- Don't Tread on My Trend Line

- Domestic News

- What's New at CoinCentral?

- Cryptocurrency News From Around the World

Don’t Tread on My Trend Line

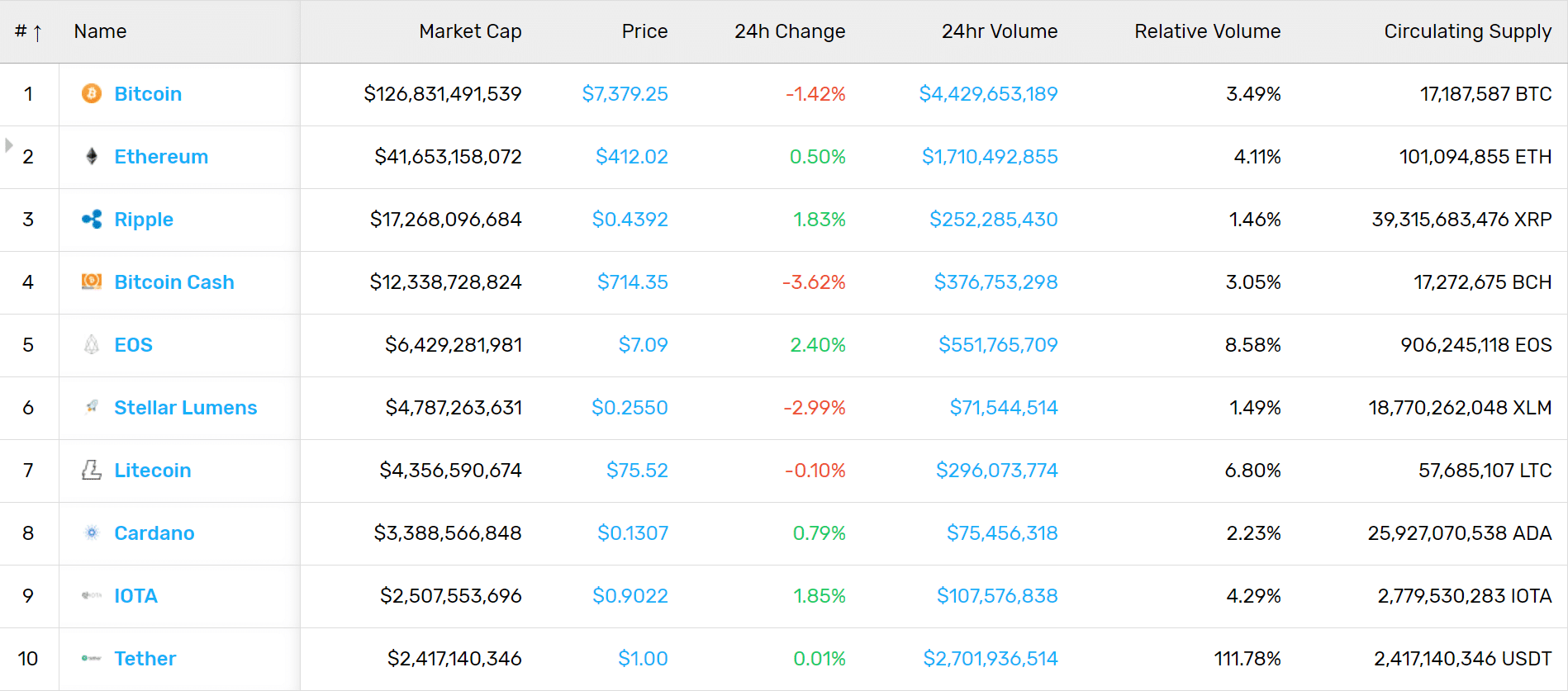

The asset-wide crypto market took a hit this week. Following a week of near-gains that was nixed by a quick sell-off following the SEC’s rejection of the Winklevosses’ latest ETF filing, crypto’s overall market cap has fallen 8% on the week. At $263 billion, it’s sitting just above some of the lowest numbers it’s posted this year.

