Solana’s (SOL) 3.2% pump over the past 30 days to trade at $220 is a nice move, especially after trading near $190 just two weeks ago. Many altcoins are down for the month, including Cronos (CRO), which is down 25%, Uniswap (UNI), which is down 18%, and Hyperliquid (HYPE), which is 11% lower.

In percentage terms, Solana investors should be pleased that their token is trading in the green over the past month. However, a 3.2% gain on a $120 billion asset is not exactly transformative and pales in comparison to what overlooked altcoins can offer.

For example, Digitap ($TAP), a smaller project that is just getting started, is making the case for a 3,200% surge in value. This may seem ambitious and result in Digitap being grouped in the memecoin category, but the math behind the world’s first “omni-bank” shows why it should be included in the list of best altcoins to invest in.

Solana’s Strong Gains Amid Altcoin Slump

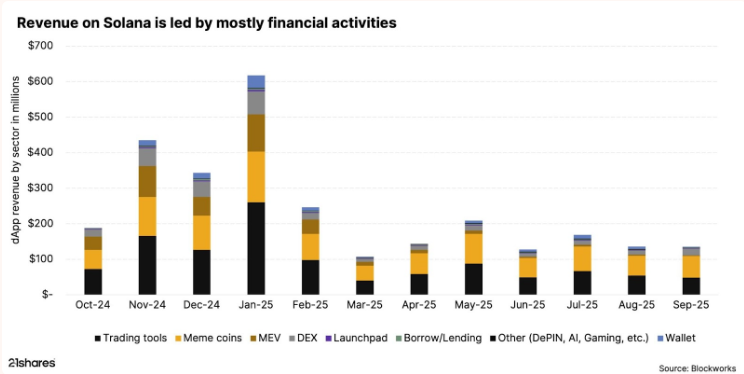

Solana has inched upward over the past 30 days and reclaimed the psychologically important $200 level. There are plenty of catalysts to justify steady growth, including a new report from 21Shares noting that Solana averaged nearly $240 million in monthly revenue from October 2024 through September 2025.

This marks a notable uptick from the $13 million in monthly revenue generated between October 2022 and September 2023.

Meanwhile, public companies and treasury companies hold more than $3 billion worth of SOL on their balance sheets. Firms like Upexi have communicated management’s plans to their investor base to aggressively accumulate additional SOL tokens, with no plans to sell.

As 21Shares concludes, Solana is no longer a story of “resilience,” but rather “one of readiness.” Solana deserves credit for creating a truly scalable and commercially viable platform. However, many investors are concluding that this means the era of large gains has come to an end, as the network’s real-world use cases are now fully understood by the market, and the token will now show modest but steady gains.

Solana’s 3% Gain vs $TAP’s Upside: What Traders Weigh Now

Digitap has developed a single banking app that allows users to transact in both crypto and fiat with an optional no-KYC sign-up process. This means users can send, receive, save, invest, transfer, and spend their money however they want. A Visa-branded physical and digital card makes it easier for users to spend their money on everyday items anywhere Visa is accepted.

The math behind Digitap’s untapped market makes the case for a 32x gain, meaning every $1 invested will be worth $33. For reference, Digitap’s presale event smashed through its first round, and the price has already increased 27% to its current offer price of $0.0159. Momentum hasn’t slowed down, so the third round price of $0.0194 could happen within days.

At a fixed supply of 2 billion tokens, Digitap is currently valued at $31.8 million, so a 32x return implies a market cap of $1.017 billion. Using Coinbase, the largest U.S. crypto exchange, as a comparison makes the case that Digitap is extremely undervalued.

Coinbase is a Nasdaq-listed company, which means its user metrics and data are publicly available. While not a perfect comparison with Digitap (Digitap focuses on banking and payments, not trading), the numbers are instructive. Coinbase provides services to more than 108 million customers and is worth $100 billion. This means each user is worth around $925 in value.

Digitap, as a banking app, offers many additional services compared to Coinbase, and its user base should be valued on similar terms. Digitap’s optional no-KYC sign-up process, multi-currency IBAN accounts, and access to a Visa card mean it can address the 1.4 billion unbanked adults who want inclusion in the global financial community.

If Digitap’s market share of this segment reaches just 5 million users, it would imply a fair valuation north of $4.6 billion. Even with more conservative assumptions, such as fewer users or lower per-user value, it is clear how $TAP can easily justify a 30x climb.

Meanwhile, Solana adding 30x in value from here is beyond any reasonable projection, as it would imply a $3 trillion market cap. This exemplifies why small-cap projects like Digitap can have outsized percentage moves if they capture just a small market share.

What Payments Volume Implies for $TAP’s Revenue Run Rate

Digitap targets more than just the 1.4 billion unbanked adults. The platform aims to remit money globally at a cost of less than 1%, which can be up to six times cheaper than legacy and outdated money remittance companies like MoneyGram.

Digitap can disrupt the global payments industry that handles trillions of dollars in transfers. Suppose Digitap facilitates just $10 billion a year in transactions within a couple of years, and its lean business model nets a few percent of that in fees or spread. This could translate to an annual revenue run rate in the hundreds of millions of dollars.

Even a multiple of 10 times on $100 million in revenue would justify a $1.017 billion valuation, or a 32x return. According to market research, the average Enterprise Value/Revenue multiple for public fintech companies is 12.5 times, while private companies can be valued at 13.7 times. M&A deals average 14.4 times, so even a 10 times multiple might be too low for a baseline assumption..

Solana Still Moves, but $TAP’s Risk/Reward Looks Better

In the current cycle, Solana’s 3% monthly move is a reminder that mega-cap tokens still have fuel left in the tank. A 100% move higher is still possible for a project like Solana, although it will take two or three years.

By contrast, a 3,200% surge for a project like Digitap is more realistic, as it is grounded in tangible factors: a tiny base valuation, a massive target market, solid fundamentals, and favorable comparison to industry titans.

If Digitap delivers on its reasonable baseline assumptions and gains just a tiny fraction of the total addressable market, it would justify the kind of asymmetric return that Solana once offered.

Discover how Digitap is unifying cash and crypto by checking out their project here:

Presale: https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.