- Prayin' for Consolidation

- Domestic News

- What's New at CoinCentral?

- Cryptocurrency News from Around the World

This Week in Crypto

Prayin’ for Consolidation

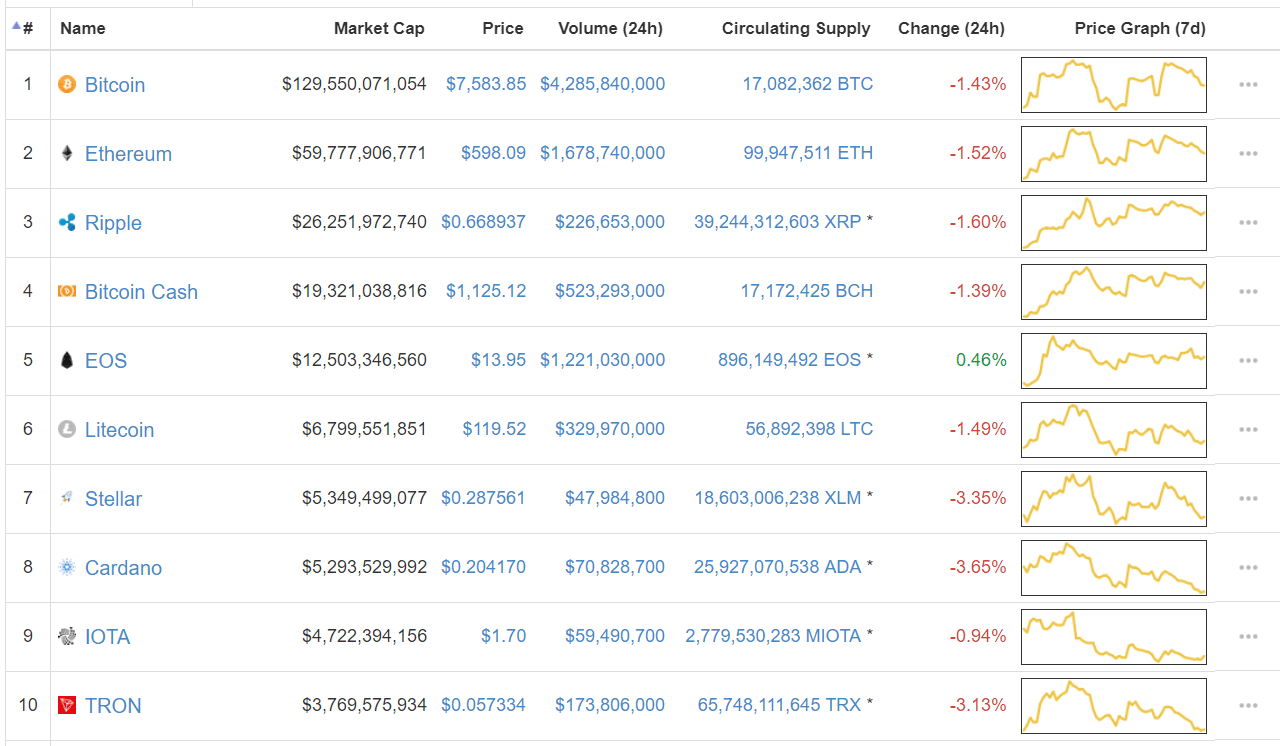

The cryptocurrency market has been trading in a relatively stagnant pattern over the week. With an overall market cap of $339bln at press time, the entire market actually gained 17% over the week, a much-welcomed rise after it went tumbling two weeks prior.

Even with this rise, most of the market’s top assets have been trading in the same ranges with little margin for movement to either extreme. If this is a reprieve from the most recent downturn, prices are trying to decide what to do next. Whether they’ll go up or down is anyone’s guess, but the best thing we can wish for right now is another week or so of sideways movement. If the market keeps consolidating like it’s doing and holds steady to its prices, it’ll become more likely that we’ve found support to take us back up again.

Bitcoin: Continuing last week’s trend of slight movement, crypto’s top asset is up 2% on the week at $7,580.

Ethereum: At $597, Etherum is up a small but not inconsequential 4% over the week.

Ripple: Ripple is leading the pack for positive price movement, as it’s up 7% on the weekly at $0.66.

Domestic News

Coinbase Acquires Financial Firms in Move to Become a Regulated Broker-Dealer: The world’s biggest cryptocurrency trading platform is one step closer to becoming a fully compliant broker-dealer under US SEC securities laws. This week, Coinbase announced its acquisition of securities dealer Keystone Capital Corp., Venovate Marketplace, Inc., and Digital Wealth LLC. These buyouts come alongside its acquisition of a broker-dealer license, an alternative trading system license, and a registered investment advisor license. While its status as a broker-dealer is “pending approval by federal authorities,” the company believes it “will soon be capable of offering blockchain-based securities, under the oversight of the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA).”

