TLDR

- Solana (SOL) broke out of a symmetrical triangle pattern with analysts targeting $164 as the next price level

- A whale trader opened a $12.65 million leveraged position at $153.79 with 10x leverage, showing strong bullish conviction

- SOL also broke above a cup and handle formation with the next resistance target at $184.82

- Derivatives data shows 61.72% of traders are long on SOL perpetuals, indicating bullish sentiment

- Trading volume remains weak despite the breakout, raising questions about the rally’s strength

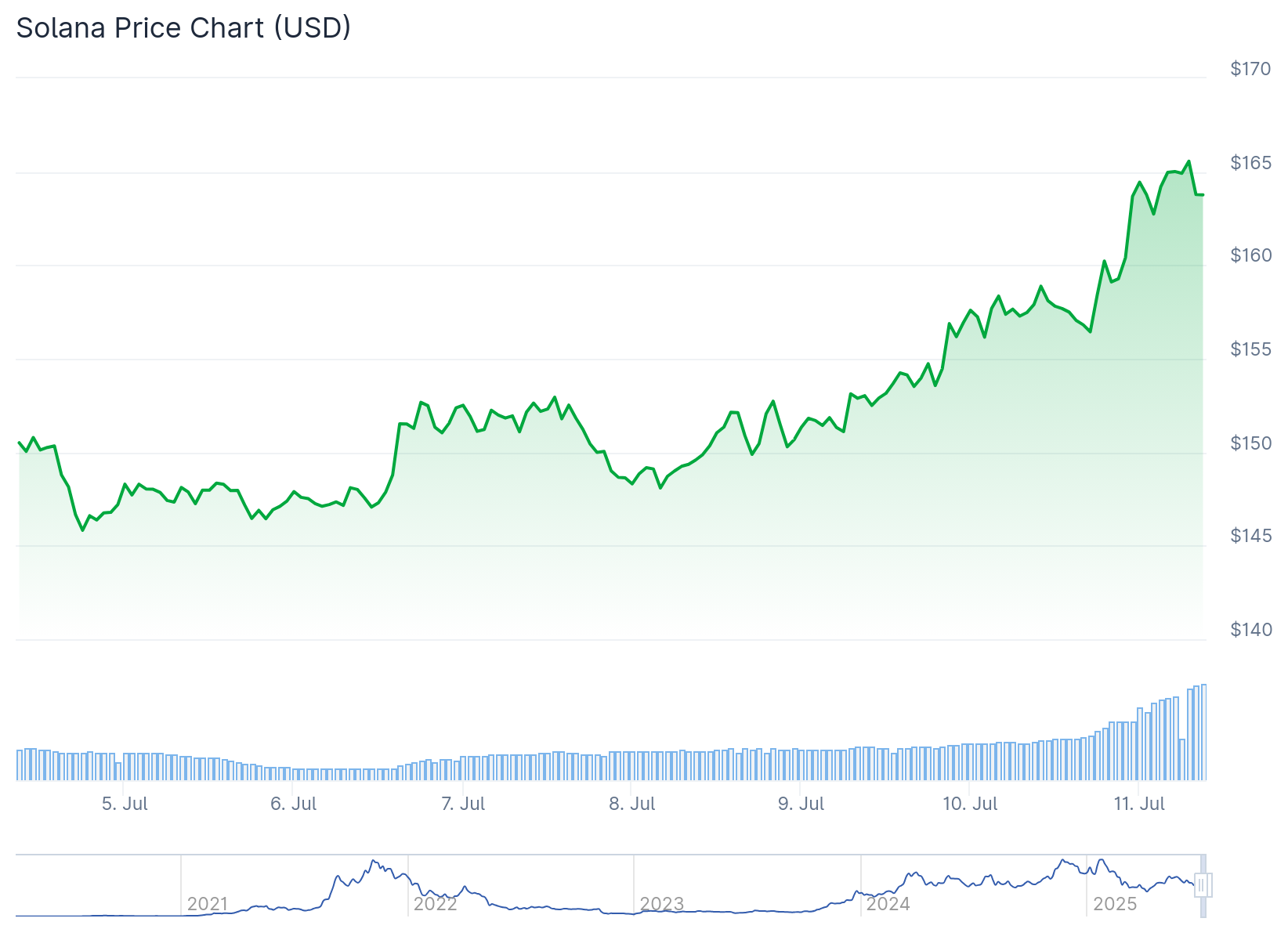

Solana has broken out of a symmetrical triangle pattern that had been constraining its price movement. The cryptocurrency is currently trading around $158, up 3% in the last 24 hours.

Technical analyst Ali Martinez identified the breakout from the symmetrical triangle formation. This pattern involves an asset trading within two converging trendlines that narrow the price range over time.

Resistance broke, and Solana $SOL could reach $164! pic.twitter.com/aNFqzOa6jb

— Ali (@ali_charts) July 10, 2025

The symmetrical triangle represents a consolidation period where breakouts can occur in either direction. However, SOL chose the upward path after approaching the triangle’s apex.

Martinez projects the next target at $164, which corresponds to the 1.272 Fibonacci Extension level. This level is based on the square root of 1.618, known as the Golden Ratio.

A whale trader has shown strong conviction in SOL’s upward potential. The trader vladilena.eth deposited $4 million USDC into Hyperliquid and opened a leveraged position worth $12.65 million.

The position uses 10x leverage with an entry price of $153.79. The liquidation level sits at $106, indicating the trader expects continued upward movement.

Cup and Handle Pattern Emerges

SOL has also broken above a cup and handle formation, another bullish technical pattern. The neckline breach occurred at $155.76, setting up a potential move toward $184.82.

The cup and handle pattern typically signals bullish continuation when volume accompanies the breakout. The smooth curvature of the cup and declining volume during the handle formation align with textbook criteria.

Traders are monitoring this zone closely as confirmation could attract additional buying interest from market participants who have been waiting on the sidelines.

Derivatives Market Shows Bullish Bias

Binance derivatives data reveals that 61.72% of accounts maintain long positions on SOL/USDT perpetuals. Only 38.28% hold short positions, creating a long/short ratio of 1.61.

This positioning reflects growing confidence among market participants. However, such imbalances can lead to volatility if crowded trades become vulnerable to sudden reversals.

Long positions could provide fuel for further upward movement if momentum continues. Conversely, any sharp pullback might trigger cascading liquidations.

The spot volume data presents a mixed picture. Despite the technical breakout and rising long positions, the Spot Volume Bubble Map shows declining trading activity.

Strong breakouts typically require high volume confirmation. The current volume weakness raises questions about the rally’s sustainability.

Volume spikes near resistance levels would help validate the bullish momentum. Without this confirmation, the move might lack the strength needed for sustained gains.

Critical liquidation clusters appear around $153 and $159 on the Binance heatmap. These levels represent zones where leveraged traders have concentrated their positions.

A clean move above $159 could trigger short liquidations, adding upward pressure to the price. A drop below $153 might flush out overleveraged long positions.

SOL’s behavior around these thresholds will likely determine its near-term direction. The clustering of liquidity makes these zones key battlegrounds between bulls and bears.

The technical setup combines multiple bullish signals including the symmetrical triangle breakout, cup and handle formation, and strong whale positioning. However, weak spot volume and critical liquidation levels create potential headwinds.

Solana currently trades at $157.70 with the whale trader’s position showing unrealized gains since the $153.79 entry point.