TLDR

- Bitcoin maintains market leadership with institutional ETF flows driving momentum and price targets reaching six figures

- Ethereum continues dominating smart contracts with predictions of $7,000 by Q4 2025 and recent $250M whale purchase

- XRP gains from U.S. strategic crypto reserve inclusion and shows 381% YTD gains with institutional partnerships

- Cardano receives regulatory boost from strategic reserve listing with bullish outlook toward $3 per token

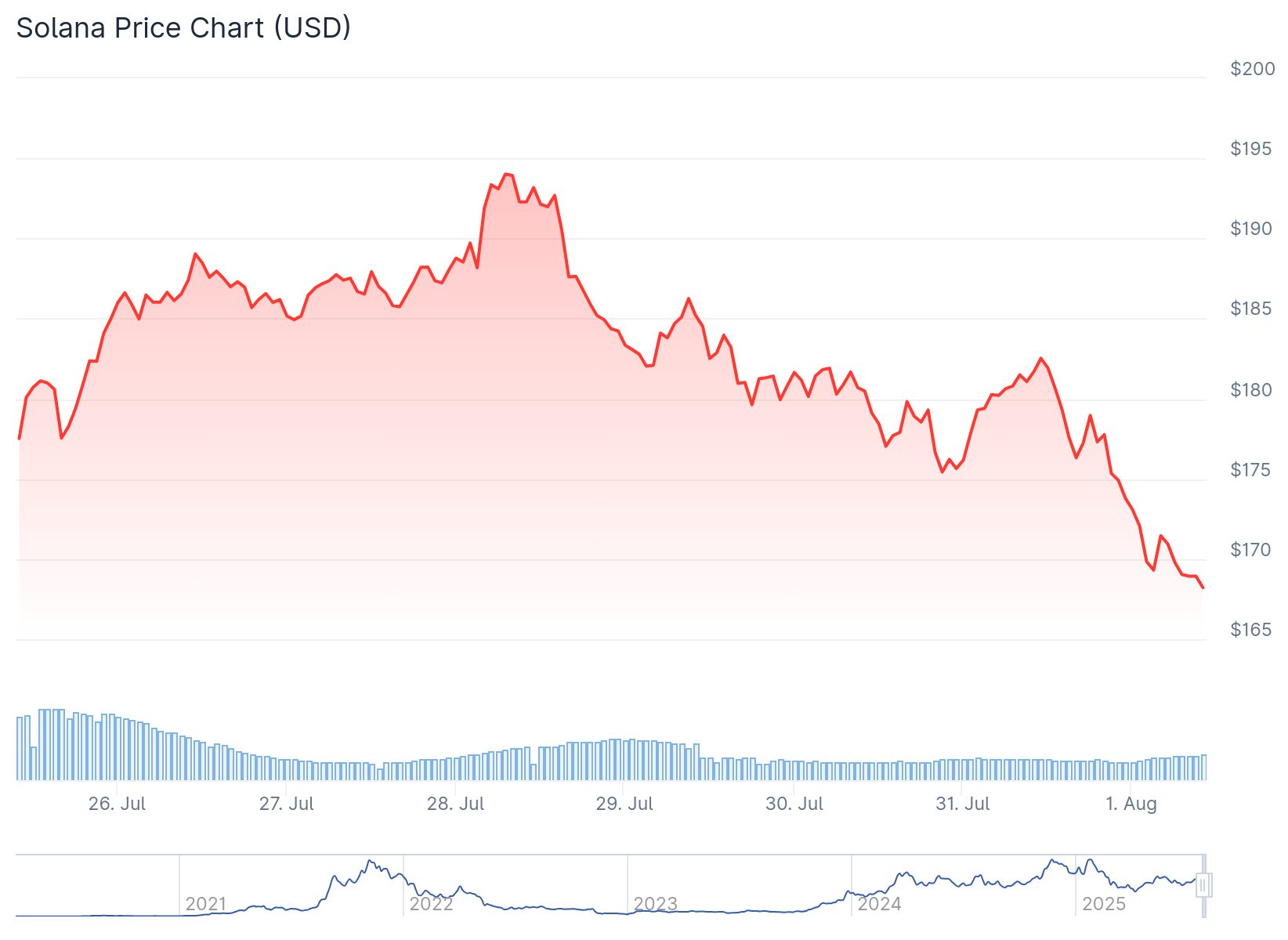

- Solana emerges as top altcoin pick with strong developer interest and ecosystem growth at $182 price level

The cryptocurrency market in August 2025 shows clear leadership from established digital assets, with institutional adoption driving momentum across major tokens. Market analysts have identified five cryptocurrencies positioned for continued growth based on fundamental developments and technical indicators.

Each of these digital assets brings unique value propositions to the market. From Bitcoin’s role as digital gold to Ethereum’s smart contract dominance, investors are seeing distinct opportunities across different blockchain ecosystems.

