TLDR

- South Africa now has 650K stores accepting Bitcoin and crypto payments.

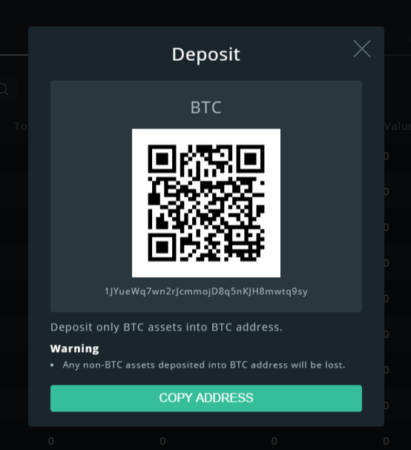

- Crypto holders can pay directly via QR codes without conversion steps.

- Major retail chains like Shoprite now accept Bitcoin payments.

- MoneyBadger and Scan to Pay partnership boosts crypto use in daily purchases.

South Africans can now use cryptocurrency to pay for goods and services at over 650,000 retail stores across the country. This breakthrough comes after a partnership between Scan to Pay, a QR payment provider, and MoneyBadger, a Bitcoin payments platform. This move makes it possible for users to pay with Bitcoin, stablecoins, and other cryptocurrencies directly at checkout, eliminating the need for conversions to local currency.

New Payment Integration Across South Africa

A recent development in South Africa has made it easier for cryptocurrency holders to make everyday purchases. With the introduction of a new payment integration, users can now pay for their groceries, meals, or online purchases using their digital assets.

The collaboration between Scan to Pay and MoneyBadger enables users to pay with Bitcoin, stablecoins, and other cryptocurrencies at over 650,000 merchants nationwide. This includes major retail chains like Shoprite, Checkers, Makro, and Vodacom.

The process is straightforward. Customers simply scan a QR code at checkout to complete their payment. The merchant receives the payment in South African rand, while the customer’s cryptocurrency is transferred through the MoneyBadger platform. This system is designed to link payments directly to users’ exchange accounts or Bitcoin Lightning wallets, making the process seamless and efficient.

Simplified Payment Process for Crypto Users

Theo Koma, product owner at Scan to Pay, emphasized the significance of this integration for cryptocurrency users. He noted that this partnership eliminates the need for users to convert their cryptocurrency into fiat currency before making a purchase. By removing this conversion step, customers can now directly spend their digital assets, which makes using crypto for everyday purchases more accessible.

“We’re making it possible for people to use their cryptocurrency holdings directly,” said Koma. This change aligns with the goal of fostering financial inclusion and streamlining the use of cryptocurrencies in daily transactions. It also reduces the barriers for crypto holders who previously needed to use third-party services to convert their digital assets into rand.

Expanded Merchant Network for Crypto Payments

The new integration also benefits merchants. Businesses that are already part of Scan to Pay’s network can now accept crypto payments without needing to set up new systems or tools. This allows the thousands of retailers already using the platform to expand their payment options and cater to a growing base of cryptocurrency users.

Luno, a major crypto platform, highlighted the benefits of this partnership. Luno’s 30,000 merchants are now connected to Scan to Pay’s broader network of 650,000 retail outlets. This greatly increases the number of places where South Africans can use their cryptocurrency holdings. The collaboration is expected to drive more adoption of cryptocurrency in retail settings and encourage more businesses to accept digital currencies as payment.

The Shift Toward Everyday Crypto Usage

The integration also reflects a broader trend in South Africa, where more people are beginning to use their cryptocurrency holdings for practical purposes rather than solely for investment. Carel van Wyk, CEO of MoneyBadger, noted that this shift is important for the local market. “South Africans are increasingly moving from holding Bitcoin as an investment to using it for everyday spending,” he explained.

Van Wyk also emphasized that spending Bitcoin helps boost its adoption. He argued that hoarding Bitcoin slows down its growth as a usable form of currency, while spending it strengthens its utility. As more South Africans begin using crypto for daily transactions, the demand for businesses to accept cryptocurrency payments is expected to grow.

This new development represents a key milestone in the evolution of cryptocurrency usage in South Africa, making it easier for people to spend their digital assets in real-world scenarios.