- Terra Staff Has Already Testified

- Do Kwon Swimming in Hot Water

- LUNA 2.0 Launches —Drops 70% In One Day of Trading

The Terra community doesn’t seem to catch a break lately. This time, prosecutors in South Korea have summoned representatives and employees at Terraform Labs to investigate the collapse of TerraUSD (UST), the company’s now failed stablecoin.

Terra Staff Has Already Testified

As per a report from a local newspaper, the Financial Crime Joint Investigation team of the Seoul Southern District Prosecutor’s Office has called all Terraform Labs employees to obtain relevant information about the company’s sudden collapse.

The employees, who have been working for Terra since 2019, have reportedly already testified. One unmanned employee revealed that most within the team knew about Terra’s flawed self-correcting mechanism, and had warned Do Kwon about a possible collapse.

South Korean prosecutors are using this information to investigate if Kwon and other Terra executives were aware of the faulty mechanism and the possible shortcomings which, according to the report, could lead to charges of fraud and price manipulation. Authorities are also investigating if local exchanges went through proper listing review processes before adding LUNA and UST to their platforms.

Do Kwon Swimming in Hot Water

South Korean authorities are focusing on Terra’s token mechanism, as UST wasn’t backed by fiat or any other collateral to protect users in case of massive liquidations. While Terra enjoyed rapid success throughout 2021 and early 2022, there were several warnings about a possible UST depeg if the protocol ever faced high selling pressure. And it did so; on May 7, UST started de-pegging following whale-sized sell-offs and UST swaps for other stablecoins.

“At a certain point in time, there is no other way but to collapse because it cannot handle interest payments and fluctuations in value.” Authorities reportedly said.

What’s more: according to a leaked document from the country’s Supreme Court Registry Office, Do Kwon allegedly dissolved two offices in South Korea. Rumors had it that Kwon was trying to avoid taxes, but it quickly backfired, as the country’s national tax agency charged Terraform Labs and its executives with a $78 million penalty for tax evasion.

Terra’s imminent collapse caused a bloodbath that spread to the entire crypto market. According to reports, the disintegration of UST and LUNA affected over 300,000 investors in South Korea, with several of them filing lawsuits against Terraform Labs and Do Kwon. One of the affected investors was arrested after he tried to knock on Kwon’s front door. A few days after the attack, Kwon was summoned to testify to South Korean authorities in a parliamentary hearing about the company’s sudden collapse.

LUNA 2.0 Launches —Drops 70% In One Day of Trading

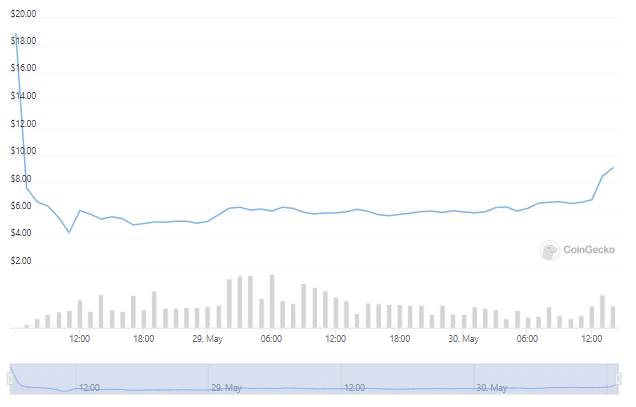

The news comes three days after Coincentral reported the relaunch of the Terra blockchain and its new token, LUNA 2.0. —which was airdropped to affected LUNA Classic (LUNC) holders. The fresh new LUNA token, however, was pumped 30% and then dumped 70% across major exchanges in the first hours of trading. Several investors indicated on Twitter that they sold their LUNA as soon as it was ready for trading in an attempt to recover a small fraction of their lost capital from the previous project.

People had to sell to recover some losses. Lots of people were behind on their bills due to the Luna collapse and so they had to take advantage of the Luna 2.0 launch and grab some money incase Terra 2.0 fails. Investor confidence in Luna is low. No one wants to lose twice.

— Tajo Crypto (@TajoCrypto) May 28, 2022

Despite the turmoil, a handful of high-profile cryptocurrency exchanges, including FTX and Binance are currently supporting LUNA trading, and several decentralized protocols have aided Terra in rebuilding its ecosystem. Polygon, one of the most popular Ethereum sidechains, announced launching an “uncapped multi-million dollar fund” to help projects on the old Terra platform migrate to the new blockchain.

Crypto users on Twitter have expressed their lack of trust in Terraform Labs, while some of them are hoping that the new Terra blockchain arises from the ashes and regains some traction in the market. At the time of writing, LUNA is trading at $9.12, recovering a steady 50% of its losses, according to data from CoinGecko.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.