TLDR

- Solana (SOL) dropped 6% this week to $184, showing weakness after recent 22% monthly gains

- Over $1.2 billion in short positions versus $924 million in long positions indicates bearish trader sentiment

- SOPR metric fell from 1.04 to 1.00, meaning sellers are barely breaking even on trades

- Critical support level at $175 could trigger deeper correction if broken

- SEC delayed Solana ETF decision until October 2025, though approval odds remain at 82%

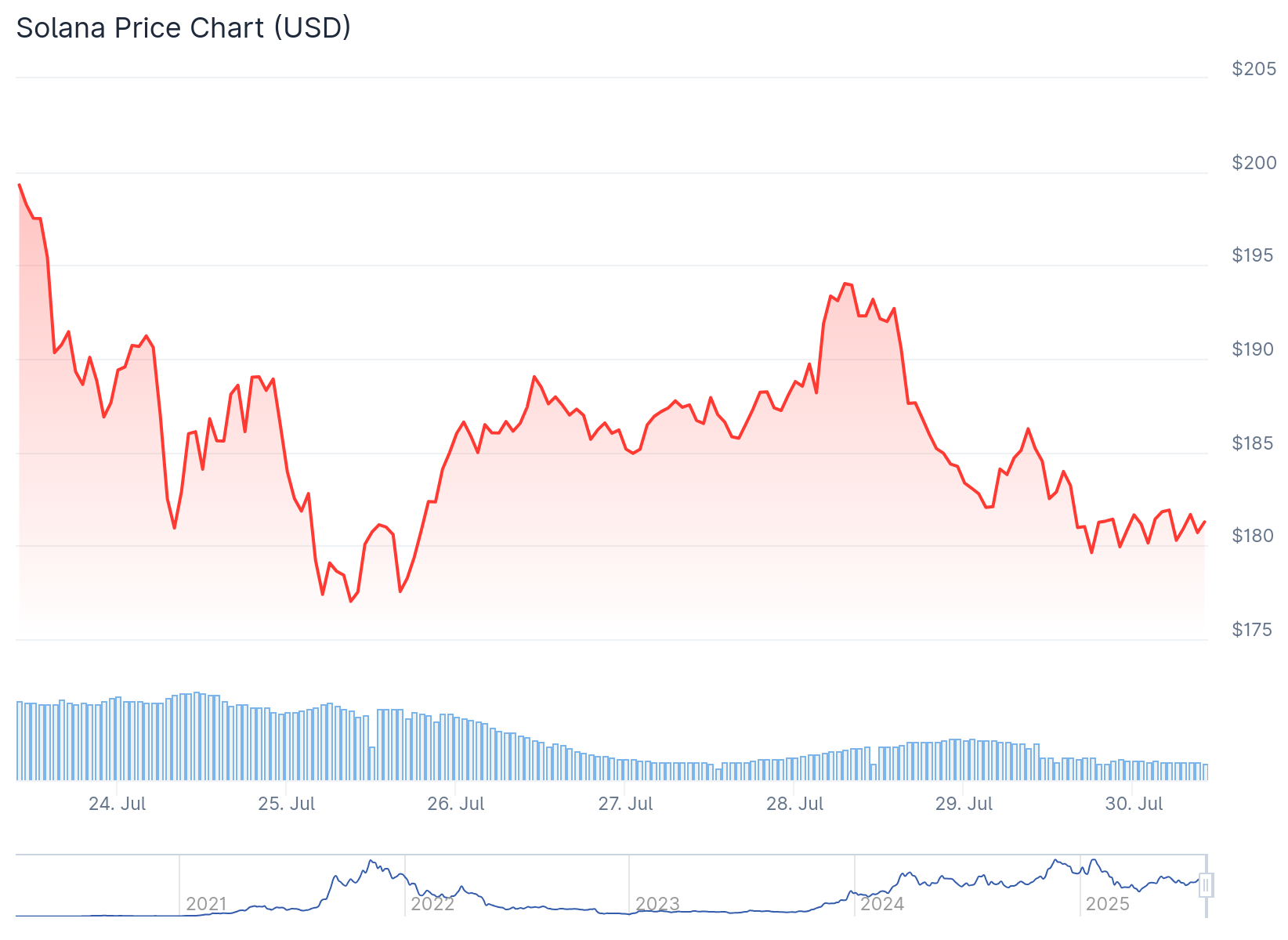

Solana has retreated 6% over the past week, trading around $184 after reaching recent highs above $200. The pullback comes despite the token posting over 22% gains in the previous month.

The correction appears to be gaining momentum as multiple indicators point to weakening buyer interest. Market data shows traders are positioning for further downside moves.

Bearish Sentiment Takes Hold

The Spent Output Profit Ratio has dropped from 1.04 to nearly 1.00 over the past seven days. This metric tracks whether token holders are selling at profit or loss.

The decline means sellers are barely breaking even on their trades. This typically occurs when market confidence begins to fade.

