This Week in Crypto

Please Sir, Can We Find the Floor?

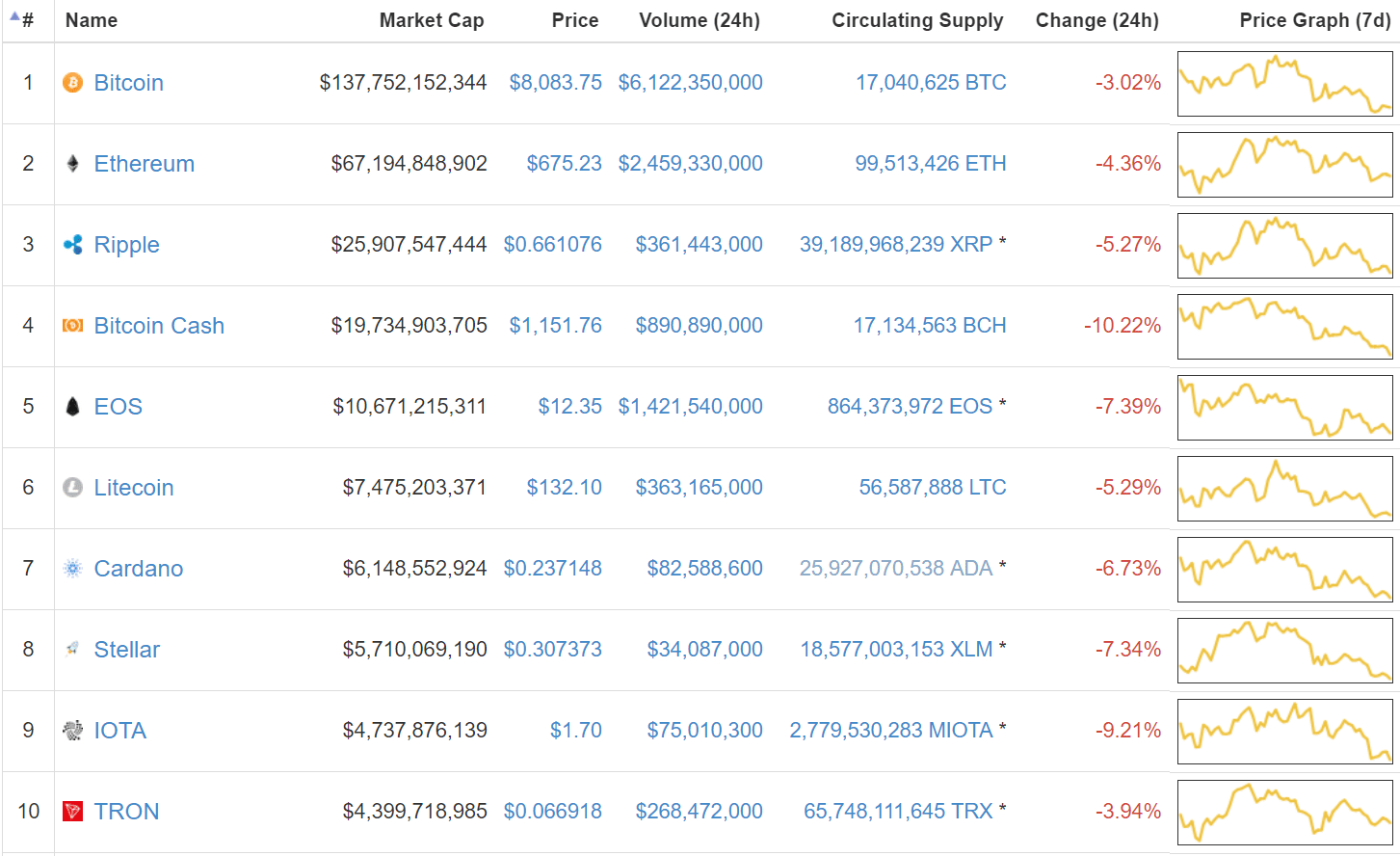

The market’s looking for support, folks. Ever since Bitcoin failed to break $10k, assets across the board have been bleeding and prices have yet to find a floor.

If you were hoping for a post-Consensus pump per historical precedent, I wouldn’t hold my breath. With a total market capitalization of $366bln, Consensus did little to save the market from the 4.6% drop it experienced over the course of the week. Sure, the loss isn’t catastrophic, but it is the second week in a row that we’ve seen negative price action.

