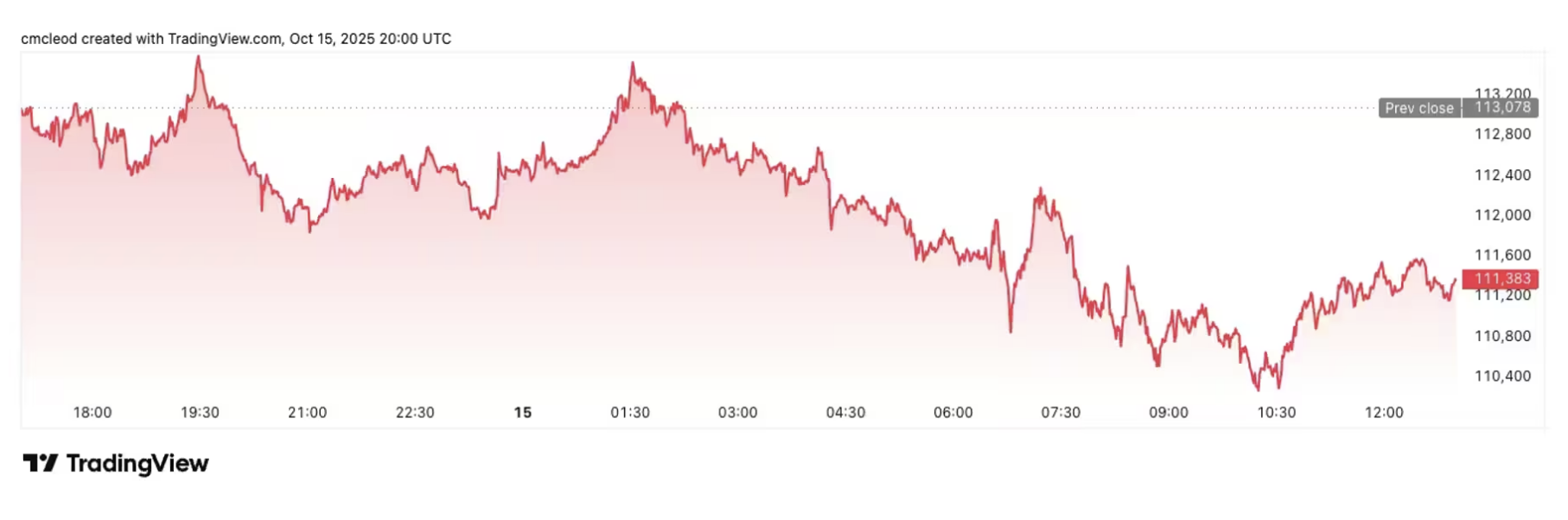

Crypto liquidations topped $900 million on October 16 as Bitcoin shed its Jackson Hole bounce and slipped below $111K, erasing gains that briefly lifted BTC toward $117K. The cascade prompted forced selling across futures markets, with overleveraged longs being flushed from exchanges in the blink of an eye. Yet, the AI token sector dodged the bloodbath, jumping above 4% for the second straight day.

When liquidations destabilize the more established, AI tokens tend to climb, and smart money rotates toward utility rather than speculation alone. For those on the lookout for the next crypto to explode, DeepSnitch AI is one to watch.

Having already crossed $429K raised at a presale price of $0.01915, this is a platform with 100x potential, boasting a rare combination of AI innovation and blockchain transparency.

Fear index hits six-month low as traders reassess risk

The crypto Fear and Greed Index dropped to 32 on October 16, marking its lowest reading since April and confirming widespread caution among market participants. Sentiment turned bearish after the liquidation event, with 93 of the top 100 coins declining over 24 hours.

The total crypto market cap contracted 1.4% to $3.88 trillion, while trading volume held fast around $194 billion as volatility remained high.

Bitcoin futures open interest stayed near $25 billion, but negative funding rates on Binance and OKX showed traders leaning short despite a stable basis. A spike in the 1-week 25 Delta Skew to above 12% suggested some participants were paying up for call options, hinting at bullish expectations buried beneath the surface fear.

This divergence between sentiment and derivatives positioning often precedes sharp reversals, though timing remains unpredictable.

Corporate Bitcoin holdings now exceed $117 billion across 172 firms, up nearly 40% from the prior quarter. That accumulation happened while retail sentiment soured, which created the well-worn scenario where institutions buy fear and retail sells into it.

The question now becomes whether altcoins can decouple from Bitcoin’s weakness, or if correlation drags everything lower until a new catalyst emerges.

Best 3 meme coins to buy now

DeepSnitch AI: Five AI agents built to decode market chaos

When DeepSnitch AI launches, it will roll out five specialized AI agents engineered to give retail traders the intelligence that whales monopolize. The platform solves information asymmetry, the core problem that tears up retail portfolios.

