coin could face additional downside pressure. However, there is also significant demand near this support level, offering potential for a rebound. Traders are closely monitoring how the price interacts with these key zones to gain insights into the token’s near-term direction.

Future Outlook: Maintaining Bullish Structure

The direction of SEI in the coming days hinges on its ability to sustain the higher-low structure established during its breakout. A rebound above $0.30 would provide more confidence to traders that the bullish trend is intact. Moreover, this level would reinforce the validity of the breakout, potentially triggering more buying activity and further price appreciation.

For now, the market remains in a consolidation phase, with SEI’s price movements confined to key support and resistance zones. Traders are focused on how the coin behaves around the $0.26 and $0.22 levels. If SEI manages to hold and build momentum, the target of $1.15 could become increasingly achievable in the coming weeks.