TLDR

- Sharplink Gaming purchased 19,271 ETH worth approximately $80 million, ending a month without new acquisitions

- The company now holds 859,400 ETH valued at roughly $3.6 billion, making it the second-largest corporate Ethereum holder

- Sharplink raised $76.5 million through equity offering at $17 per share, a 12% premium to market price

- Corporate treasuries collectively hold 5.98 million ETH, representing nearly 4.94% of Ethereum’s total supply

- Ethereum traded at $4,240, up 7% on the day, as the company times its purchase during market recovery

Sharplink Gaming purchased 19,271 Ether tokens worth about $80 million on Monday. The buy ended a month-long pause in the company’s accumulation strategy.

Sharplink Gaming (@SharpLinkGaming) has added another 19,271 $ETH, worth $80.37M, to its Strategic $ETH reserve.

They now hold 859,395 $ETH, worth $3.58B.

Address: 0x5e3b62e38808fc9582c23bc05e8a19a091d979c9

Data @nansen_ai pic.twitter.com/HPPEW1SYpm

— Onchain Lens (@OnchainLens) October 26, 2025

The purchase brings Sharplink’s total Ethereum holdings to 859,400 tokens. At current prices, the treasury is valued at approximately $3.6 billion.

The company now ranks as the second-largest corporate holder of Ethereum. Only BitMine holds more, with roughly 3.24 million tokens worth $13.5 billion.

ACY Securities analysts noted the timing of the purchase. They suggested it could be positioning ahead of potential Ethereum ETF inflows or improved economic conditions.

The acquisition comes as Ethereum faces pressure from broader market concerns. President Donald Trump announced plans to impose tariffs up to 155% on Chinese goods starting November 1.

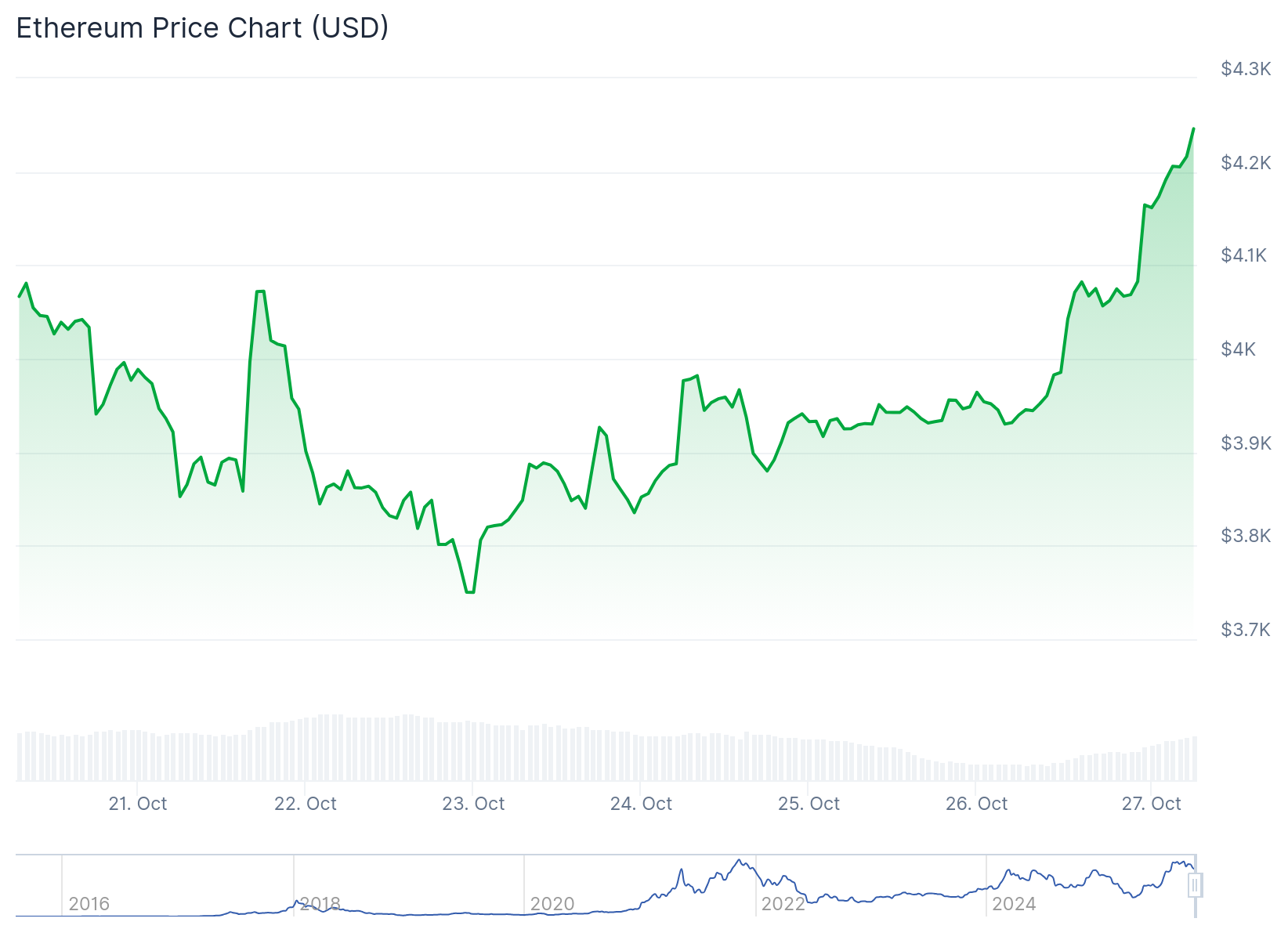

Despite these headwinds, Ethereum gained 7.1% on the day of Sharplink’s purchase. However, the token was up only 1.1% over the prior two weeks.

Sharplink funded its latest purchase partly through recent capital raises. The company secured $76.5 million earlier this month through an equity offering.

The deal sold 4.5 million common shares at $17 each. This represented a 12% premium to the October 15 closing price of $15.15.

Recent Capital Activity

In August, Sharplink entered securities purchase agreements totaling $400 million with five institutional investors. These deals strengthened the company’s capacity for treasury operations and growth initiatives.

The company also announced plans to tokenize its Nasdaq-listed SBET shares on Ethereum. This partnership with Superstate signals deeper integration with Ethereum infrastructure beyond simple holding.

Corporate treasuries now collectively hold 5.98 million ETH according to Strategic ETH Reserve data. This represents nearly 4.94% of Ethereum’s total supply.

Market Conditions and Technical Outlook

Ethereum traded near $4,240 following the announcement. The price approached a critical resistance zone at $4,250.

CoinGlass data shows the fourth quarter has historically been Ethereum’s second-weakest period. Traders continue monitoring these seasonal patterns as they position for the remainder of the year.

The token bounced from support around $3,750 earlier in October. Bulls are now targeting a potential move toward the October high of $4,734.