What if the next major crypto winners are not “faster chains” or “new memes,” but the projects turning real investing demand into on-chain products?

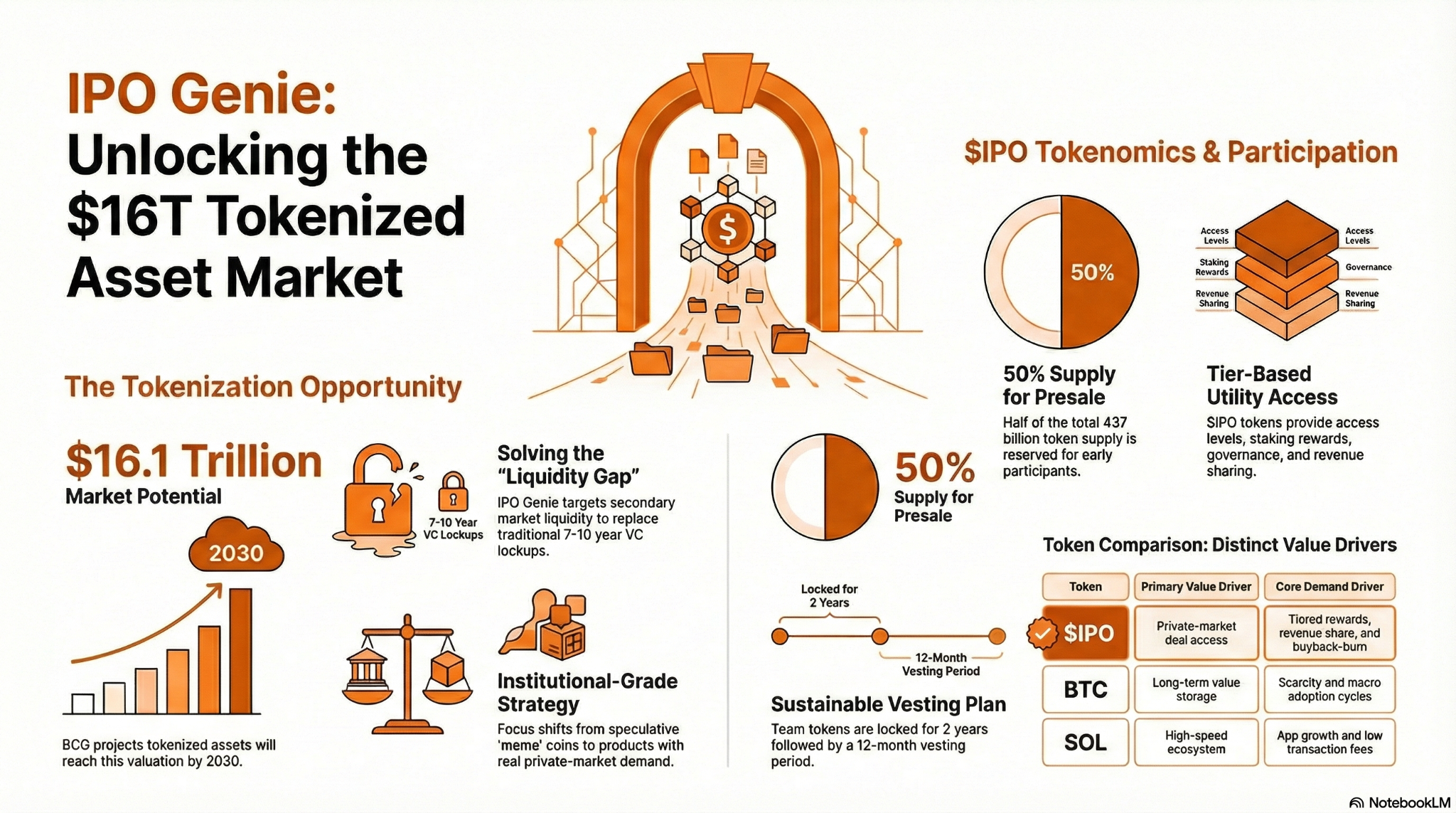

That question is getting louder on January 17, 2026, because tokenization is no longer niche. In fact, BCG & ADDX projected that tokenized assets could reach about $16.1T by 2030. (source)

Meanwhile, a Ripple-BCG report projected tokenized assets could grow to $18.9T by 2033, while still noting real obstacles exist.