Today we’re excited to announce that we’re on track to become a US-regulated blockchain securities trading venue. We believe this is an important moment not only for Coinbase, but the entire crypto ecosystem. https://t.co/3grNDa6l9Z

— Coinbase 🛡️ (@coinbase) June 6, 2018

US SEC Is “Underwhelmed” by Crypto Exchange Efforts to Conform to Regulations: Even with the world’s largest exchange playing teacher’s pet with the SEC, the US regulatory agency is still unimpressed with the rest of the class’ performance. At the Exchange and Brokerage Conference on Wednesday this week, SEC Director of Division of Trading and Markets Brett Redfearn and SEC Chairman Jay Clayton both expressed dissatisfaction with domestic exchanges’ unwillingness to cozy up to regulations. “We’re underwhelmed by the enthusiasm for coming within the regulatory structure right now,” Redfearn told CNBC. “There are a number of exchanges that are trading ICOs that I would think that we would see more registrations.” During the conference, Clayton reiterated his belief to CNBC that ICOs and their tokens act as securities under US securities laws: “We regulate the offering of that security and regulate the trading of that security.”

The SEC Designed a New Senior Advisor Position for Digital Assets: Underwhelmed as it may be by exchanges and their regulatory apathy, the SEC isn’t easing up on its cryptocurrency strategy. It appointed Valerie A. Szczepanik as the Senior Advisor for Digital Assets and Innovation, a new advisory position created to overlook cryptocurrencies and ICOs. The seminal role will work across SEC divisions to evaluate how digital assets and their technology factor into existing securities laws. “Valerie’s thought leadership in this area is recognized both within the Commission and across financial regulators in the United States and abroad. With her demonstrated skill, experience, and keen awareness of the importance of fostering innovation while ensuring investor protection, Val is the right person to coordinate our efforts in this dynamic area that has both promise and risk,” Chairman Jay Clayton stated in response to the appointment.

Former SEC Chairman to Represent Ripple in Lawsuit over XRP Security Status: We can’t seem to get away from stories on the SEC and securities laws, can we? In an ironic turn, this time, the story is about a (former) SEC chair defending a cryptocurrency against a securities classification. Former SEC Chairwoman Mary Jo White has been hired to defend Ripple in a private investor suit which argues that the company sold XRP tokens as unregistered securities. She’ll be joined by her enforcement chief Andrew Ceresney, and their legal firm, Debevoise and Plimpton, will work on the case with co-counsel from Meagher & Flom, Arps, Skadden, and Slate.

New York State Legislative House Mulls Prospect of Cryptocurrency Task Force: This Wednesday, the New York State legislature voted to advance a bill that proposes the formation of a cryptocurrency task force. Overseen by the New York State Assembly’s banks committee, the bill posits the creation of a “digital currency task force to provide the governor and the legislature with information on the potential effects of the widespread implementation of digital currencies on financial markets in the state.” Among other things, the task force would be charged to monitor developments of cryptocurrencies and blockchain technology within the state, evaluate the legislative approaches of foreign governments, examine domestic mining and its impact on electrical consumption, and monitor market manipulation and other illegal activities tied to cryptocurrencies.

John McAfee Announces 2020 Presidential Bid, Vows to Run Under Crypto-Centric Platform: John McAfee is running for president again, but this time, he’s making crypto the primary focus of his platform. Taking to Twitter to herald his return to the presidential stage, the infamous cyber-security entrepreneur turned rabble-rousing crypto-enthusiast stated that, even if the Libertarian party doesn’t allow him to re-run, he’ll establish his own party to provide “the ultimate campaign platform” for the crypto community. McAfee fell shy to Gary Johnson in last year’s 2016 Libertarian primaries, his first time participating in a presidential election. If you expect success this year, though, McAfee wants you to temper your optimism, as he bluntly admitted in a follow-up tweet that he has a slim-to-none chance of winning: “Don’t think that I have a chance of winning. I do not. But what truly changes America is not the president, but the process of creating one. If my following is sufficient I get to stand the world’s largest stage and talk to the everyone, as I did last time, to tell the truth.”

In spite of past refusals, I have decided to again run for POTUS in 2020. If asked again by the Libertarian party, I will run with them. If not, I will create my own party. I believe this will best serve the crypto community by providing the ultimate campaign platform for us.