Bitcoin: At $7,400, Bitcoin has lost 6% of its value over the week.

Ethereum: Fairing worse, Ethereum is down 10% on the week at $413.

XRP: Nearly stagnant, XRP has only lost 2% this week, sporting a price tag of $0.43.

Domestic News

Dept. of Treasury’s Recent Fintech Report Briefly Addresses Blockchain: In a report to President Trump entitled “A Financial System That Creates Economic Opportunities: Nonbank Financials, Fintech, and Innovation,” the US Department of the Treasury broached the topic of blockchain along other burgeoning FinTech technologies like AI, cloud computing, and others. “New technologies, like predictive data analytics, artificial intelligence, and blockchain or distributed ledger technology, are examples of promising innovations that could be used by financial services firms. They are also technologies for which regulatory treatment may be uncertain, if for no other reason than that innovative technology requires time to mature,” the report reads.

In the US, Blockchain Funding In 2018 is Exceeding 2017 Numbers: In a report by KPMG, the big four firm found that, along with international FinTech investments outpacing 2017’s total so far into 2018, blockchain investments in the US are on the rise, as well. “In the first half of 2018, blockchain investment in the US exceeded the total investment seen in 2017, led by $100 million+ funding rounds to R3 and Circle Internet Finance. A number of other significant blockchain deals also occurred during Q1 and Q2’18, including Paxos’ $65 million Series B raise aimed at helping it scale operations for delivery of its blockchain platform,” the report reads.

Long Blockchain, Formerly Long Island Iced Tea, Slapped With Subpoena From SEC: At the height of bitcoin’s hype last year, Long Island Ice Tea decided it would change its name to Long Blockchain. The move was a boon to the tea maker, as its stock rose over 300% in response to the rebranding. Well, the SEC took notice, requesting financial documents with a July 10th subpoena. “The company is fully cooperating with the SEC’s investigation,” the company said in a statement. “The company cannot predict or determine whether any proceeding may be instituted by the SEC in connection with the subpoena or the outcome of any proceeding that may be instituted.”

Bill Clinton to Kickoff Ripple‘s October Tech Conference With Keynote Address: The 42nd President of the United States, Big daddy Bill Clinton, is slated to give the introductory keynote speech at Ripple’s fall conference, Swell, which will be held in San Francisco, CA on the 1st and 2nd of October. Ripple chose the former president to open the conference because, “[at] a time when groundbreaking technology and regulation were often on a collision course, President Clinton helped usher in a period of extreme growth and adoption of the Internet, shaping what it is today. He also established programs that bridged the “digital divide” and brought new technology to underserved communities around the world,” the announcement’s blog post reads.

We're thrilled to announce @BillClinton as keynote speaker for this year’s #SwellbyRipple. For more details: https://t.co/KYQgI4YrWv pic.twitter.com/XSo46T2s3d

— Ripple (@Ripple) July 31, 2018

Study: Only 2% of US Investors Hold Bitcoin, Crypto in Some Form: A jointly conducted poll by Gallup and Wells Fargo shows that bitcoin is still relatively uncharted territory for most US investors. According to the study’s finding, “just 2% of investors say they currently own bitcoin, and less than 1% plan to buy it in the near future. While most investors say they have no interest in ever buying bitcoin, about one in four (26%) say they are intrigued by it but won’t be buying it anytime soon.”

Decentralized Exchange Launches in San Francisco, Uses XRP as Base Currency: San Francisco-based DCEX exchange launched this week. Using XRP as a base currency, the exchange is powered by a blockchin platform built by AlphaPoint. “DCEX is a next-generation crypto-to-crypto marketplace, with all currencies trading against XRP (XRP) as a base currency. Clients will be able to trade a total of 15 coin pairs – XRP, Bitcoin (BTC), Litecoin (LTC), Ethereum (ETH), Bitcoin Cash (BCH), Bitcoin Gold (BTG), Ethereum classic (ETC), OmiseGo (OMG), EOS (EOS), DASH (DASH), Tron (TRX), Monero (XMR), VeChain (VEN), IOTA (IOTA), ZCash (ZEC), and stable-coin TrueUSD (TUSD), with plans to add Neo (NEO), Cardano (ADA), and more pairs in the coming months. Additionally, DCEX offers access to all ten coins listed in the Bloomberg Galaxy Crypto Index (BGCI) in one location,” an official blog post reads.