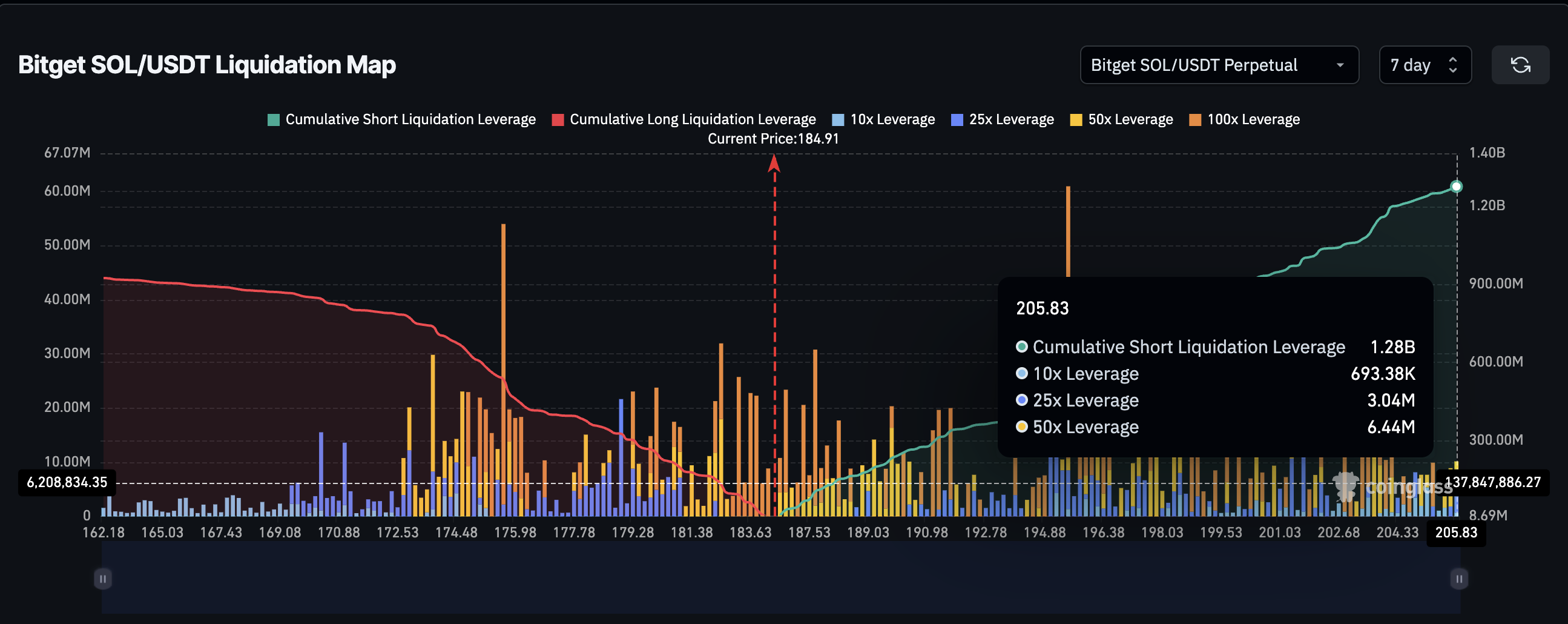

Liquidation data supports this bearish outlook. Short positions totaling $1.28 billion currently outweigh long positions of $924 million in the seven-day window.

The imbalance suggests traders expect Solana’s price to fall further. This represents a shift from the bullish positioning seen during the recent rally.

The Bull-Bear Power Index has also been trending downward. This indicator measures buying strength versus selling pressure.

The declining reading shows buyers are losing control as the correction deepens. Fewer aggressive purchases are happening during price dips.

This reduces the likelihood of a quick recovery. Bulls appear to be taking a step back from the market.

Key Technical Levels

Solana pulled back from its local peak at $206 and now hovers around the $184 level. Technical analysis points to $175 as the next critical support zone.

This level represents a 38.2% Fibonacci retracement from the recent $125 low to the $206 high. Such retracement levels often act as initial support in uptrends.

If Solana holds above $175, it may consolidate before attempting another move higher. A break above $187 resistance could quickly reverse the current bearish sentiment.

However, a drop below $175 would confirm the negative signals from other indicators. This could open the door for a deeper correction.

The network continues to show strong fundamentals despite the price weakness. Solana recently recorded over 1,600 transactions per second during peak activity periods.

Regular throughput remains above 1,100 TPS, reflecting continued adoption. The network plans to increase block capacity from 60 million to 100 million compute units.

ETF Developments

The SEC has postponed its decision on Grayscale’s Solana ETF until October 10, 2025. Market participants assign roughly 82% odds to eventual approval.

The REX-Osprey SOL ETF has attracted over $100 million in net inflows during its initial weeks. This demonstrates growing institutional interest in Solana exposure.

Liquid staking demand has increased among institutional investors. Marinade Finance achieved SOC 2 Type 2 compliance, boosting network credibility.

DeFi Development Corp recently increased its Solana holdings through additional purchases. Cross-chain initiatives continue to attract capital to the ecosystem.

Price forecasts for August 2025 target the $186 to $212 range. Longer-term projections suggest potential upside to $400 by late 2025 in bullish scenarios.

Current market conditions show Solana trading around $186 with key support at $180 holding for now.