— John McAfee (@officialmcafee) June 3, 2018

Ripple Introduces University Blockchain Research Initiative, Donates $50mln for Crypto Education: Real-time gross settlement system and remittance protocol Ripple is making its commitment to blockchain education known. The project disclosed its University Blockchain Research Initiative (UBRI) this Monday, a program that plans to dedicate $50mln in funding to 17 universities to stimulate educational efforts and enrich instructional resources for the emerging field. “[We’re] excited to announce the University Blockchain Research Initiative (UBRI), a collaboration with top universities around the world to support and accelerate academic research, technical development and innovation in blockchain, cryptocurrency and digital payments,” the company stated in a press release. Among others, Princeton’s Center for Information Technology Policy will work with UBRI to study cryptocurrency’s impact on US and global policy, and UPenn will receive funding to support MBA-MS candidates for its dual degree in cryptocurrency/blockchain business and development.

What’s New at CoinCentral?

US SEC Creates New Senior Advisor Position Dedicated to Cryptocurrency: The position is the latest move in the agency’s cryptocurrency strategy.

Is Cloud Mining More Profitable Than Bitcoin Mining Hardware?: Stuck between a cloud and a hardware miner? There are some things you should consider.

The Blockchain Healthcare Revolution is in Progress: Distributed ledger and blockchain technology are already finding their way into the healthcare industry.

How to Calculate the Profitability of Bitcoin Mining Hardware: Calculating how much your miner is (or could be) making can be a pain, but it’s necessary to keep a healthy bottom line.

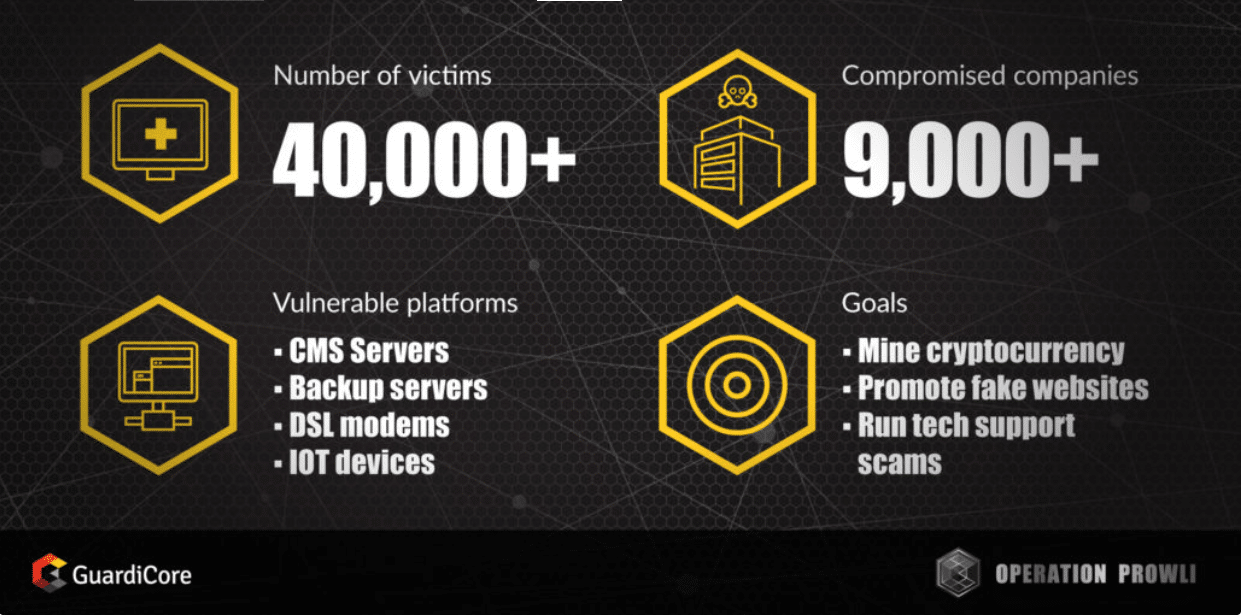

Cryptocurrency Mining Botnets Are Becoming an Epidemic: Botnets and cryptocurrency mining malware have become a scourge on the internet as of late.

Solving Blockchain’s Biggest Usability Issue: For adoption to ramp up, blockchain needs to solve its usability issues.

Can Blockchain Rescue our Identity from the Digital Abyss?: Our modern identity management systems are currently in crisis and it seems this is really just the status quo, but does it need to be?

What’s Behind the ConsenSys Expansion to Ireland? World Class Talent for Starters: The Ethereum incubator ConsenSys is making its move into Ireland to join a thriving tech scene.

