TLDR

- Whale transfers of $836 million moved to exchanges, with most going to Binance and $54 million to Coinbase Institutional

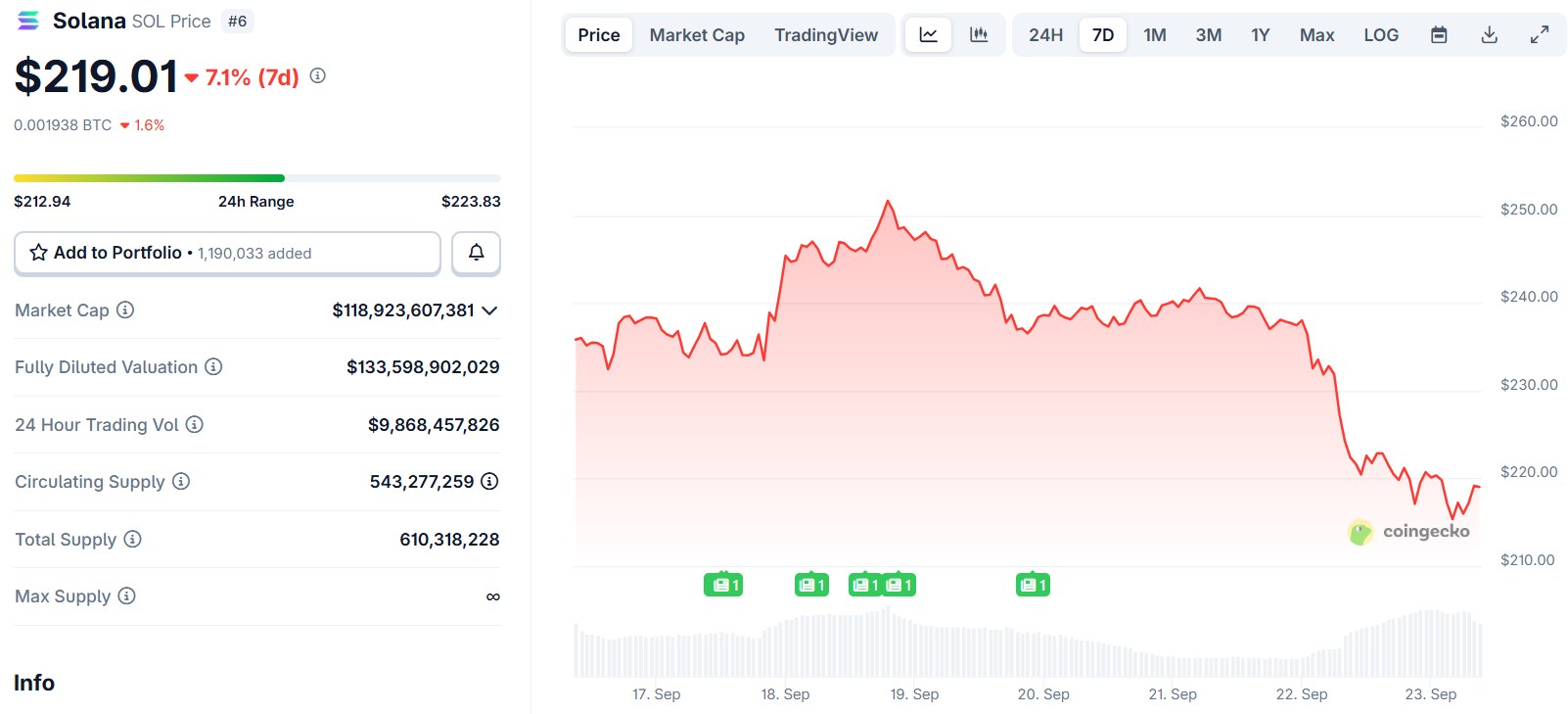

- Solana price trades at $219.35 after a 7% decline, facing potential retest of $200 support level

- Daily Active Addresses dropped 27% from 2.6 million to 1.9 million users in one week

- Technical indicators show bearish momentum with DMI crossing and ADX at 31

- Weighted sentiment turned negative at -1.09 as bearish voices dominate market discussion

Solana price action faces uncertainty as massive whale movements create pressure on the altcoin’s current trading range. The cryptocurrency sits at $219.35 following recent declines that have traders watching key support levels.

Large whale transfers exceeding $836 million moved into Binance wallets within hours. Another $54 million was routed to Coinbase Institutional during the same period. These concentrated inflows often signal potential repositioning by major holders.

The scale of these movements represents over 2.5 million SOL tokens changing hands. Such transfers typically create liquidity pressure on exchange order books. The distinction between Binance and Coinbase Institutional flows suggests different intentions among whale holders.

Technical analysis reveals SOL approaching critical levels. The $200 support zone has emerged as a key area that could define short-term direction. A retest of this level appears increasingly likely given current market dynamics.

Technical Indicators Show Bearish Pressure

The DMI indicator shows +D crossing below -D with ADX reading 31. This technical setup previously coincided with SOL dropping to $126 before staging a 62% rebound. Current chart patterns suggest similar dynamics may be developing.

Repeated rejections near $240 demonstrate buyers lack conviction to push higher. The ascending trendline from April continues providing structural support for the bullish case. However, momentum indicators point toward continued pressure in the near term.

If the $200 level holds firm, projections target a move toward $270. A decisive break above $248 would strengthen the case for an extension toward $325. These targets depend on the current support zone maintaining its strength.

The daily chart shows Solana consolidating above the $214-$220 support zone. This area has acted as foundation for recent price action. Breaking below this range could expose the altcoin to extended volatility.

Network Activity Declines Raise Questions

Daily Active Addresses fell nearly 27% within one week. The metric dropped from 2.6 million to 1.9 million users. This decline highlights weakening participation across the Solana network.

The divergence between price stability and shrinking activity creates sustainability concerns. Reduced participation constrains transaction volumes and ecosystem development. Both factors are vital for maintaining positive market narratives.

Network engagement now stands as a critical factor shaping investor perception. The disconnect between derivatives optimism and on-chain activity could trigger increased volatility. Market participants are monitoring whether usage metrics will recover alongside price action.

Perpetual Futures markets show mixed signals despite network concerns. The OI-Weighted Funding Rate remains slightly positive at +0.0074%. This indicates traders continue paying premiums to maintain long positions.

Weighted sentiment readings turned negative at -1.09 according to Santiment data. Bearish voices currently dominate social media and trading discussions. This shift follows weeks of inconsistent optimism that repeatedly faded after short-lived spikes.

The combination of whale activity and negative sentiment could amplify near-term selling pressure. However, historical patterns suggest sharp rebounds often follow similar inflow periods. Past cycles show selling pressure typically exhausts itself before recovery phases begin.

Exchange inflows highlight immediate risks while institutional transfers suggest strategic repositioning rather than pure liquidation. This contrast leaves traders questioning whether whales are preparing for major market movements or simple portfolio rebalancing.

Current market conditions place SOL at a pivotal juncture where multiple factors will determine direction. Whale behavior, technical levels, and network activity all contribute to the immediate outlook.

The $836 million whale transfer represents one of the largest single-day movements recorded for Solana in recent months.