Whales see moves before they happen because they have infrastructure tracking every meaningful wallet and social channel, but DeepSnitch AI will democratize that access, turning surveillance tools into a subscription product priced at entry-level presale rates.

Using Telegram’s billion-plus user base, DeepSnitch AI will instantly distribute distilled, need-to-know information for traders. This kind of utility and adoption potential makes Shiba Inu price predictions seem paler.

The presale has officially surpassed $429K at $0.01915, with Stage 2 nearing sell-out. Audited by both Coinsult and SolidProof, DeepSnitch AI offers security verification that separates real, sustained projects from cash grab uncertainty.

Early backers will receive priority access to features as development milestones roll out, and the staking rewards will flow steadily and exclusively once the claiming period opens post-presale.

October momentum is lifting AI sector tokens even as majors correct, and if DeepSnitch AI captures even a fraction of the surveillance demand from traders tired of getting rugged, exit liquidity from presale pricing stands a real chance of delivering 100x returns.

That’s the asymmetric bet SHIB forecast can’t lay claim to with a $6 billion market cap.

Shiba Inu: Meme coin tests critical support amid broader weakness

Shiba Inu price prediction models show SHIB trading around $0.000010 on October 16, down 16% over the past week and consolidating below resistance at $0.000012. The meme coin held support above $0.0000099, though momentum indicators leaned bearish with RSI near 44 signaling weak buying pressure.

CoinPedia projects SHIB could reach $0.000064 during the upcoming altcoin season if broader market recovery materializes and Shibarium adoption accelerates.

Changelly estimates Shiba Inu price prediction targets between $0.000032 and $0.000048 by year-end, as long as favorable conditions stick around. But the SHIB coin prediction hinges on whether the ecosystem delivers utility beyond meme status, a challenge that becomes harder as the market matures and traders demand tangible functionality over narrative alone.

Shibarium continues processing transactions with low fees, but development updates remain sparse compared to 2021’s hype cycles. The community holds strong, but without fresh catalysts, SHIB risks range-bound trading that frustrates holders hoping for breakouts.

At a $6 billion market cap, the meme coin would need another cultural moment or technical breakthrough to justify 10x gains. Meanwhile, DeepSnitch AI only needs market penetration.

Ripple XRP: CEO pushes for regulatory parity at DC Fintech Week

XRP held around $3.04 on October 16 after Ripple CEO Brad Garlinghouse called for equal treatment between crypto firms and traditional banks during remarks at DC Fintech Week. Garlinghouse argued that cryptocurrency companies meeting AML and KYC standards should receive Federal Reserve master accounts automatically, a privilege banks enjoy without question. The comments followed news of Ripple expanding partnerships with financial institutions, gearing XRP to be a bridge asset for cross-border payments.

Some analysts forecast XRP reaching $20 by year-end if ETF approvals arrive and regulatory clarity continues improving. Still, XRP’s $168 billion market cap means even that ambitious target represents roughly 560% gains. But for those who want 100x potential, that cap won’t do, while presales in the early stages remain ripe with possibilities.

For traders seeking stability with institutional backing, XRP is compelling. For those wanting exponential returns, DeepSnitch AI’s utility-driven model and presale timing offer a different equation entirely, where market cap provides room to run.

The verdict

Liquidations exceeding $900 million flushed weak positions from markets, but corporate accumulation continues at a record pace with Bitcoin treasuries topping $117 billion. Shiba Inu price prediction targets $0.000064 in optimistic scenarios, though the SHIB forecast faces headwinds from weak momentum and limited catalysts near term. XRP offers institutional credibility, but at $168 billion market cap, the days of 100x returns are over.

DeepSnitch AI, priced at $0.01915 with $429K raised and Stage 2 nearing completion, combines AI surveillance tools with plenty of presale upside. Five specialized agents delivering whale alerts, rug checks, and sentiment tracking are set to become essential infrastructure when volatility returns.

Visit the website to join the presale.

FAQs

What is the Shiba Inu price prediction for October 2025?

SHIB trades around $0.000010 with support at $0.0000099 and resistance at $0.000012. CoinPedia forecasts potential climbs toward $0.000064 during altcoin season if momentum returns.

Can SHIB reach $0.01?

Reaching $0.01 would require a $5.9 trillion market cap, making it nearly impossible. Most Shiba Inu price 2025 projections focus on $0.00003 to $0.0001 over multiple years.

Why choose DeepSnitch AI over Shiba Inu?

DeepSnitch AI offers 100x potential at $0.01915 with real AI-driven surveillance tools, while SHIB forecast models project 6x gains maximum. Early presale access plus utility creates asymmetric upside, hard to match among meme coins.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.