TLDR

- Bitwise Solana Staking ETF (BSOL) recorded $69.5 million in inflows on its first trading day, making it the largest crypto ETF launch of 2025

- The ETF achieved $55.4 million in trading volume and reached a net asset value of $289 million

- BSOL outperformed competing Solana staking products by 480%, with inflows far exceeding REX Osprey’s $12 million

- Whales opened leveraged long positions on SOL in response to the launch, with one whale using 10x leverage

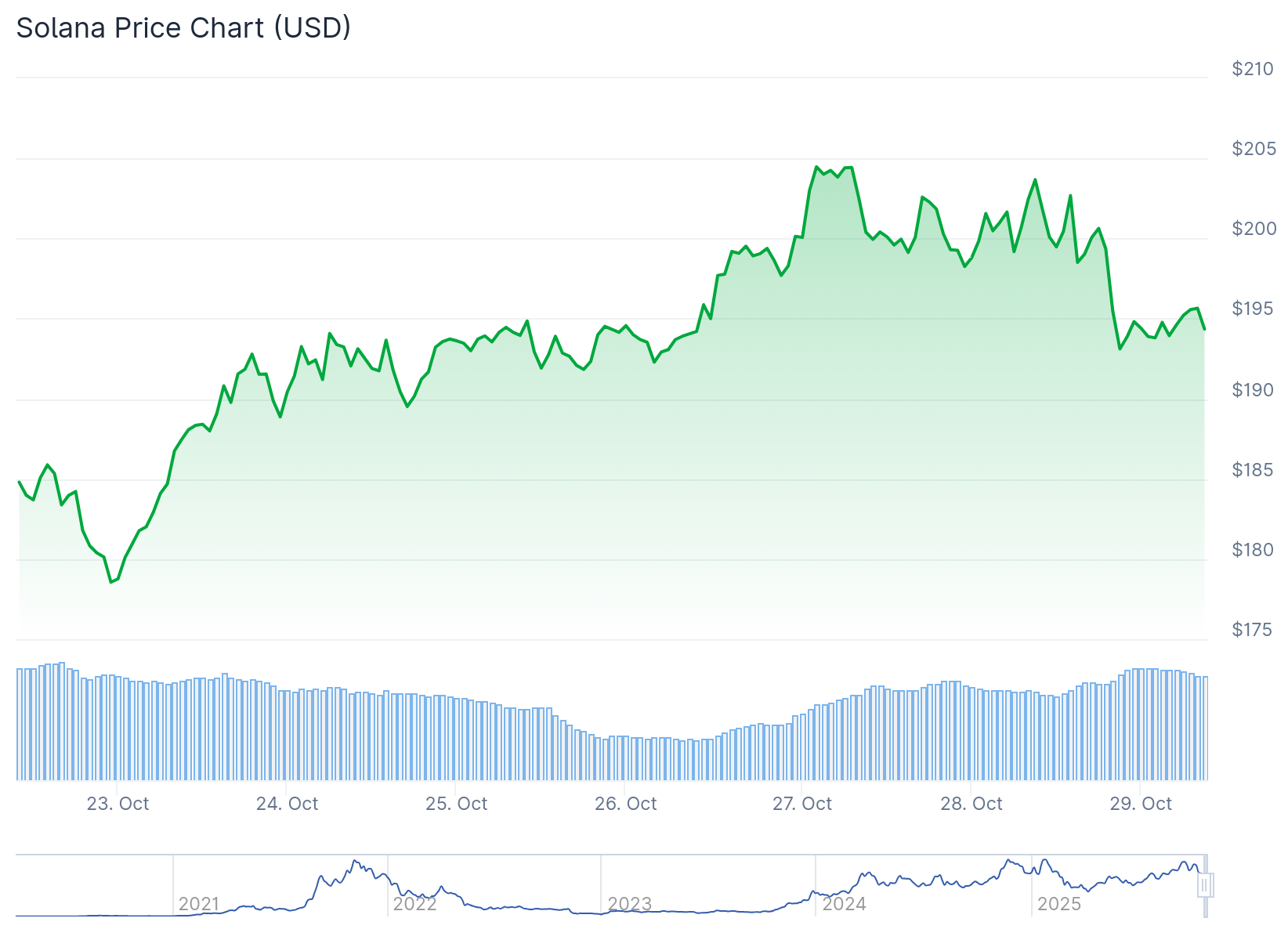

- SOL price fell 3% to $194 despite the ETF launch, though trading volume jumped 25% in 24 hours

Bitwise’s Solana Staking ETF made its debut on Tuesday with strong institutional support. The ETF recorded $69.5 million in inflows on its first day of trading.

The product, trading under the ticker BSOL on NYSE Arca, started with $222.9 million in seed capital. This pre-launch funding showed institutional confidence before the ETF opened to public trading.

BSOL achieved $55.4 million in trading volume during its debut. Bloomberg ETF analyst Eric Balchunas confirmed this was the highest volume of any crypto ETF launched in 2025.

Big first day for the Bitwise Solana Staking ETF $BSOL:

$55.4 million in trading volume

$217.2 million in AUMNow the largest spot Solana ETF, targeting 100% staked & seeking to maximize Solana’s 7%+ average staking rewards.*

The Solana story continues.

— Bitwise (@BitwiseInvest) October 28, 2025

The performance outpaced other recent crypto ETF launches. Canary Capital’s HBAR ETF recorded $8 million in trading volume on its debut, while its Litecoin ETF saw only $1 million.

BSOL’s inflows exceeded competing Solana products by a wide margin. The REX Osprey SOL Staking ETF recorded just $12 million in first-day inflows, making BSOL’s numbers 480% higher.

BSOL Net Asset Value Reaches $289 Million

The ETF’s net asset value climbed to nearly $289 million after its first trading day. This represents 0.01% of Solana’s total market cap.

BSOL is the first Solana staking ETF approved for trading in the United States. The product stakes 100% of its SOL holdings, offering investors more than 7% in annual staking rewards.

Balchunas noted the $222.9 million in seed capital was impressive. He suggested the asset manager could have waited to include this capital as day-one inflows to boost the launch metrics further.

Final tally of Day One trading.. $BSOL: $56m$HBR: $8m$LTCC: $1m

I can't believe how close I came. ETF sixth sense for the win. Wish there was a @Polymarket for this I'd be rich. https://t.co/TODOk13WUt— Eric Balchunas (@EricBalchunas) October 28, 2025

The launch comes as Wall Street expands beyond Bitcoin and Ethereum ETFs. Asset managers are now creating products tied to alternative cryptocurrencies with features like staking rewards.

Whale Activity and Price Movement

Large investors responded to the ETF launch with leveraged positions. One whale with a 100% win rate opened a 10x leveraged long position on SOL, according to Onchain Lens.

This same whale recently closed a 13x leveraged Bitcoin position for $1.4 million in profit. The move to Solana came immediately after the BSOL launch.

Despite institutional interest, SOL’s price dropped 3% in the 24 hours following the launch. The token traded at $194, down from a 24-hour high of $203.83.

Trading volume told a different story. SOL’s 24-hour trading volume jumped 25%, showing increased trader interest.

The derivatives market showed buying activity in the hours after launch. Four-hour SOL futures open interest rose 0.22%, according to CoinGlass data.

Total Solana futures open interest climbed 3% to $10.22 billion over 24 hours. Binance saw a 2.50% increase in open interest, while CME experienced a 0.03% decline.

The 24-hour price range for SOL spanned from $191.39 to $203.83. The price currently sits near the lower end of this range at $194.