What’s New at CoinCentral?

Blockchain Problems Exist, Take Two Aspirins, and Plenty of Rest: Blockchain isn’t perfect, so it’s important to reckon with its faults.

Bitcoin Cash vs. Bitcoin | The Pros and Cons: The two seem doomed to be competitors, so how do they stack up against each other?

Digital Currency Regulations Should Be Among Congress’s Top Priorities, Says Prominent Lawmaker: This lawmaker thinks Congress should be putting crypto at the top of its to-do list.

A Brief History of the Silk Road: Drugs, (Non)Violence, and Video Games: A look into the Silk Road and just what goes on in the dark web’s markets.

Capitalise CEO and Co-Founder Shahar Rubin on Simplifying Trading Algorithms: Check out what the Capitalise CEO has to say about trimming the fat for trading.

AI and Blockchain – Super Cool or a Little Creepy?: Seriously though, do they herald the coming of an automated utopia or some tech-dominated dystopia?

What is Gridcoin?: The Gridcoin platform creates a supercomputer-like environment by combining every user’s computational power on the network.

DMG Blockchain Is Installing a Cryptocurrency Mining Substation: DMG Blockchain Solutions, a cryptocurrency mining company that also provides blockchain solutions, is currently setting up an 85-megawatt crypto mining substation and transformer. This is in a bid to expand its mining operations.

Reasons Why U.S. Authorities Are Challenged to Legalize Bitcoin Casino Transactions: In this article, we examine why regulators in the U.S. have been slow to legalize transactions made through bitcoin casinos. We also look at why these policies are unlikely to change in the coming years.

Crypto Mining: Google’s Play Store Joins Apple in Banning Mining Apps: First, they came for the ads, then they came for the apps.

Part 2: Interview with Andy Levine on Steem Today and Tomorrow: Check out round two of our interview with Steem’s Andy Levine.

Blockchain Digital Advertising Platforms Used To Combat Fraud: Transparency, efficiency, reliability–how blockchain can change digital advertising and make it more honest.

Will Cryptocurrency Regulation Stifle Innovation?: Many think that regulation invites innovation, but others aren’t so convinced.

[thrive_leads id=’5219′]

Indian State Government to Implement Blockchain Technology: On July 26th, the Indian state of Telangana announced initiatives to leverage blockchain to mitigate the pervasive corruption and fraudulent activity embedded in state and national governments.

Sharing Economy Companies Are Set to Be Disrupted by Blockchain: From decentralized Ubers, Airbnbs, and beyond, crypto keeps the sharing economy’s ethos at its core.

Blockchain Waste Management | One Man’s Rubbish is Another One’s Treasure: Now, with the arrival of decentralized technology that Bitcoin pioneered, companies are looking to blockchain for meaningful waste solutions.

Knowing Your Cryptocurrency Categories is Knowing Your Portfolio: Diversity is key, especially in this volatile industry.

New British Market Study Highlights Lack of Cryptocurrency Understanding: Even though the industry will be a decade old soon, there’s still plenty of misunderstanding surrounding it.

Cryptocurrency Market Capitalization: What Is It? How Do You Use It?: A novice metric, market cap is an essential tool for any investor and trader.

Ethereum vs. EOS | An Analysis of Blockchain’s Two Largest Dapp Platforms: If Bitcoin and Bitcoin Cash are natural opposites, Ethereum and EOS are drumming up a rivalry to rival crypto’s two biggest opposing coins.

Part 3: Interview with Andy Levine on Steem Today and Tomorrow: Check out round three of our interview with Steem’s Andy Levine.

Bermuda, Malta, Gibraltar, and Liechtenstein Lure Cryptocurrency Companies: These small countries are looking to attract big players to their borders.

