TLDR

- SOL dropped 10% this week despite strong on-chain metrics including 2.67% TVL growth and 500% monthly stablecoin increase

- DeFi Dev Corp increased SOL holdings by 91% to 1.18 million tokens, valued at $204 million

- Solana’s new Seeker mobile phone began shipping to over 50 countries with hardware-level crypto security

- SOL/ETH ratio hit 2022 lows as $4 billion in open interest was liquidated and capital rotated to Ethereum

- Potential Solana spot ETF approval in October could provide stronger catalyst than current mobile adoption

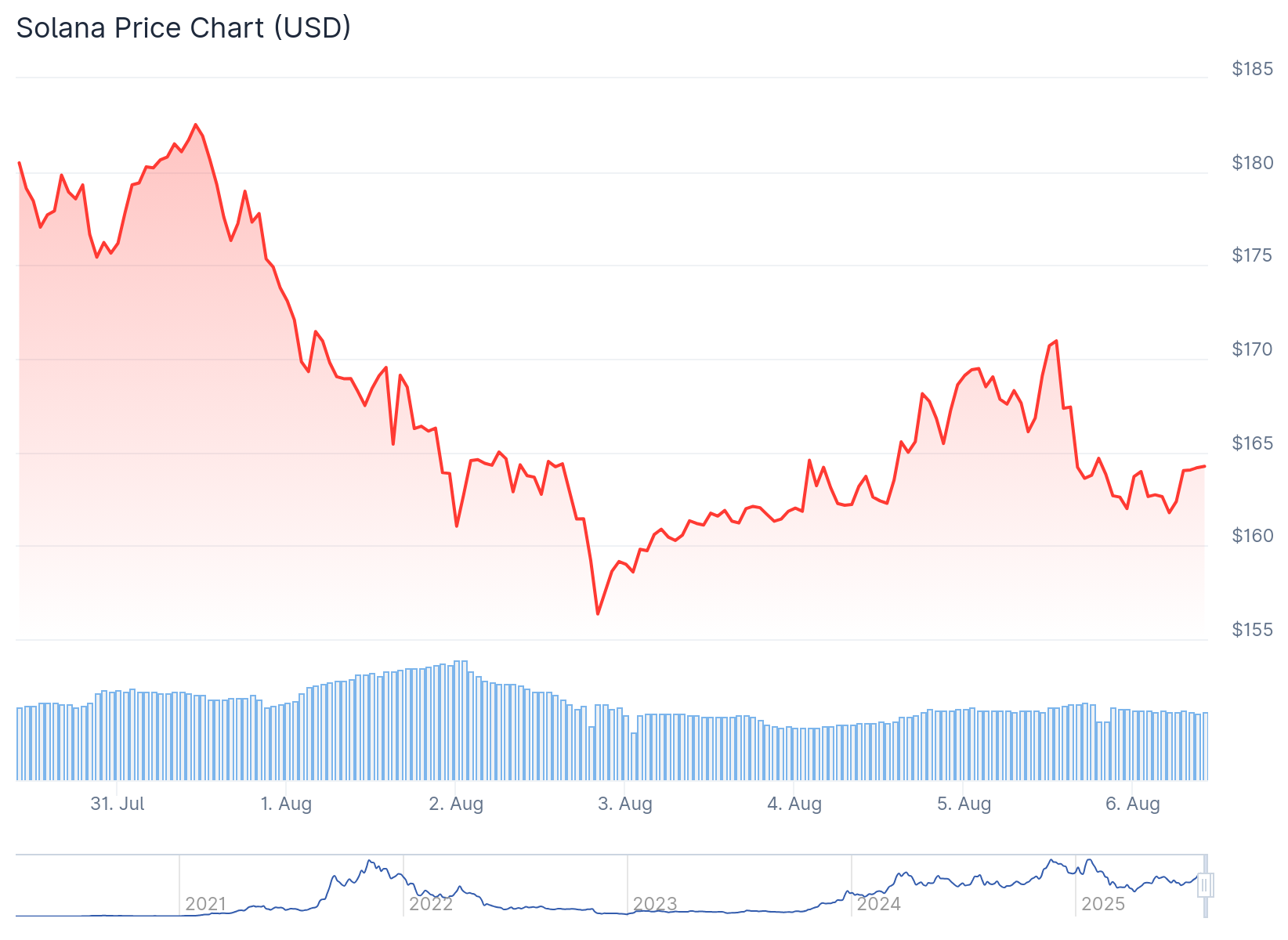

Solana has posted a 10% weekly loss despite maintaining strong on-chain fundamentals. The blockchain’s Total Value Locked increased 2.67% in the past 24 hours.

User retention remains stable across the network. Protocol throughput continues scaling with a 500% month-over-month increase in stablecoin growth.

The ecosystem appears structurally sound. However, price action is moving in the opposite direction of these positive metrics.

SOL is underperforming its Layer 1 competitors this week. The token leads the top five cryptocurrencies in weekly losses.

Aggressive deleveraging has created pressure across the market. Over $4 billion in open interest has been flushed from SOL positions in two weeks.

Ethereum absorbed an even larger $10 billion open interest flush. The second-largest cryptocurrency also faced persistent ETF outflows during this period.

Despite these headwinds, Ethereum continues outperforming Solana. The SOL/ETH trading pair keeps trending lower.

Institutional Interest Remains Strong

DeFi Dev Corp reported a sharp 91% month-over-month increase in SOL exposure during July. The firm now holds 1.18 million SOL tokens.

The position is valued at $204 million, representing a 112% monthly increase. This brings their total SOL supply to 124,315 tokens.

However, Solana closed July with only an 11.57% gain. Ethereum rallied 48.76% during the same period.

The SOL/ETH ratio dropped 25% in July. This marked its worst monthly performance since 2022.

Institutional flows are deepening the divergence between the two assets. Ethereum’s stronger returns continue attracting smart money.

Wallets holding over 10,000 ETH have increased sharply. Meanwhile, this cohort is declining for Solana.

Mobile Phone Launch Provides New Utility

Solana Mobile has started shipping its Seeker phone to over 50 countries. The device bridges Web3 infrastructure with mobile user experience.

Seekers officially start shipping today! Thank you for your support and belief in Solana Mobile since day one.

We’re sending tens of thousands of devices to 50+ countries around the world, so sit tight as your order makes its way through over the coming weeks. pic.twitter.com/dQtkWi26JB

— Seeker | Solana Mobile (@solanamobile) August 4, 2025

The phone features hardware-level security for private keys and seed phrases. This security layer isolates sensitive information from the application layer.

An integrated DApp store gives developers an alternative marketplace. This avoids the heavy fees charged by Google and Apple app stores.

The mobile push could serve as a catalyst for wider Solana adoption. However, builder onboarding and ecosystem growth will likely play out over the long term.

Technical analysis shows SOL finding support around the 0.382 Fibonacci level at $157.70. This level often marks reversals for steep corrections.

Momentum indicators still reflect ongoing weakness. The RSI bounced off neutral to 45, with bulls failing to overwhelm sellers.

The MACD line has leveled above the signal line. This shows early reversal signs but lacks strength for a lasting uptrend.

SOL could retest the $157.70 support level. A successful bounce might form a double bottom pattern for stronger reversal foundations.

A recovery could target resistance at $207, marking a potential 26% gain. This level previously capped the token’s bull run.

Breaking $207 would complete an ascending channel breakout. This could pave the way toward the early-year high around $290.

A potential Solana spot ETF approval in October remains a key catalyst. This could open doors to traditional finance demand and faster price discovery.