TLDR

- President Trump confirmed he will meet Chinese President Xi Jinping at the APEC summit in Seoul on October 31

- Bitcoin rose 2% following the announcement while Ethereum and BNB gained 3.5%

- The meeting comes after trade tensions caused $20 billion in crypto liquidations earlier this month

- September Consumer Price Index data will be released Friday after government shutdown delays

- Major tech earnings from Tesla, Netflix, and Intel are scheduled this week

President Donald Trump confirmed Sunday that he will meet with Chinese President Xi Jinping at the Asia-Pacific Economic Cooperation summit in Seoul. The summit begins October 31.

Trump made the announcement during a Fox News interview with Maria Bartiromo. He described Xi as “a very strong leader” and said the two countries would work toward a fair deal.

The news boosted cryptocurrency prices immediately. Bitcoin increased approximately 2% following Trump’s comments.

Ethereum and BNB each rose about 3.5%. Solana’s SOL token climbed nearly 4% according to TradingView data.

The meeting represents a shift from Trump’s previous stance. He had earlier stated there was “no reason” to meet Xi at the APEC summit.

Treasury Secretary Scott Bessent told reporters that relations with Beijing have “de-escalated.” He expects to meet with Chinese Vice Premier He Lifeng this week.

Trump also indicated his threatened tariff levels on China are “not sustainable.” The administration recently exempted dozens of products from reciprocal tariffs.

Market Recovery After Historic Crash

The crypto market is recovering from a severe downturn earlier this month. Trump’s announcement of additional trade tariffs triggered nearly $20 billion in liquidations in the crypto derivatives market.

The event marked the worst crypto liquidation in history. Some altcoins lost 99% of their value during the crash.

The Crypto Fear and Greed indicator dropped to 22 on Friday. This signals “Extreme Fear” among investors and represents a six-month low.

Analysts at the Kobeissi Letter forecast the downturn will be short-lived. They believe the long-term bull trend remains intact.

Stock market futures also rose Monday morning. The Dow Jones futures increased 0.2% while S&P 500 and Nasdaq 100 futures gained 0.3% and 0.4% respectively.

Economic Data and Earnings Reports

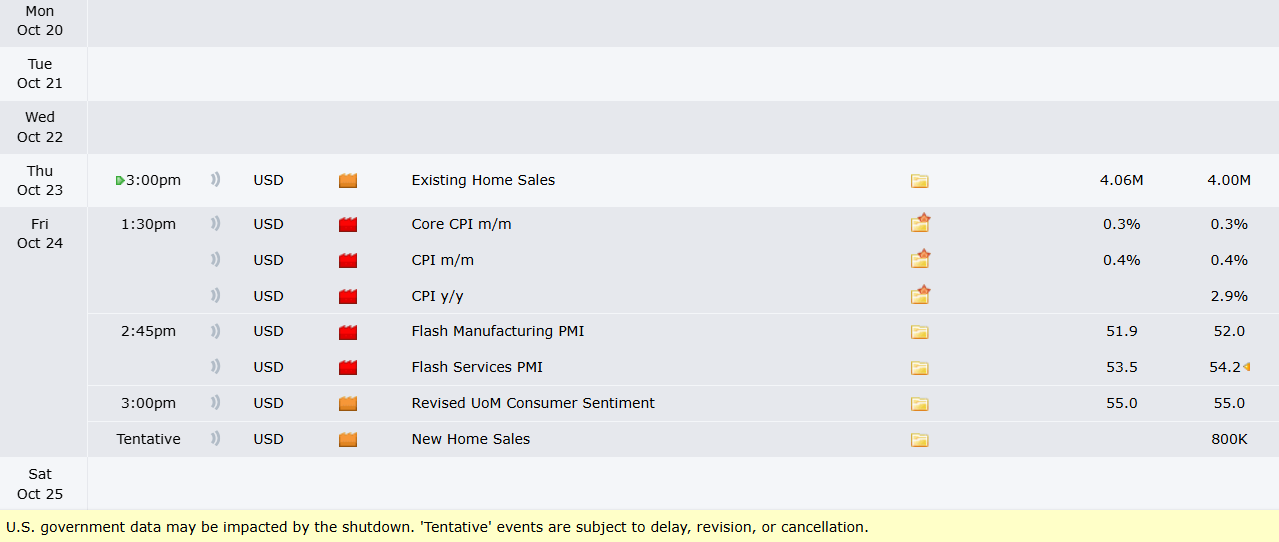

The Bureau of Labor Statistics will release September’s Consumer Price Index on Friday. The data was delayed more than a week due to the government shutdown.

The government shutdown has entered its third week. Democrats and Republicans remain at odds over federal healthcare subsidies.

The CPI data could influence the Federal Reserve’s interest rate decision. The Fed will meet next week to determine its rate path.

Analysts expect inflation to remain high. The data represents the last major economic indicator before the Fed’s meeting.

#earnings for the week of October 20, 2025https://t.co/hLn2sKQhEY$TSLA $NFLX $IBM $INTC $ISRG $KMI $APH $NEM $TXN $AAL $GEV $QS $FCX $KO $GE $CLF $VRT $AGNC $ALK $CCS $ELV $LMT $NXT $PM $RTX $HON $BSX $COF $DECK $DOW $PG $TCBI $SAP $NOK $LRCX $DOV $CCK $AA $HAS $LUV $MMM… pic.twitter.com/TGhGgifobq

— Earnings Whispers (@eWhispers) October 17, 2025

Major companies will report earnings this week. Netflix reports Tuesday followed by Tesla on Wednesday.

Intel will release its quarterly results Thursday. The chipmaker’s shares have surged after recent deals including a partnership with Nvidia.

Ford and General Motors will also report earnings this week. Both automakers likely benefited from buyers rushing to claim expiring EV tax credits before the deadline.