TLDR

- SOL price jumped 10.5% after testing $191 support but remains down 10% over two weeks compared to rivals like Ethereum and BNB

- Network activity declined with transactions down 10% and fees dropping 50% in the past week as competing chains like Hyperliquid and Aster gain market share

- A potential spot ETF approval deadline of October 10 has analysts predicting 95% or higher approval odds

- Jump Crypto’s Firedancer upgrade proposal SIMD-0370 could remove fixed compute limits and let validators process transactions based on hardware capability

- Forward Industries holds over 1.58 billion SOL tokens, representing more than 5% of total supply

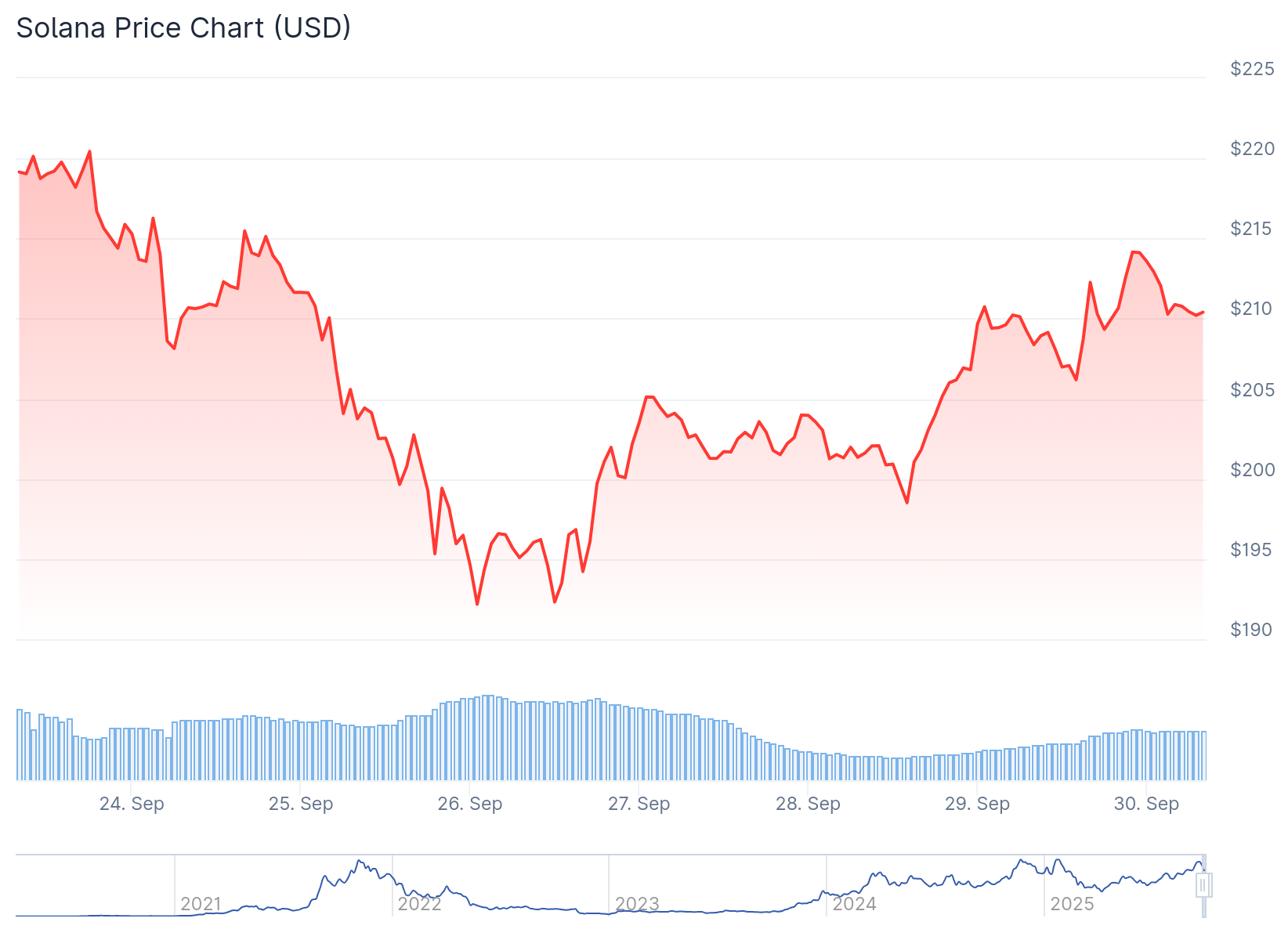

Solana’s native token recovered over the weekend after dropping to $191 on Friday. The rebound brought SOL to $210 levels, representing a 10.5% gain.

Despite this recovery, SOL has underperformed compared to other major cryptocurrencies over the past two weeks. The token remains 10% lower while competitors like Ethereum and BNB posted stronger results.

Market sentiment improved after President Donald Trump signaled his intention to avoid a government shutdown. Congress has not yet secured the 60 votes needed to pass a temporary funding bill by Tuesday.

Gold reached an all-time high of $3,833 on Monday. This reflects ongoing concerns about US fiscal debt despite broader cryptocurrency market gains.

Network activity on Solana has decreased recently. Over the past seven days, transactions fell 10% while network fees dropped nearly 50% according to Nansen data.

Competing blockchains showed opposite trends during the same period. BNB Chain saw fees jump 56% while Arbitrum and HyperEVM more than doubled their fee revenue.

Competition Heats Up

The growth of synthetic perpetual futures platforms has impacted Solana’s position. Hyperliquid, Aster, and edgeX have gained traction in decentralized exchange activity.

Hyperliquid launched its own chain to reduce fees and eliminate maximal extractable value from validators. Aster, backed by YZi Labs (formerly Binance Labs), is currently integrated with BNB Chain and plans to introduce its own layer-1 network.

These developments challenge Solana’s previous dominance through platforms like Meteora, Raydium, and Pump. Many SOL holders had expected the network to maintain its competitive edge on fees and user experience.

Technical Upgrades on Horizon

Jump Crypto’s Firedancer team introduced proposal SIMD-0370. This proposal would remove the fixed compute unit block limit currently capping Solana at 60 million CUs per block.

🚨JUST IN: @jump_firedancer team has introduced SIMD-0370, a proposal to remove Solana’s fixed compute unit block limit after Alpenglow. Instead of static caps, validators would skip blocks they can’t process in time. pic.twitter.com/0JcBiLVvpt

— SolanaFloor (@SolanaFloor) September 27, 2025

The upgrade would let validator performance determine network capacity instead. Validators could skip blocks they cannot process in time, reducing congestion while allowing capable validators to pack more transactions.

This creates a performance incentive system. Block producers earn higher fees by packing more transactions while validators that skip blocks lose rewards, encouraging hardware and software improvements.

The US Securities and Exchange Commission faces a final deadline of October 10 for Solana spot ETF applications. Analysts assign approval odds of 95% or higher.

A successful ETF launch could bring institutional inflows during the first months of trading. Forward Industries, the largest Solana digital treasury, has accumulated over 1.58 billion SOL tokens.

Some concerns exist about validator sustainability. According to analysis shared on X, 76% of validator income comes from newly issued coins rather than maximal extractable value or priority fees.

This raises questions about the long-term sustainability of staking reward rates. Critics suggest Solana’s inflation could pose risks given the network’s nearly 1,000 validators and their operational costs.

SOL is currently trading around $210 after defending the $200 support level. Technical indicators show mixed signals with RSI climbing back above 45 while MACD remains bearish.