TLDR

- Faraday Future announces launch of $10 billion crypto strategy starting with $30 million initial purchase next week

- Company plans to create C10 Treasury and C10 Index tracking top 10 cryptocurrencies excluding stablecoins

- Strategy includes tokenized vehicle sales through “EAI Vehicle Chain” and potential crypto ETF launch

- Move comes as company has delivered only 16 vehicles and faces SEC enforcement threats against founder

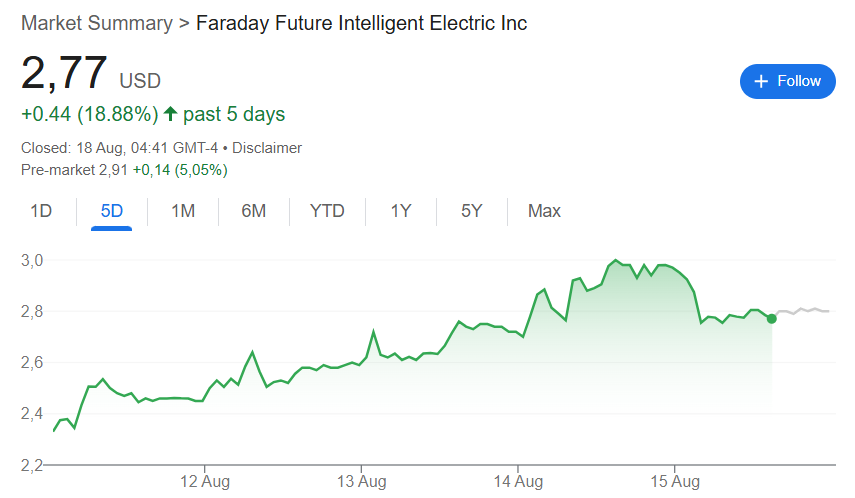

- Faraday Future stock down 7.6% Friday but up 75% over past six months

Faraday Future Intelligent Electric Inc. announced a major pivot into cryptocurrency investments on August 17, 2025. The electric vehicle startup revealed plans for what it calls the “EAI + Crypto” Dual-Flywheel & Dual-Bridge Ecosystem Strategy.

The company will start by purchasing $30 million worth of cryptocurrencies next week. This marks the beginning of Phase 1, which allocates $500 million to $1 billion for crypto investments.

Today, Faraday Future launched the first-ever US-listed company #C10 Treasury plan and introduced the #C10 Index.

Phase 1: $500M–$1B allocation, with the first $30M expected to start next week — long-term vision: $10B scale.

This marks the start of our “EAI + Crypto”… pic.twitter.com/EE59z5RUVh— Faraday Future (@FaradayFuture) August 17, 2025

Faraday Future hopes to scale this program to $10 billion over time. The company claims this represents the first such treasury program by a U.S.-listed company.

The strategy centers around two main products. The C10 Treasury will hold the cryptocurrency investments for the company.

The C10 Index will function as a market-cap-weighted basket fund. This fund will track the top 10 crypto assets while excluding stablecoins.

Faraday Future also plans to explore launching an exchange-traded fund based on this index. The company has not provided a timeline for the potential ETF launch.

Tokenized Vehicle Sales Platform

The company will introduce an “EAI Vehicle Chain” for tokenized vehicle sales. This platform will allow customers to make crypto-based deposits for vehicle purchases.

EAI stands for Embodied AI, referring to artificial intelligence integrated into physical objects like cars. The platform aims to connect traditional vehicle sales with blockchain technology.

California State Treasurer Fiona Ma endorsed the crypto strategy. She stated the plan “has the potential to boost our economy, create high-quality jobs, attract top-tier investment, and advance sustainable development worldwide.”

The announcement came during Monterey Car Week. Company officials emphasized transparency and compliance in their approach to blending mobility with blockchain applications.

Company Faces Production Challenges

The crypto pivot comes during a difficult period for Faraday Future. The company has delivered only 16 vehicles as of January 2025.

Faraday Future halted work on a $1 billion electric vehicle factory in Nevada in 2016. This decision caused major delays in production of its flagship vehicle, the FF91.

The startup has recently shifted to rebadging Chinese-made electric vans. This represents a departure from its original luxury EV manufacturing plans.

In July, the SEC sent a Wells notice to founder Jia Yueting and president Jerry Wang. This notice signals potential enforcement action following a three-year fraud investigation.

The investigation focused on allegedly false statements made during the company’s 2021 SPAC merger. Both executives face potential regulatory action from the securities regulator.

Faraday Future stock closed Friday down 7.6% at $2.77 per share. However, shares have gained 75% over the past six months and are up 14% year-to-date according to Google Finance.