So, attention is shifting toward deals with clear “why,” not just “when moon.” And that is exactly why IPO Genie is pulling so many eyes right now.

Key takeaways (read this first):

- IPO Genie is riding a fast-rising theme: private markets moving on-chain plus real utility.

- Early buyers care because access is tier-based, and the presale allocation is fixed at 50% of supply.

- The line that keeps spreading is simple: no decade-long waits to see liquidity.

- Still, it is a high risk. Liquidity can be delayed, and there are regulatory and tech risks.

The Money is Moving Toward Tokenized Assets, & The Timing is not Subtle

Crypto buyers have seen enough launches to recognize one pattern. Utility tends to outlast slogans. So, it matters that large institutions are now publishing hard-number estimates for tokenization, not just opinions.

At the same time, private markets are under pressure to provide liquidity. For example, the Financial Times reported that private equity groups have been holding assets longer as exits have gotten tougher, which minimizes the cycle of returning capital. As a result, anything that credibly points to earlier liquidity gets instant attention.

Therefore, this is the time IPO Genie is entering the crypto market. And that is why it feels like more than a typical early-stage crypto presale.

Why Early Participation Matters More Here Than in Most Launches

In many presales, “early” only means “cheaper.” Here, “early” also means positioning.

- The presale is structurally large: 50% of the total supply is allocated to presale participants. That creates a time window that is simple to understand.

- Second, IPO Genie uses tier-based access. Simply, $IPO means better

- access,

- earlier allocations,

- and extra benefits at higher tiers.

So, joining earlier is not only about “getting in.” It is also about getting in before tiers feel crowded.

- And the lock-in story is the hook people repeat. IPO Genie’s whitepaper frames the pain clearly: traditional VC lockups can run 7–10 years.

IPO Genie pushes the opposite idea: positions can be traded via secondary markets, with the practical reminder that selling may not always be immediate.

As a result, market watchers say IPO Genie is a reliable crypto presale decision, not just a justa random early-stage opportunity.

What’s Driving the Sudden Attention Around IPO Genie

Live Presale: ipogenie.ai

This Crypto presale 2026 conversation is not happening in a vacuum. Instead, it is a combination of 3 trends into one story.

- One, private markets are still massive, but access is tiny. IPO Genie cites a private market size of $3T+ and highlights how limited retail access is.

- Two, the product lines up with what buyers keep asking for: real utility. The token’s utility is presented as access rights, staking rewards, governance, revenue share, and higher-tier downside tools.

- Three, the tokenomics read like a plan, not a poster. Total supply is 437,000,000,000 $IPO, and team tokens are locked for 2 years, then vest over 12 months.

Additionally, the design includes buyback-and-burn from platform revenues, alongside staking lockups and tier incentives.

Meanwhile, this is why “analysts” keep tracking the broader category. When reports talk about tokenization growth in the 10 of trillions, buyers look for projects that match that direction. That is also why many are calling setups like this an institutional-grade crypto presale. Thus, this means the theme fits where large capital is likely to move next.

