TLDRs:

- S&P 500 earnings growth slows to 8.8% amid rising AI costs and US tariffs.

- AI megacaps drive gains, but smaller firms face pressure to show ROI.

- US tariffs reached $93 billion, creating a headwind for corporate profits.

- Investors demand clearer AI payback metrics and third-party benchmarking tools.

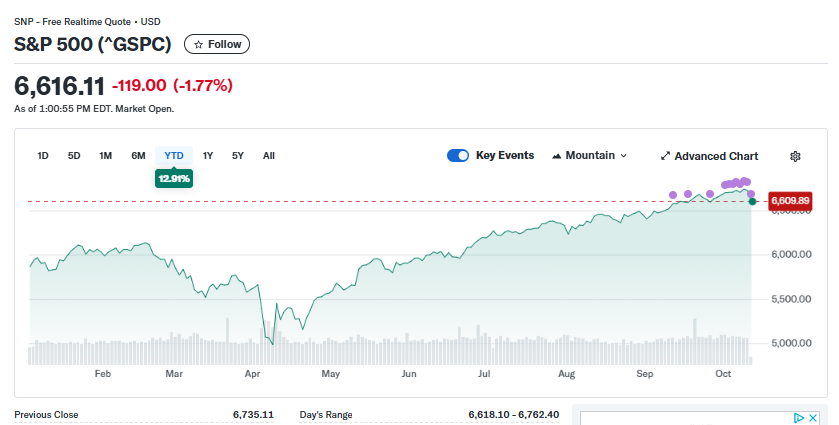

S&P 500 companies are facing a period of cautious optimism as projected earnings growth slows.

Analysts from LSEG forecast an 8.8% year-on-year increase in corporate profits for Q3 2025, a notable decline from the more than 13% growth seen in the first two quarters of the year. Sales growth is also expected to decelerate slightly, rising 5.7% compared to 6.4% in the previous quarter.

Investors are keeping a close eye on these numbers, particularly as companies continue to pour capital into artificial intelligence (AI) initiatives. The S&P 500 currently trades at roughly 23 times forward earnings, above its 10-year average, prompting questions about whether these substantial AI investments will ultimately yield sufficient returns.

AI Megacaps Drive Market Gains

A handful of technology giants, often referred to as the “Magnificent 7” (Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta, and Tesla) have been the primary drivers of the market’s growth.

These firms delivered an impressive 26.6% year-over-year earnings increase in Q2 2025, compared to just 4% for the rest of the S&P 500. Four of these companies ranked among the top six contributors to earnings growth in the index.

Magnificent 7 companies’ earnings have grown far faster than the rest of the S&P 500 since 2005.

During the last 2 decades the total earnings of magnificent-7 have increased roughly 40 times, while the broader S&P 500’s earnings only roughly doubled in the same period. https://t.co/Q6AzPr7W8J pic.twitter.com/GboJIV8wTs

— Rohan Paul (@rohanpaul_ai) October 9, 2025

While these megacaps continue to benefit from AI-related demand, this concentration of growth raises concerns for investors. If any of these leaders falter or if doubts over AI investment returns grow, the broader index could face increased volatility. Analysts warn that companies outside this top tier need to clearly demonstrate the financial benefits of their AI spending to avoid investor skepticism.

Tariffs Pose Additional Headwinds

US tariffs have emerged as another pressure point on corporate profits. According to Goldman Sachs, customs duties climbed 33% to $93 billion in Q3, creating a notable cost headwind for many companies.

While some market watchers, such as Oliver Pursche, suggest that tariffs and associated uncertainties have not yet severely impacted overall earnings, the combination of tariffs and high AI spending underscores a more challenging profit environment.

This dual pressure of rising operational costs from tariffs and heavy AI capital expenditures has forced firms to scrutinize their spending more carefully. Executives are increasingly seeking ways to optimize resource allocation, ensuring that each dollar invested in AI and supply chain adjustments produces measurable value.

Demand for Clear AI ROI Metrics

The spotlight on AI spending is driving demand for transparency in return on investment (ROI). MIT research indicates that 95% of early corporate AI projects have failed to deliver tangible returns, while studies from BetterUp Labs and the Stanford Social Media Lab found that 40% of employees recently received substandard AI-generated work requiring human correction.

Industry experts, including Bain, estimate that AI-related capital expenditures could reach $500 billion annually by 2030, with revenue targets needing to hit $2 trillion to break even. To help navigate this complexity, companies are increasingly adopting third-party AI ROI and Financial Operations (FinOps) benchmarking tools. Metrics such as cost per inference, GPU utilization, and measurable revenue uplift are now central to investor discussions, as the market demands accountability for AI investments.