As we watch Bitcoin flirt with $8k, expect lower prices still if we drop below this support level.

Bitcoin: Crypto’s #1 is down 6% on the week, holding just above the $8k threshold at $8,080.

Ethereum: Ethereum hasn’t moved much at all to speak of. At $675, it’s almost exactly where it was last Friday, only losing 0.4% over the week.

Ripple: In the same boat as Ethereum, Ripple is (almost) keeping its head above water, as it’s down just 1.4% at $0.66.

Domestic News

Circle Raises $110mln in Series E Funding, Partners with Bitmain, Stable Coin in the Works: Peer-to-peer payment company Circle, who purchased Poloniex exchange earlier this year, just raised $110mln in its latest round of venture capital investing. The series E investment round has the rising blockchain company valued at $3bln, with Bitmain, one of the world’s largest mining hardware producers, committing the most funding and forging a partnership with Circle in the process. Per this partnership and Circle’s new strategic financing campaign, the company plans to develop its own stablecoin (USDC) along with CENTRE, an open-source network for converting physical and digital assets into stablecoins.

As well as their key support for CENTRE and USDC, @BITMAINtech is also leading a $110M series E strategic investment in Circle. We’re over the moon to have one of the most important and forward-thinking companies join our investor’s list. Welcome, @BITMAINtech pic.twitter.com/uP249k1ZLT

— Circle (@circle) May 15, 2018

Israel-Based Exchange eToro Announces Expansion to US: After raising some $100mln in March, eToro will establish a headquarters in the United States. With offices in Tel Aviv, London, and Limassol, the North American headquarters will be the company’s first foothold in the Western Hemisphere, and the multi-asset trading and brokerage firm expects to have cryptocurrency trading available for US residents later this year. “We believe we are going to see trillions of dollars moving into crypto and blockchain assets, and as we are one of the largest players in Europe and expanding to Asia as well; it seems logical to also have a significant footprint in the U.S,” Yoni Assia, eToro’s CEO and founder told Bitcoin Magazine.

Gemini Exchange Announces Fiat Support for Zcash, a First for Privacy Coins: Privacy coins just received a noteworthy buff to their legitimacy. This week, the Winklevoss-owned Gemini exchange announced that it would open Zcash markets on its platforms, with future plans to add Litecoin and Bitcoin Cash. The listing comes after Gemini, a fully licensed exchange under New York state law, received approval from the New York State Department of Financial Services to list the privacy coin. As the first fiat pair for a privacy coin on a major, regulated exchange in the US, the development is proof that coins with anonymity protocols can “coexist with regulatory compliance,” Josh Swihart, Zcash’s Marketing Director conveyed to Bitcoin Magazine.

