TLDR

- Analyst sets $1,314 price target for Solana (SOL) based on cup-and-handle pattern breakout from multi-year formation

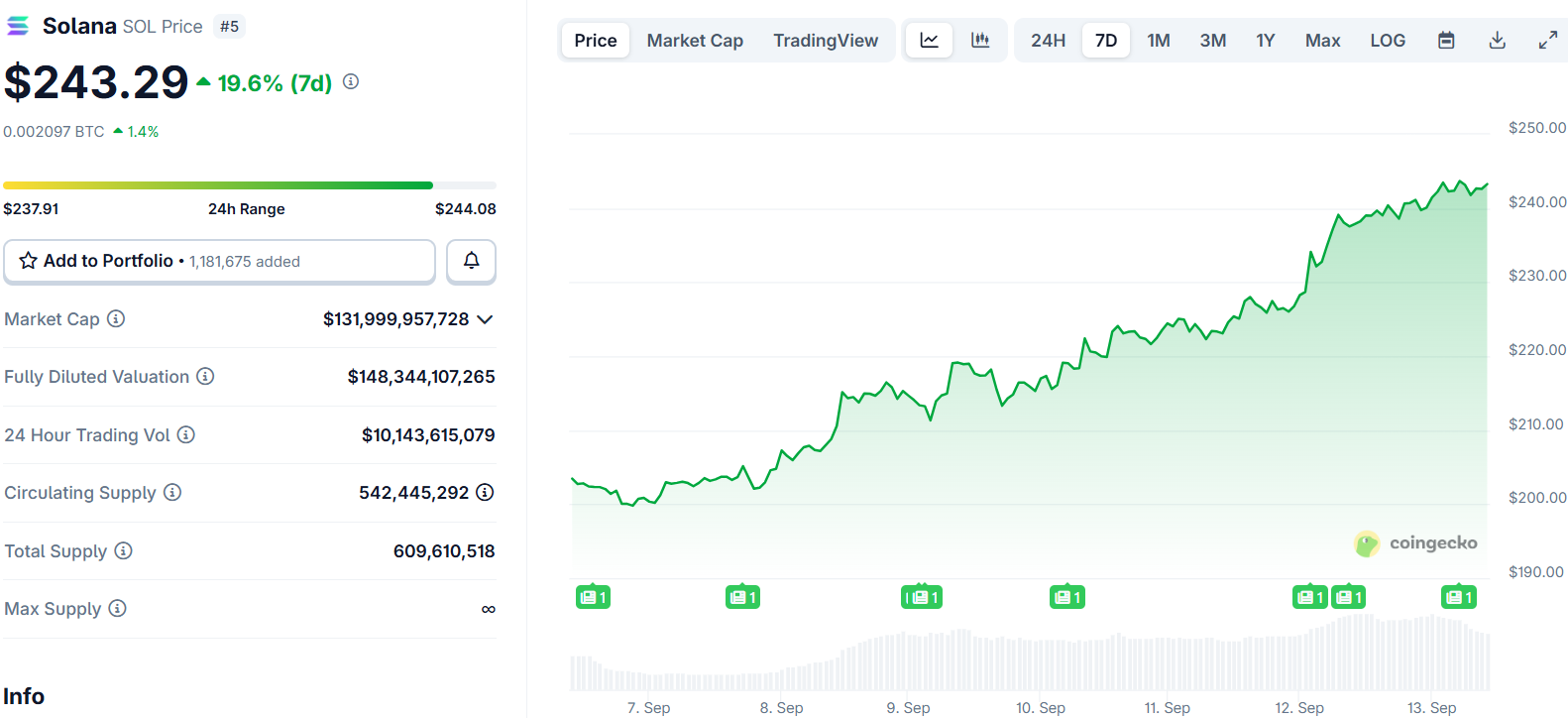

- SOL price surged 17% over the past week, reaching $238 after breaking resistance levels in July

- Forward Industries raised $1.65 billion to establish Solana Treasury, marking major corporate adoption

- Forward’s shares jumped 128% in pre-market trading while SOL rose 2.3% on the news

- Major crypto firms Galaxy Digital, Jump Crypto, and Multicoin Capital joined as investors and advisors

Solana has emerged as a standout performer in the cryptocurrency market this week. The token gained over 17% in the past seven days to reach $238.

A technical analysis from cryptocurrency analyst Ali Martinez suggests SOL could climb much higher. Martinez identified a cup-and-handle pattern formation on Solana’s weekly price chart spanning multiple years.

The pattern consists of two main components. A U-shaped trendline forms the “cup” portion. A downward parallel channel represents the “handle.”

$1,314.41 is the main target for Solana $SOL after breaking out of a cup and handle! pic.twitter.com/RkwosDpwnB

— Ali (@ali_charts) September 12, 2025

SOL’s price declined and recovered between 2021 and 2024, creating the cup formation. This year, the token entered the handle phase with downward consolidation.

The breakout occurred in July when SOL surged beyond the pattern’s resistance line. This upward move suggests potential continued bullish momentum for the cryptocurrency.

Technical Target Points to Major Upside

Martinez set a price target of $1,314.41 based on Fibonacci Extension levels. The analyst used SOL’s cup low as the zero level for calculations.

The target corresponds to the 1.414 Fibonacci Extension level. This represents a potential gain of over 450% from current price levels.

Cup-and-handle patterns typically signal bullish continuation. Breakouts from these formations often lead to sustained upward price movement.

The weekly timeframe adds weight to the analysis. Longer-term patterns tend to produce more reliable signals than shorter-term formations.

Corporate Adoption Drives Institutional Interest

Forward Industries completed a $1.65 billion private placement to establish a Solana Treasury. This represents one of the largest corporate moves into Solana to date.

🚨BREAKING: @galaxyhq Digital has accumulated 1.81M $SOL worth $432M in the past 24 hours, reportedly for Forward Industries’ $1.65B Solana treasury. Only 26% of the raise has been deployed so far, with 74% still remaining. pic.twitter.com/iwE2uI88PX

— SolanaFloor (@SolanaFloor) September 12, 2025

The company plans to deploy SOL through token staking and lending strategies. Market-making activities will also be part of their approach.

Major crypto firms participated in the funding round. Galaxy Digital, Jump Crypto, and Multicoin Capital served as both investors and strategic advisors.

Kyle Samani from Multicoin will join Forward’s board as chairman. Representatives from Galaxy and Jump will serve as board observers.

Forward’s shares surged 128% in pre-market trading following the announcement. SOL itself gained 2.3% on the news.

The market reaction reflects growing excitement around corporate cryptocurrency adoption. Both retail and institutional investors showed strong interest.

Forward’s strategy goes beyond passive holding. The company will actively generate returns through various on-chain activities.

The Solana Treasury will participate directly in the blockchain ecosystem. This approach aims to maximize returns while supporting network growth.

Corporate treasury strategies are evolving toward digital assets. Companies like MicroStrategy pioneered this approach with Bitcoin holdings.

Forward joins other firms exploring blockchain-based treasury management. The move positions them as a leader in Solana ecosystem participation.

The funding structure provides Forward with experienced crypto guidance. Advisory relationships with major firms offer strategic advantages.

SOL’s recent performance reflects broader institutional interest. The combination of technical patterns and corporate adoption creates multiple bullish catalysts.

Forward Industries raised $1.65 billion through private placement to establish its Solana Treasury with major crypto firms as investors and advisors.