TLDR

- Solana broke above $200 for the first time since February, gaining 28% in 30 days

- Over $85 million worth of SOL moved off exchanges, showing long-term holder confidence

- Technical indicators including MACD golden cross and RSI at 66 support bullish momentum

- Short-term target of $250-$500 possible, with some analysts eyeing $1,000 long-term

- Trading volumes reached $13 billion, accounting for 13% of SOL’s circulating supply

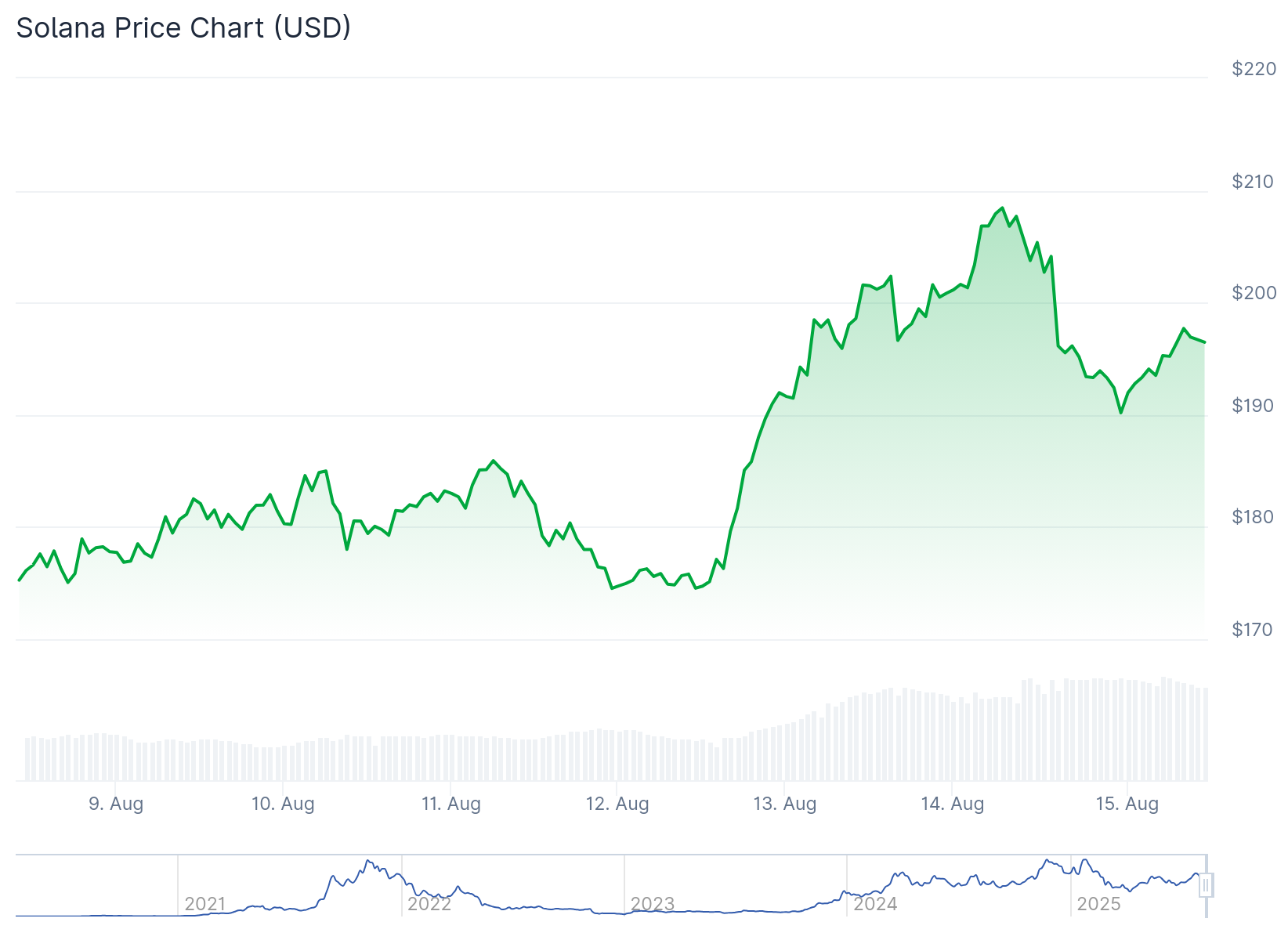

Solana has broken through the $200 price level this week for the first time since February. The token has gained nearly 28% over the past 30 days as altcoin season begins.

The cryptocurrency market cap has reached $4.2 trillion. Ethereum has also surged near $5,000, confirming capital rotation toward altcoins.

Trading volumes for SOL hit $13 billion in 24 hours. This represents nearly 13% of the token’s circulating supply.

The REX-Osprey Solana + Staking ETF now has $182 million in assets under management. This regulated vehicle could attract more institutional buying pressure.

SOL faced some selling pressure at the $206 resistance level from July 23. This could present an opportunity for new buyers to enter at lower prices.

Technical Analysis Shows Bullish Momentum

The Moving Average Convergence Divergence (MACD) has formed a golden cross. This occurs when the MACD line crosses above the signal line, typically indicating a bullish trend.

The Relative Strength Index (RSI) stands at 66, firmly in bullish territory. While this shows positive momentum, it approaches the overbought level above 70.

A pullback to the $190 area could provide support for the next leg up. From there, SOL could target its previous all-time high of $294.

Exchange data shows strong underlying demand. Over $85 million worth of SOL moved off exchanges on August 11.

These tokens went into private wallets, suggesting long-term holding intentions. Such outflows reduce the likelihood of immediate selling pressure.

Derivatives markets show increased interest. Open interest in SOL futures rose 15% during the past week according to Coinglass data.

The long/short ratio on Binance reached 2.79. This means over 67% of traders expect further price increases.

Solana Price Predictions

Short positions worth approximately $95 million are concentrated around $219. If SOL breaks above $206 and approaches $219, these liquidations could create additional buying pressure.

Analysts see a near-term target of $500, representing 180% upside potential within 3 to 6 months. The $250 level remains a key resistance to watch.

$SOL Journey to $1000? 🚀 #SOLANA has already delivered massive returns.

When it was around $40, I told you the $1000 target is on the cards and we’re already up 500%, touching nearly $300.✅ First Target: $500

🟢 Above $500 = Bonus territory

🟢 High potential to reach $1000… https://t.co/ZZj1zBeCmx pic.twitter.com/WTqW6lnnNM— Crypto Patel (@CryptoPatel) August 14, 2025

Crypto analyst Patel has outlined a path to $1,000 for SOL. He noted that when SOL was around $40, the $1,000 target seemed distant.

With SOL now approaching $300, this long-term target appears more achievable. However, the token must first overcome several resistance levels.

The $500 level represents the most plausible near-term target. Additional catalysts would be needed to push the price beyond that level.

Current market conditions support continued bullish momentum. The combination of technical indicators, exchange outflows, and institutional interest creates a positive backdrop.

Solana price currently trades above its 30-day moving average with strong volume support.