How to Buy Ripple on GateHub | Step-by-Step Guide: A succinct guide to purchasing Ripple on GateHub.

uPort’s Danny Zuckerman on Self-Sovereign Identity: Please enjoy this informative conversation on the current state and evolution of digital identity.

Cryptocurrency News From Around the World

Indian State Government to Implement Blockchain Technology: The Indian state of Telangana announced a host of initiatives this week that will look to blockchain to police the corruption and fraud that plagues Telangana’s government. Last month, the state introduced blockchain solutions into the government’s land registry and revenue departments in a bid to increase transparency, a preventative response to stanch the bribery that occurs in roughly 38% of the state’s real estate transactions.

Börse Stuttgart, Germany’s Second Largest Stock Exchange, Plans ICO, Multilateral Trading Facility: Börse Stuttgart is adding to its workload. A month out from the release of its anticipated Bison crypto trading app, Germany’s second largest stock exchange has announced its plans to create an ICO platform, as well as a multilateral crypto trading venue. The two services would be invaluable avenues of liquidity for any in the ICO market who use it while also extending Börse Stuttgart reach into the industry. “At the trading venue tokens issued via our ICO platform can be traded on the secondary market. This is an important success factor for ICOs. At the same time we are responding to demand from both retail and institutional investors for a regulated and reliable environment for trading with cryptocurrencies,” CEO Alexander Höptner said in a statement.

Boerse Stuttgart to Host Crypto Trading and Coin Offerings – https://t.co/iG6GsvLKcp

Advertise #ICO https://t.co/89O4ciDsi7

#bitcoin #btc #bitcoinnews #cryptocurrency #blockchain #btcusd #比特幣新聞 pic.twitter.com/Q6XPXWWeEn— The Bitcoin News 🚀₿ (@TheBitcoinNews) August 3, 2018

South Korean Financial Agency Makes a Case for Blockchain’s Integration into Stock Market: In a report to local and regulators and officials, the South Korean Financial Supervisory Service (FSS) has implored domestic municipalities to begin developing solutions for blockchain’s integration with traditional financial systems and platforms. The agency holds that blockchain could make settling stock market transactions faster and safer than current software. According to the report, it took note of blockchain’s use in international stock markets, paying special attention to Nasdaq’s use of blockchain for record keeping and private data.

Morgan Stanley Hires Credit Suisse Crypto Advocate, Trader as Head of Digital Markets: One of the world’s largest multinational banks, is inching further toward the cryptocurrency industry. This time in the form of a new hire, the investment bank has hired Andrew Peel, an employee at Credit Suisse and a self-described expert in cryptocurrency trading, as its new head of digital markets. Peel previously spent 12 years at Credit Suisse, serving 9 of them as a derivatives trader, and he’s been a cryptocurrency advocate since 2013.

Binance Acquires TrustWallet, the Exchange’s First Public Acquisition: Binance has bought out TrustWallet, a decentralized, open source Ethereum wallet that supports “over 20,000 different Ethereum based tokens (ERC20, ERC223 and ERC721),” according to a Binance blog post. The acquisition of TrustWallet will add an on-chain mobile wallet to the list of Binance services with other future integration possibilities. The TrustWallet brand and team will retain the autonomy and freedom to develop the core product while benefiting from the increased synergy from Binance, including the broad user base and the upcoming DEX,” the post continues to read. Binance CEO Changpeng Zhao indicated that acquisitions have an important role to play for maturing this industry, hinting that this could be the first of many for Binance: “We’re looking for strong tech teams. Acquisition will be a very key component to continuing to grow and contributing to this industry.”

Bitmain Posts Impressive $1 bln in Profit for Q1 of 2018, Plans IPO: Chinese mining giant Bitmain has netted a staggering $1 bln in profit–not revenue, mind you–in Q1 of 2018. On the tail end of this news, an unnamed source told Fortune that the company was making headway with its IPO, which Juhan Wu, Bitmain’s CEO, hinted at in June. The source indicated that the IPO will launch “very soon” in an overseas market that will allow investors to buy into the offering with USD.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.