TLDR

- SharpLink Gaming raised $400 million through a stock sale to boost its Ethereum treasury holdings above $3 billion

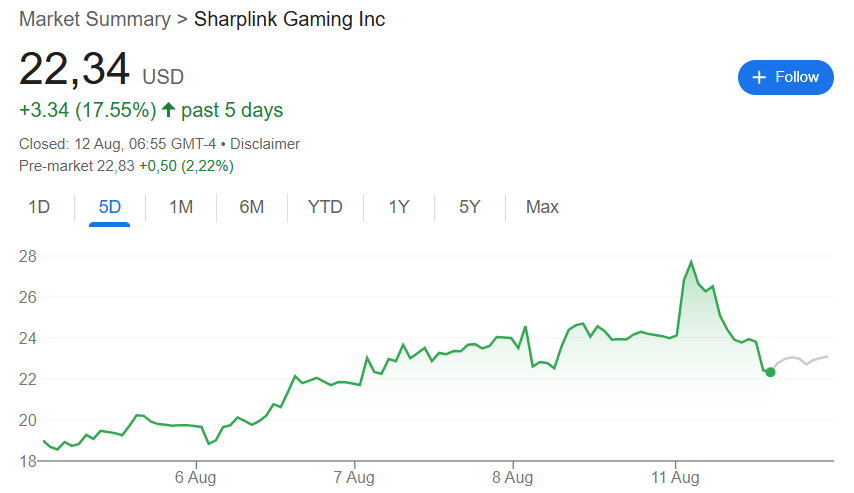

- The company’s shares dropped 6.6% on Monday despite the funding deal, closing at $22.34

- SharpLink has raised nearly $900 million in the past week for cryptocurrency purchases

- The firm currently holds 598,800 ETH worth over $2.5 billion, making it the second-largest corporate Ethereum holder

- Ethereum has surged 44.5% in the past 30 days, trading near $4,300 and approaching its all-time high

SharpLink Gaming announced a $400 million stock sale on Monday to expand its Ethereum holdings. The sports betting marketing company turned cryptocurrency treasury firm sold shares at $21.76 each to five global institutional investors.

The deal is expected to close on Tuesday pending final conditions. SharpLink expects its total Ethereum holdings to exceed $3 billion in value following the purchase.

Despite the funding success, SharpLink shares fell 6.6% during Monday trading to close at $22.34. The stock had reached highs above $28 earlier in the day before declining.

After-hours trading showed a modest recovery with shares gaining 3.5% to $23.10. The company remains up 17.5% over the past five trading days and 189% year-to-date.

SharpLink co-CEO Joseph Chalom said the rapid investment reflects market confidence in the company’s Ethereum strategy. He described the funding as recognition of Ethereum’s potential in the digital asset space.

The latest deal adds to SharpLink’s recent fundraising activity. The company has raised nearly $900 million in the past week through multiple transactions.

On Thursday, SharpLink completed a $200 million share purchase with four institutional investors. Earlier this month, it raised $264.5 million through an at-the-market offering.

Corporate Ethereum Holdings Surge

SharpLink currently holds 598,800 ETH worth approximately $2.57 billion at current prices. This makes it the second-largest corporate Ethereum holder among public companies.

BitMine Immersion Technologies leads corporate Ethereum holdings with over 1.15 million ETH valued at nearly $5 billion. The Las Vegas-based firm increased its holdings by 317,000 ETH last week.

Ethereum co-founder Joseph Lubin serves as SharpLink’s chairman. The company began accumulating Ethereum in May 2024 as part of its treasury strategy shift.

SharpLink aims to hold 1% of Ethereum’s total circulating supply, which equals over 1.2 million ETH. The company has approximately $200 million in unused proceeds from previous offerings.

Several publicly traded firms have adopted similar Ethereum treasury strategies this year. Companies including EtherMachine and Bit Digital hold billions in combined Ethereum value.

Ethereum Price Recovery Drives Interest

Ethereum has recovered from months of underperformance relative to Bitcoin. The cryptocurrency gained 44.5% in the past 30 days, climbing from below $3,000 to above $4,300.

ETH currently trades at $4,278, approximately 12% below its all-time high of $4,878 set in November 2021. The recent price surge has boosted corporate treasury values across the sector.

Standard Chartered analysts predict corporate Ethereum holdings could reach 10% of total circulating supply. This trend reflects growing institutional adoption of Ethereum as a treasury asset.

Prediction markets suggest strong confidence in Ethereum’s continued growth. More than 75% of users on crypto prediction platform Myriad expect Ethereum to surpass its record price before year-end.

SharpLink’s stock experienced volatility earlier this year when shares fell 73% after-hours following a filing to potentially resell 58.7 million common shares. Lubin clarified the filing represented standard procedure rather than immediate sale plans.