TLDR

- Tesla signs a $16.5B chip deal with Samsung to produce AI6 chips through 2033.

- Production will occur at Samsung’s Texas fab under Musk’s direct oversight.

- Musk signals output could exceed deal’s value, calling it “just the bare minimum.”

- Tesla aims to accelerate Full Self-Driving (FSD) rollout by late 2026.

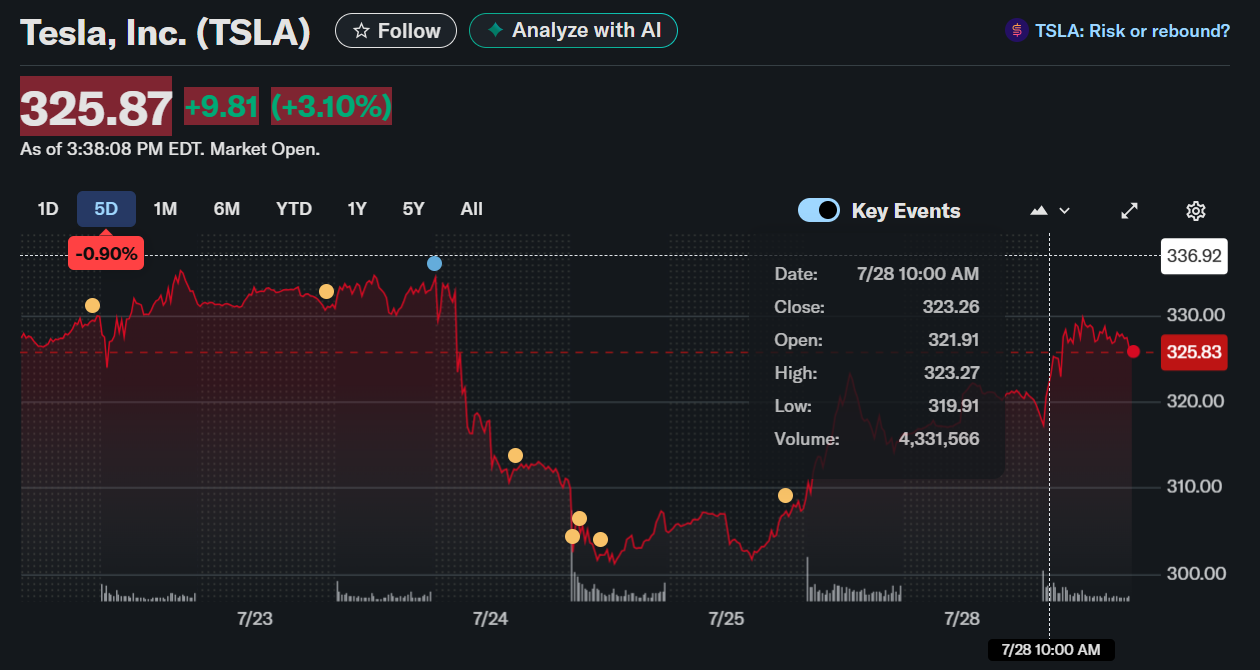

- TSLA stock is up 3.9% to $328.40 amid optimism about self-driving tech advancements.

Tesla Inc. (NASDAQ: TSLA) shares rose 3.9% to $328.40 after CEO Elon Musk confirmed a $16.5 billion chip agreement with Samsung Electronics.

The deal marks a major step in Tesla’s autonomous vehicle roadmap and gives Samsung’s struggling foundry unit a vital customer and production opportunity. The contract, which runs through 2033, tasks Samsung’s Taylor, Texas plant with building Tesla’s upcoming AI6 chip, critical to future driving systems.

Musk emphasized the strategic weight of this partnership on X (formerly Twitter), suggesting the real output of the deal could far exceed the announced figure. He also revealed that he’ll be directly involved in walking and optimizing the fabrication line.

Implications for Samsung’s Foundry

Samsung’s win follows a rough stretch of underutilization in its semiconductor division. The company has lagged behind TSMC, which held a dominant 67.6% foundry market share in Q1, compared to Samsung’s 7.7%. With this Tesla deal, Samsung stands to gain a 10% annual boost in foundry revenue and may regain footing as a competitive alternative to TSMC.

Analysts view the agreement as more than a revenue source—it’s a long-term validation of Samsung’s next-gen 2-nanometer chip technology. It also aligns with U.S. efforts under the 2022 Chips and Science Act to bring semiconductor production stateside. Samsung’s U.S. expansion is backed by up to $9 billion in incentives.

Tesla’s Full Self-Driving Timeline

For Tesla, the AI6 chip is central to delivering on its Full Self-Driving (FSD) vision. Musk previously forecasted that Tesla could launch true autonomous vehicles by late 2026. However, Tesla’s evolving chip sourcing, moving from Samsung’s AI4 to TSMC’s AI5 and then back to Samsung’s AI6, has sparked skepticism about the clarity of its strategy. Customers have already faced issues with retrofitting older chips, which Musk called too costly.

Tesla has recently launched a driverless taxi service in Austin, but cars still require safety staff. While Musk remains confident, industry observers remain cautious about Tesla’s shifting hardware plans.

Stock Performance and Outlook

Despite recent volatility, TSLA is up 49.4% over the past year and a staggering 233.6% over five years. However, year-to-date, it has declined 18.68%, underperforming the S&P 500’s 8.68% gain. The upcoming quarters may remain turbulent until Tesla delivers autonomous vehicles at scale. The next earnings report will be a crucial checkpoint for investors gauging Tesla’s AI-driven future.