Block Broker, an ICO to Prevent Exit Scams, Pulls an Exit Scam: It built its brand on investor protection until it ran off with $3mln worth of its own investors’ contributions.

David Knott, OmiseGo Research Scientist, on Plasma and Scaling: See what one of OmiseGo’s research scientists has to say about the much-anticipated Plasma protocol.

What You Need to Know About EU Data Privacy and Blockchain: Last week, the EU brought into force the General Data Protection Regulation (GDPR) – the biggest change in data privacy legislation in the last 20 years.

[thrive_leads id=’5219′]

Cryptocurrency News from Around the World

HitBTC Establish Plan of Operations for Japanese Services After Freezing User Accounts: After suspending Japanese accounts for the sake of regulatory compliance, HitBTC, one of the world’s largest cryptocurrency exchanges, unveiled a gameplan to revamp its services in Japan. According to a blog post, the company is attempting to establish itself as a licensed subsidiary in the country after regulatory changes by the Japanese Financial Services Agency. “Previously this year, HitBTC team started working with a worldwide-recognized Japanese law firm, the cooperation aimed to get HitBTC through the local subsidiary setup and licensing procedure to resume its services for Japan residents. The company is actively hiring for the local office and exploring M&A opportunities to expedite the launch of the Japanese operations in Q3 2018,” the blog post reads.

Security Firm Unearths Monero Mining Malware, 40,000 Devices Affected: Guardicore Labs’ security team has “uncovered a traffic manipulation and cryptocurrency mining campaign infecting a wide number of organizations in industries such as finance, education and government,” a blog post by the security firm reads. Operation Prowli, as the firm calls it, disseminated malware and mining code through websites and servers to infect some 40,000 devices. The operation used infected devices to mine Monero, the chosen boon of many a hacker looking to profit off remote mining programs.

South Korean Supreme Court Says Bitcoin is an Asset: Overturning a lower court ruling from last year, South Korea’s Supreme Court ruled this week that Bitcoin is a legally recognized asset. In September of last year, Ahn, a South Korean man charged with distribution of child porn, was sentenced to 18 months in prison, but the court ruled that the government could not seize the Bitcoin he had accumulated in exchange for the illicit materials. The case was appealed and taken to the supreme court, who subsequently ruled that the government has every right to confiscate Ahn’s proceeds, arguing that, though intangible, Bitcoin holds value as an asset, the reception of which for a service “is an act of taking profits.”

Huobi Launches $93mln Joint China-South Korea Blockchain Fund: In collaboration with NewMargin Capital, a Chinese venture capital firm, and the South Korean securities firm Kiwoom Securities Co., Huobi is launching a blockchain investment fund just a few bucks shy of $100mln. The Mirae Asset Financial Group, a South Korean financial firm, will participate in the fund as an investor, as well. Focused on fostering development, the$93mln investment fund will be funneled into crypto startups and encourage China and South Korea to work together towards blockchain innovation.

South African Central Bank Pilots Tokenized Fiat Payments Using Quorum: South Africa’s Central Bank (SARB) tested its proof-of-concept for the so-called Project Khokha this week. The project leverages Quorum, an Ethereum-based private blockchain, to tokenize fiat currency for payment settlements on the blockchain. With help from Ethereum incubator ConsenSys and accounting firm PricewaterhouseCoopers Inc., seven South African banks took part in the pilot. According to SARB’s report, the “results show that the typical daily volume of the South African payments system could be processed in less than two hours with full confidentiality of transactions and settlement finality. Transactions were processed within two seconds, across a network of geographically distributed nodes, with distributed consensus providing the requisite resilience. The SARB was able to view the detail of all the transactions to allow for regulatory oversight.”

Parity Asks Users to Update Software Client After Testnet Vulnerability Surfaces: Parity is under community scrutiny again after another flaw was discovered in the popular Ethereum wallet’s code. This time, the vulnerability had the potential to infect Ethereum’s mainnet, a Parity blog post suggests. According to the post, there was a “consensus-related issue between Parity Ethereum (up to versions 1.10.4-stable and 1.11.1-beta) and all other Ethereum clients,” one that could cause Parity transactions to be relayed out-of-sync with the Ethereum network, rendering them null. Parity has released a patch for the flaw, imploring users to “upgrade to fixed versions 1.10.6-stable and 1.11.3-beta asap, and then double-check that [they] are running version 1.10.6-stable or 1.11.3-beta.”

Alert: Please update your Parity Ethereum clients to 1.11.3-beta or 1.10.6-stable asap. https://t.co/QNxzv74kSF

— Parity Technologies (@paritytech) June 6, 2018

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.