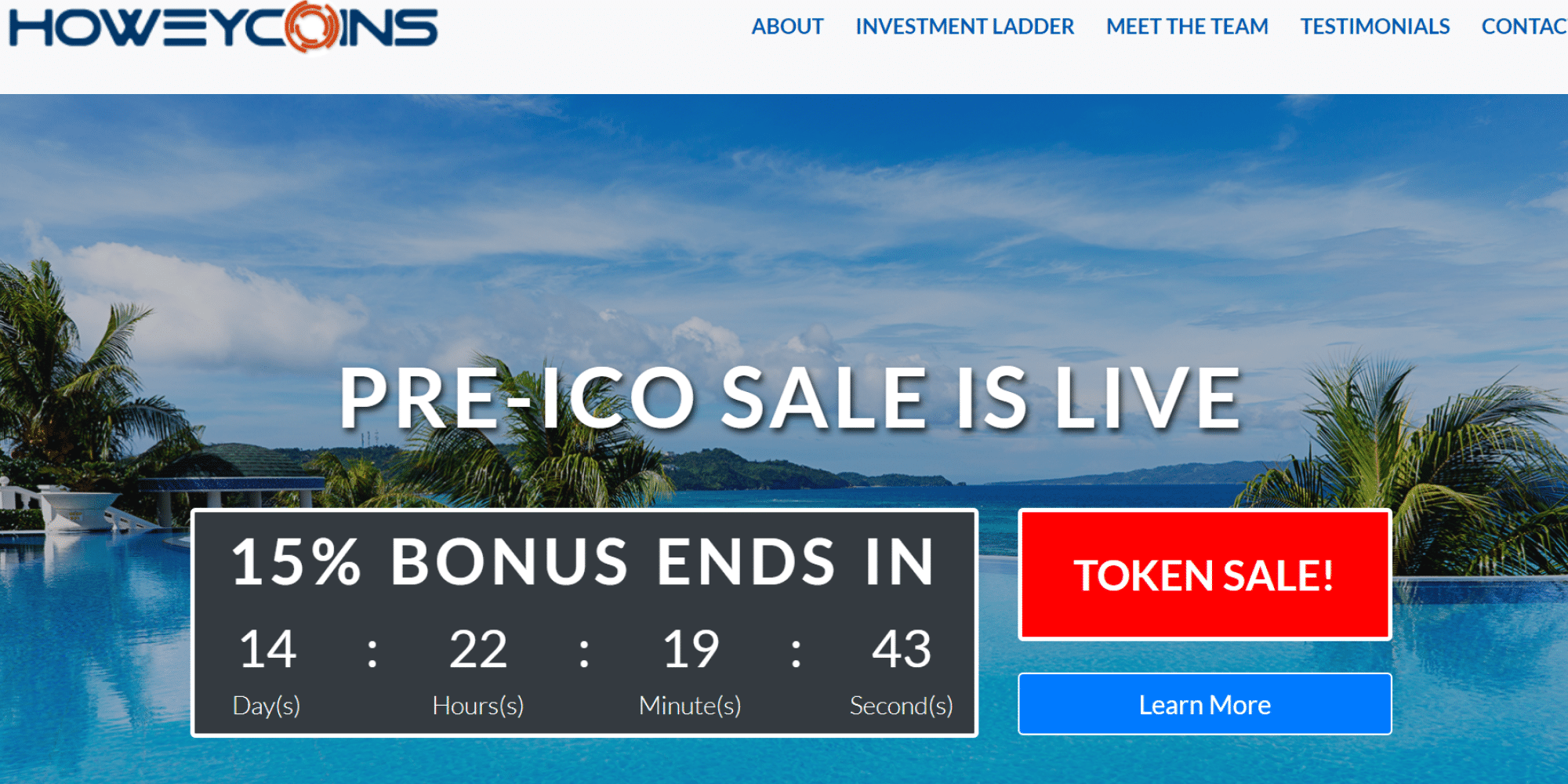

United States SEC Creates a Mock ICO to Teach Investors a Lesson in Investment Temperance: In its latest campaign against crypto’s unscrupulous actors, the US Securities and Exchange Commission is embedding itself with the enemy–kind of. The regulatory agency recently launched HoweyCoins, an overtly-fake ICO whose website features many of the warning signs that have become hallmarks of fraudulent projects looking to make a quick buck. If you attempt to invest in the ICO, you’ll be redirected to a web page that warns you against buying into projects like HoweyCoins, complete with a laundry list of red flags to look out for when shopping for your next moonshot.

LedgerX Establishes First Ever Bitcoin Savings Account with Clearance from United States CFTC: LedgerX, a crypto asset management platform, debuted a new option for its Bitcoin services this week. The savings account feature allows users to earn USD alongside their Bitcoin holdings, offering them the option to execute a call overwrite, a contract which allows LedgerX users to sell call options on their holdings in three or six month periods. LedgerX is able to offer the unprecedented savings account and call overwrite feature thanks to its registration with the CFTC as a swap execution facility (SEF) and a derivatives clearing organization (DCO).

Amazon Web Services Partners with ConsenSys to Deliver Kaleido, An All-in-One Blockchain Network for Enterprises: Web services and online retail giant Amazon is officially in the blockchain game. This week, the company unveiled Kaleido, a blockchain software as a service kit available on the Amazon Web Services Marketplace. Built with help from Ethereum incubator ConsenSys, the software allows its users to manage their own private chain that stays anchored to and consistent with Ethereum’s public chain. The product is meant to be “an all-in-one blockchain platform aimed at speeding and simplifying enterprise use of the technology.”