Quick Comparison Table: $IPO vs BTC vs SOL for 2026-Style Investors

| Token | What buyers mainly want from it | What can drive demand | Liquidity expectation | Core risk to remember |

| $IPO (IPO Genie) | Access + rewards tied to private-market deal participation | Tier access, staking rewards, governance role, revenue share, buyback-and-burn design | Built for secondary trading, but selling depends on market demand | Startup failure risk, liquidity timing, regulatory, and tech risk |

| BTC | Long-term value storage | Scarcity, adoption cycles, macro narratives | Very high liquidity across global markets | Sharp volatility, macro shocks |

| ETH | Infrastructure exposure and network usage | DeFi activity, staking demand, Layer-2 growth, protocol upgrades | High liquidity, but sensitive to network fees and usage | Scaling pressure, regulatory uncertainty around staking |

| SOL | High-speed ecosystem exposure | App growth, low fees, and developer adoption | Generally liquid, but market-driven | Network reliability issues, ecosystem concentration |

In other words, BTC, ETH, and SOL are liquid market bets. Meanwhile, $IPO is pitched as a gateway-style token where access and platform mechanics are part of the demand story. That difference is why many treat it like the next big crypto presale rather than “just another listing.”

Why Investors Move Faster in January than Usual

Hype without substance fades fast. However, promos paired with real utility convert.

IPO Genie’s model already includes community flywheels like staking rewards and growth incentives.

So, when time-limited campaigns show up, buyers do not see “marketing only.” In fact, they see a reason to act sooner, because token positioning can affect access later.

Also, IPO Genie has referenced community-facing campaigns such as an airdrop and seasonal offers (including a Christmas bonus on purchases). Furthermore, event visibility is tied to the Misfits Boxing sponsorship in Dubai. Those touches matter because they pull attention, but the conversion happens because the token has clear roles inside the platform’s design.

Therefore, investors join the $IPO before the end of January in 2026 because prices will rise within hours.

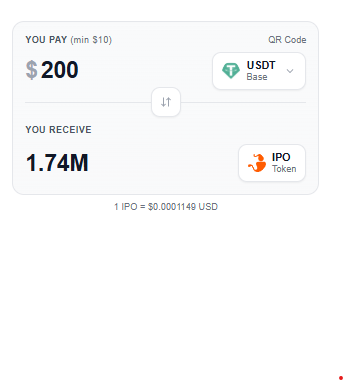

$200 = $1.74 million $IPO

For example, if an early investor joins the IPO Genie Platform right now at the live stage 38 with $0.0001149. Then they could secure the $1.74 million IPO tokens. While the supplyis rapidly shrinking.

So, it is simple, and it matches the presale allocation reality.

Smart Risk Notes Before Anyone Clicks “Buy”

Even if this Crypto presale 2026 story sounds exciting, the risks are real.

- Tokenized private markets can be volatile.

- Liquidity can be delayed even if secondary markets exist.

- Thus, the rules can change in smart contract systems carry technical risk.

So, the sensible approach is position sizing, diversification, and independent due diligence. IPO Genie’s own risk disclosure stresses there are no guarantees of returns and encourages professional advice.

The January Window Everyone Keeps Talking About

This Crypto presale 2026 window is an important decision. If buyers want exposure to tokenized private-market access with rewards and governance mechanics, they will not wait for “later.” Because later usually means harder access and more competition for allocations.

And that is the real reason people are rushing around the $IPO. It is not only price talk. It is the fear of missing positioning in a system that is designed to reward early access.

If you want to join the top crypto presale in Q1 2026 before the end of January, then you may consider the IPO Genie. Because it ranked #1 among the trending crypto presales in Q1 2026.

Join the Top 2026 Crypto Presale today with just $10:

Official website | Twitter (X) | Telegram

FAQs

1) How can someone join the presale before the end of January?

They would buy $IPO through the official presale route and follow the platform’s onboarding steps. IPO Genie also describes built-in compliance flows like KYC/AML checks.

2) What makes IPO Genie feel like a reliable crypto presale to many buyers?

Clear tokenomics, the team lock structure, and clear risk disclosure are credibility signals.

3) What does “exit anytime” mean in practice?

It means the design targets secondary liquidity instead of decade-long lockups, but selling may still depend on market conditions.