TLDR

- Senator McCormick disclosed a Bitwise Bitcoin ETF buy worth $65K–$150K.

- He serves on the Senate Banking Committee’s digital assets subcommittee.

- Purchases were made on November 24 and 25 per transaction reports.

- Bitcoin remains above $91K despite declining demand and volatility.

Senator Dave McCormick, a Republican from Pennsylvania, reported buying up to $150,000 worth of Bitwise Bitcoin ETF shares this week. The purchases were disclosed in a periodic transaction report filed with the U.S. Senate on Thursday.

According to the report, McCormick made two separate purchases, one on November 24 and another on November 25. The investment falls between $65,002 and $150,000 in total value. The ETF, managed by Bitwise Asset Management, gives traditional investors access to Bitcoin exposure through regulated financial markets.

McCormick’s disclosure comes as lawmakers are increasingly engaged in the digital asset space. As a member of the Senate Banking Committee’s digital assets subcommittee, he holds a position that could influence future crypto policy in the U.S.

Increased Lawmaker Activity in Crypto Markets

McCormick joins a growing list of U.S. officials with personal investments in crypto-linked assets. This move signals increasing engagement by lawmakers in blockchain and digital asset markets, even as regulatory frameworks are still being debated.

The timing of the disclosure aligns with heightened institutional interest in spot Bitcoin ETFs. Analysts have pointed out that recent inflows into such products may be linked to renewed expectations around U.S. Federal Reserve interest rate decisions.

Bitcoin Trades Steady Despite Weak Demand and High Expiry Volume

Bitcoin is currently holding steady above $91,000, even as demand remains weak. Over 147,000 BTC options—worth $13.42 billion—expired today on Deribit, the leading crypto derivatives exchange. Market participants saw a balance between call and put positions, helping maintain the current price range.

As of now, Bitcoin is trading at $91,856, with a 24-hour range of $90,471 to $91,829. However, overall market activity has cooled. Trading volume is down by 32% over the past 24 hours, reflecting reduced interest among both retail and institutional traders.

Analysts Split on Bitcoin’s Price Direction

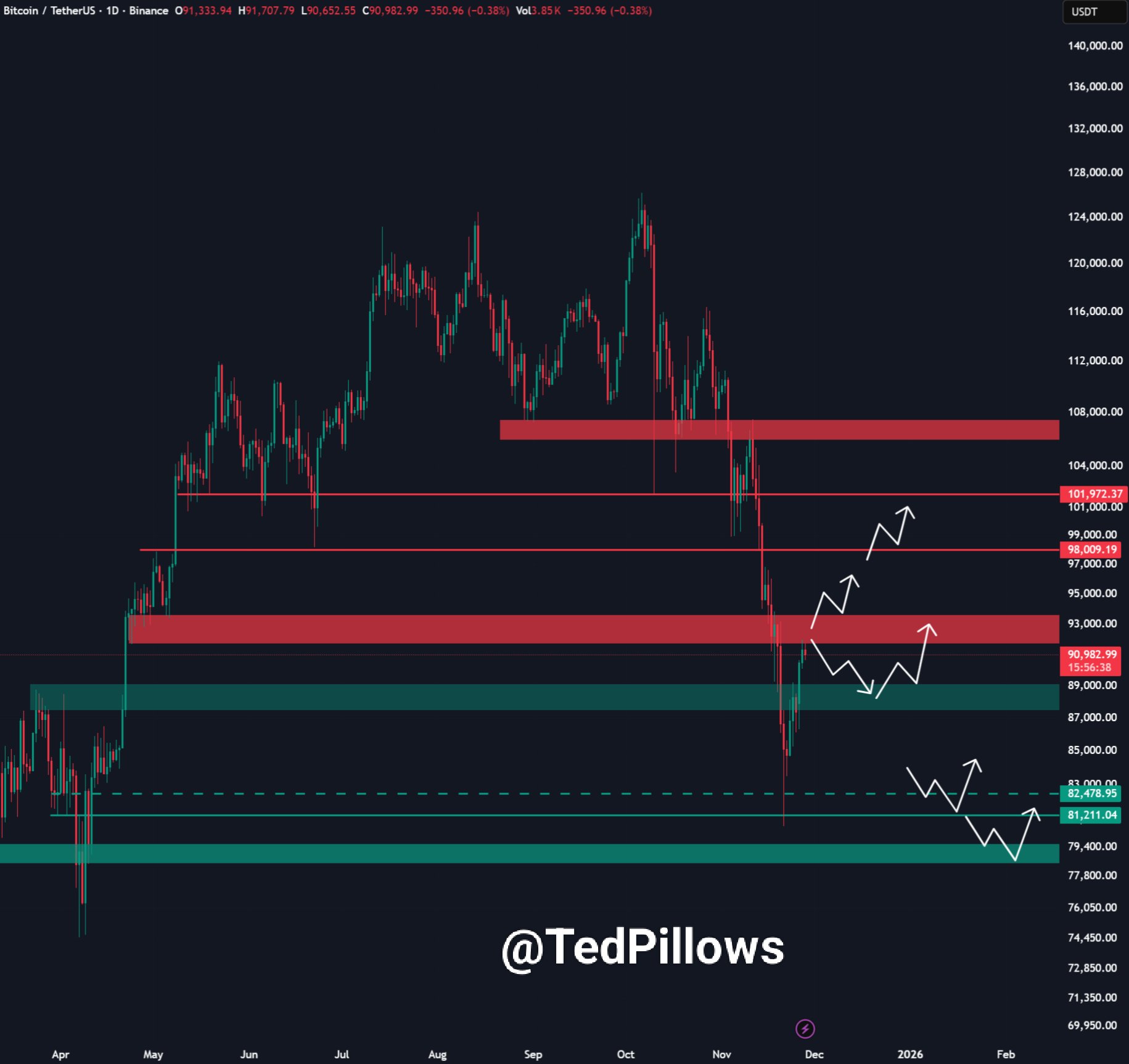

Technical analysts are divided on Bitcoin’s next move. Ted Pillows, a market analyst, noted that Bitcoin faces strong resistance near $92,000 to $93,000. A confirmed breakout could drive the price toward the $100,000 level. However, failure to move past that resistance may send Bitcoin back below $88,000.

Meanwhile, veteran trader Peter Brandt has warned that Bitcoin may fall to $60,000 if current support levels do not hold. Others, including 10X Research, suggest that the crypto market may be shifting toward a fundamentals-driven cycle, as investor behavior changes and volatility continues to fall.

The current focus remains on the on-chain Bitcoin Cost Basis metric. Breaking through the $93,000–$96,000 range is viewed as critical for any sustained upward momentum. If achieved, analysts predict a potential move into the $100,000–$108,000 range by year-end.