J.P. Morgan Unveils Prototype for Its Capital Markets Blockchain Platform: At Consensus this year, J.P. Morgan Chase & Company presented a prototype for its blockchain platform. The platform was built to simplify and streamline securities transactions, which currently must run through multiple avenues before changing hands from one party to another. J.P. Morgan’s executive director of the Blockchain Center of Excellence, Christine Moy, told the Wall Street Journal that “[the] promise of natively issuing financial instruments on blockchain is that you can share that infrastructure.”

What’s New at CoinCentral?

Cryptopia CEO Alan Booth on the Cryptocurrency Exchange Realm: See what Cryptopia’s CEO has to say about the state of crypto exchanges in our exclusive interview.

How Blockchain Can Fill the Gap in Cybersecurity and AI: Could blockchain tie up loose ends in these industries? We certainly think so.

Ethereum Futures Contracts Have Officially Arrived: The first ever fully-licensed Ethereum derivatives launched on the UK-based Crypto Facilities exchange this week.

What is Bytom (BTM)? | Beginner’s Guide: Learn more about Bytom with our handy beginner’s guide.

How to Pay Your Bills with Bitcoin: The option is out there if you know where to look.

Bittrex vs. Bitfinex Exchange Comparison: See how two of the space’s heaviest hitters stack up against each other.

Crypto Crimes: ICO Scams, Robbery, and Money Laundering: In the digital wild west, best to keep all sensitive information close to your chest.

Who is Brock Pierce? Blockchain Capital, EOS, and the John Oliver Takedown: He lives in Puerto Rico, doesn’t pay a penny in taxes for his crypto gains, and has become one of the more controversial figures in the crypto space over the course of his career.

Why Blockchain Technology Will Be Essential for the Trust Economy: “Trust” and “trustless” get thrown around in this industry a lot, so what does blockchain mean for the trust economy?

Sold! CryptoKitty gets auctioned for $140,000 at the Codex Art Auction: They thought it wouldn’t go for more than a few ten thousand dollars–boy was that a conservative estimate.

Proxeus CEO Antoine Verdon on Making Blockchain Accessible to All: Antoine Verdon has some great insight into how we can make decentralized networks even more available to those who need their services most.

Autonomous Trucking and Blockchain Technology: Advancing Supply Chain Oversight: Blockchain and autonomous freight lines; have we entered the future? Maybe not yet, but we’re getting there.

What is Libra Credit: Digital Assets as the Future of International Credit: Libra Credit is offering an Ethereum-based decentralized lending ecosystem that helps users get open access to credit anywhere at anytime.

What Are the Potential Benefits and Impacts of Bitcoin Donations on Charity: Philanthropy without having to rely on a central intermediary–sign us up.

How Blockchain Services Will Transform the Global Economy: We’re already starting to see the effects take place, but this is just the beginning.

Partnering with ConsenSys, Amazon Web Services Launches Kaleido Blockchain Platform: Kaleido is an Ethereum-based protocol that is meant to streamline blockchain integration for enterprises.

Bitcoin Cash to Hard Fork: 32MB Block Size and Smart Contracts: Preparing for BCH’s hard fork, we interviewed Alejandro de la Torre, VP of Business operations at BTC.com.

Ledger Co-founder Thomas France on Coin Support and Staying Ahead of Hackers: Hear what the co-founder of the world’s most popular hardware wallet has to say about the project’s future and its commitment to security.

Why Are More Governments Stopping Bitcoin Mining Operations?: With crypto on the radar of the international political scene, governments are snuffing out mining farms.

Now There Are Cryptocurrencies for Retirees, As Well: We can’t make this stuff up, folks. The article speaks for itself.

What is Elix / Elixir (ELX)? | Beginner’s Guide: Learn all about Elixir with our in-depth beginner’s guide.

United States SEC Creates Scam ICO as a Warning to Investors: HoweyCoins is the SEC’s most novel attempt yet to keep you from signing up for the latest less-than-legit ICO.

Chinese Govt. Releases Crypto Ratings, Ethereum Comes in First While Bitcoin Lags Behind: The ratings on part of the Chinese government are the public complement to Weiss’ private, subscription-based ratings.

Jihan Wu: A Story of Bitmain, Twitter Profanity, & BCH Evangelism: Prolific and contentious, you’ve likely seen Jihan Wu’s name thrown around in the cryptocurrency space–but in what context, exactly?

