TLDR

- Solana recorded higher perpetual futures volumes than Ethereum in the past 24 hours.

- The Phantom wallet supported growth by offering direct native access to perpetual markets.

- Drift became the leading Solana perpetual futures protocol with $1.2B in value locked.

- SOL settlements reached $2.89B in weekly volumes driven by increased market activity.

- Ethereum retained an ecosystem advantage through perpetual futures expansion on L2 chains.

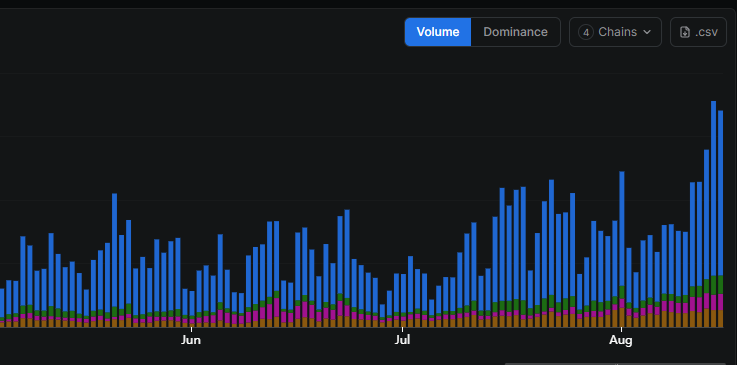

Solana recorded higher perpetual futures trading volumes than Ethereum over the past 24 hours, signaling a shift in decentralized derivatives activity. The network processed more SOL trades than centralized futures markets, reflecting strong demand for permissionless trading. The growth comes as decentralized perpetual futures reach record levels, largely supported by Hyperliquid’s dominance.

Solana’s Growing Lead in Perpetual Futures

Solana’s surge in perpetual futures trading began in June and has continued with consistent onboarding of new users. The Phantom wallet facilitated this growth by providing direct native access to perpetual markets. As volumes increased, Solana solidified its lead over Ethereum in this segment.

The network’s perpetual futures platforms mainly trade wrapped BTC, wrapped ETH, and SOL, with settlements reaching $2.89B in weekly volumes. This rise coincided with SOL climbing above $200 before recently trading at $195.59. “The trend shows clear user preference for on-chain settlement,” a market analyst noted.

- Source: DeFiLlama

Although Solana leads in perpetual futures volume, over 85% of total activity remains on Hyperliquid. Drift, the top Solana perpetual futures protocol, reached $1.2B in value locked. SOL and JLP tokens account for 68% of Drift’s activity.

Trading on Drift?

Boost your returns by using syrupUSDC as collateral!Earn 6.9% yield from syrupUSDC collateral

+ Lending yield from Drift

+ Additional incentives from $100,000 rewards pool@maplefinance pic.twitter.com/2RR4tdlBTD— Drift (@DriftProtocol) August 14, 2025

Ethereum Retains Broader Ecosystem Strength

Ethereum still holds an advantage in ecosystem depth due to perpetual futures expansion on its L2 chains. Platforms on Base and Arbitrum deliver high-speed trades with lower fees, supporting competitive activity. This helps Ethereum maintain its market presence despite losing the 24-hour perpetual futures lead.

Settlement for ETH perpetuals on Ethereum’s native chain has also grown in recent weeks. Activity is supported by liquidity from stablecoins and native assets. Ethereum’s fee generation remains higher than Solana’s at the chain level.

However, Solana applications often generate more fees per app than other chains. This points to strong protocol-level engagement despite lower total chain fees. Developers continue to expand trading tools to capture user interest.

DeFi Expansion Across Leading Chains

Solana’s total value locked climbed above $10B in August, recovering from earlier downturns. Stablecoin liquidity exceeded $12B after Circle minted new USDC tranches and USDT inflows returned. Kamino Lend became the largest protocol, holding over $3B in value locked.

Ethereum and Solana now dominate the DeFi landscape, hosting the most widely used applications and platforms. Protocols like Jupiter and Ethena compete for top rankings behind Tether. Other chains, including BNB Smart Chain and TRON, remain active but lag behind in volumes.

Both chains benefit from increased demand for decentralized perpetual futures. Yet, Solana’s current momentum suggests it may continue setting short-term records in derivatives settlement.