Top 5 Upcoming Mainnets Scheduled for Q2 2018: Stay in the loop with this quarter’s most anticipated mainnets.

Cryptocurrency News from Around the World

Ethereum Futures Contracts Hit the United Kingdom Trading Scene: The UK-regulated cryptocurrency exchange Crypto Facilities opened up trading for Ethereum futures this week. With the May 11 debut, the futures became the world’s first fully-regulated Ethereum derivatives. “Ether is the second most liquid cryptocurrency after Bitcoin, trading in the billions of dollars daily, and we are excited to be launching ETH futures. The Ethereum network is the pre-eminent blockchain for smart contracts, and we believe this new trading instrument will attract more investors and bring greater liquidity to the marketplace,” Crypto Facilities founder Timo Schlaefer said in regards to the developments.

Our ETH/USD Futures contracts are live!

Contract Specs – https://t.co/vDr9Cj4ZKo

Start trading now – https://t.co/dSN7CWqpPr#ETH #ethereum #Futures pic.twitter.com/fIfle36sql

— Kraken Pro (@krakenpro) May 11, 2018

Russia Weighs Legislation to Include Digital Economy Standards in Civil Codes: Russia’s lower legislative house, the State Duma, will hold a first reading for a bill that proposes including standards for crypto’s emerging digital economy in the Russian Federation’s Civil Codes. Overseen by the Committee for Legislative Work, the bill could “minimize the existing risks of using digital objects for transferring assets into an unregulated digital environment.” While, if signed into law, the bill would mean smart contracts are treated as written consent for legal proceedings, it does not grant cryptocurrencies status as legal tender under Russian law.

Ethereum Alliance Rolls Out Technical Standards for Enterprises, First Universal Specifications: At this year’s Consensus conference, the Ethereum Alliance announced that it has delivered on a promise it made at the Blockchain Expo World Series in London last month. The working group has released a client that “will give businesses and developers a comprehensive, instantly accessible view of the enterprise environment using Ethereum,” the group claims. “The EEA’s Enterprise Ethereum Specification is the result of 18 months of intense collaboration between leading enterprise, technology and platform members within our technical committee. This EEA open-source, cross-platform framework will enable the mass adoption at a depth and breadth otherwise unachievable in individual corporate silos,” the group continued.

Second Largest Stock Exchange in Germany is Planning a Fee-Free Crypto Trading App: With the hopes of launching an easy-to-use, convenient trading app, Stuttgart Börse, one of Germany’s premier stock exchanges, unveiled plans for its own cryptocurrency trading service this week. Developed with help from Sowa Labs, the app, called Bison, will feature zero fees and markets for Bitcoin, Ethereum, Ripple, and Litecoin, and it is expected to be in the hands of consumers by fall of 2018. The app also comes with its own AI service, Cryptoradar, which allegedly will deliver daily, real-time analysis of crypto markets with data collected from over 250,000 tweet sources.

Japanese Mitsubishi UFJ Financial Group, the Fifth Largest Bank in the World, Entertaining its Own Cyptocurrency: The banking arm for Japan’s Mitsubishi UFJ Financial Group (MUFG) is planning to develop its own cryptocurrency. Dubbed MUFG Coin, the bank expects to run a trial for the currency by 2019, indicating that its test run could involve some 100,000 account holders. The currency is expected to take the form of a stablecoin pegged to the Japanese yen.

Taiwanese Bank Fubon Commercial Launches Blockchain Payment System: A first for Taiwan, the Taipei-based Fubon Commercial Bank has deployed a payment system that leverages Ethereum’s blockchain. The launch is the culmination of the bank’s partnership with Taiwan’s National Chengchi University, and the payment system will include services for merchants and restaurants near the university. It’s also the latest step Taipei has taken towards becoming a blockchain-run “smart city,” an initiative the country’s capital announced at the beginning of this year.

The World’s Financial Repository, Switzerland, Takes a Look into a National Cryptocurrency: Switzerland’s Federal Council of the Government has made an official legislative request for a report on the potential benefits and risks of launching its own state-backed coin, the e-franc. “The Federal Council is aware of the major challenges, both legal and monetary, which would be accompanied by the use of an e-franc… It asks that the proposal be adopted to examine the risks and opportunities of an e-franc and to clarify the legal, economic and financial aspects of the e-franc,” the Council stated in regards to the request.