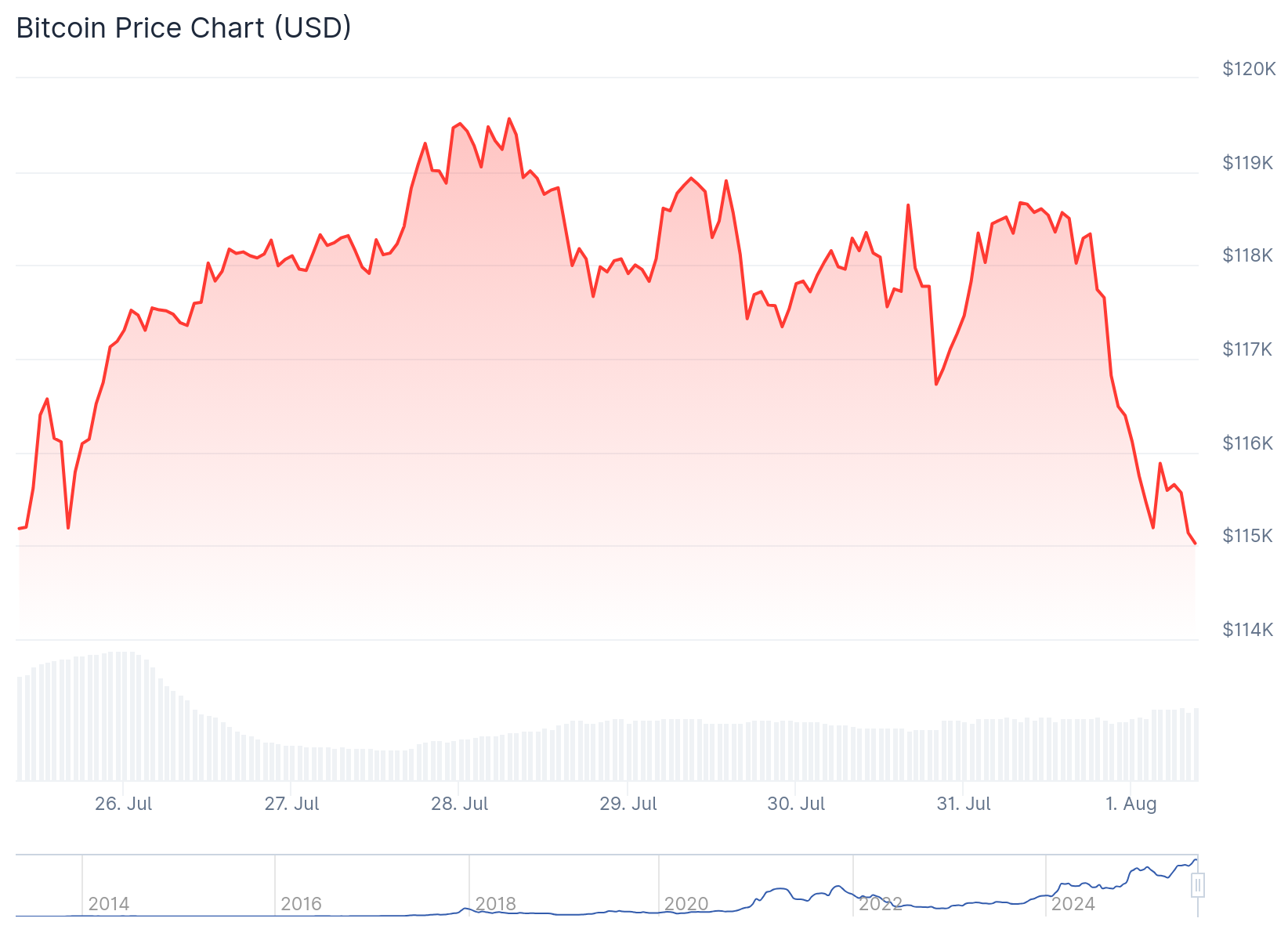

Bitcoin Maintains Market Dominance

Bitcoin remains the undisputed market leader with a market capitalization approaching $2.2 trillion. The digital asset functions as “digital gold” for institutional portfolios, with ETF inflows serving as a primary catalyst for price appreciation.

Citi analysts point to growing ETF demand as the core driver behind Bitcoin’s current momentum. Exchange-traded fund activity has created consistent buying pressure, reducing available supply on exchanges.

Price targets from Cantor Fitzgerald analysts suggest Bitcoin could reach six-figure valuations. The projections are supported by increasing executive interest and favorable regulatory developments across multiple jurisdictions.

Bitcoin’s recent trading range of $114,700 to $118,283 reflects steady institutional accumulation. The price stability at these levels indicates strong support from long-term holders and institutional buyers.

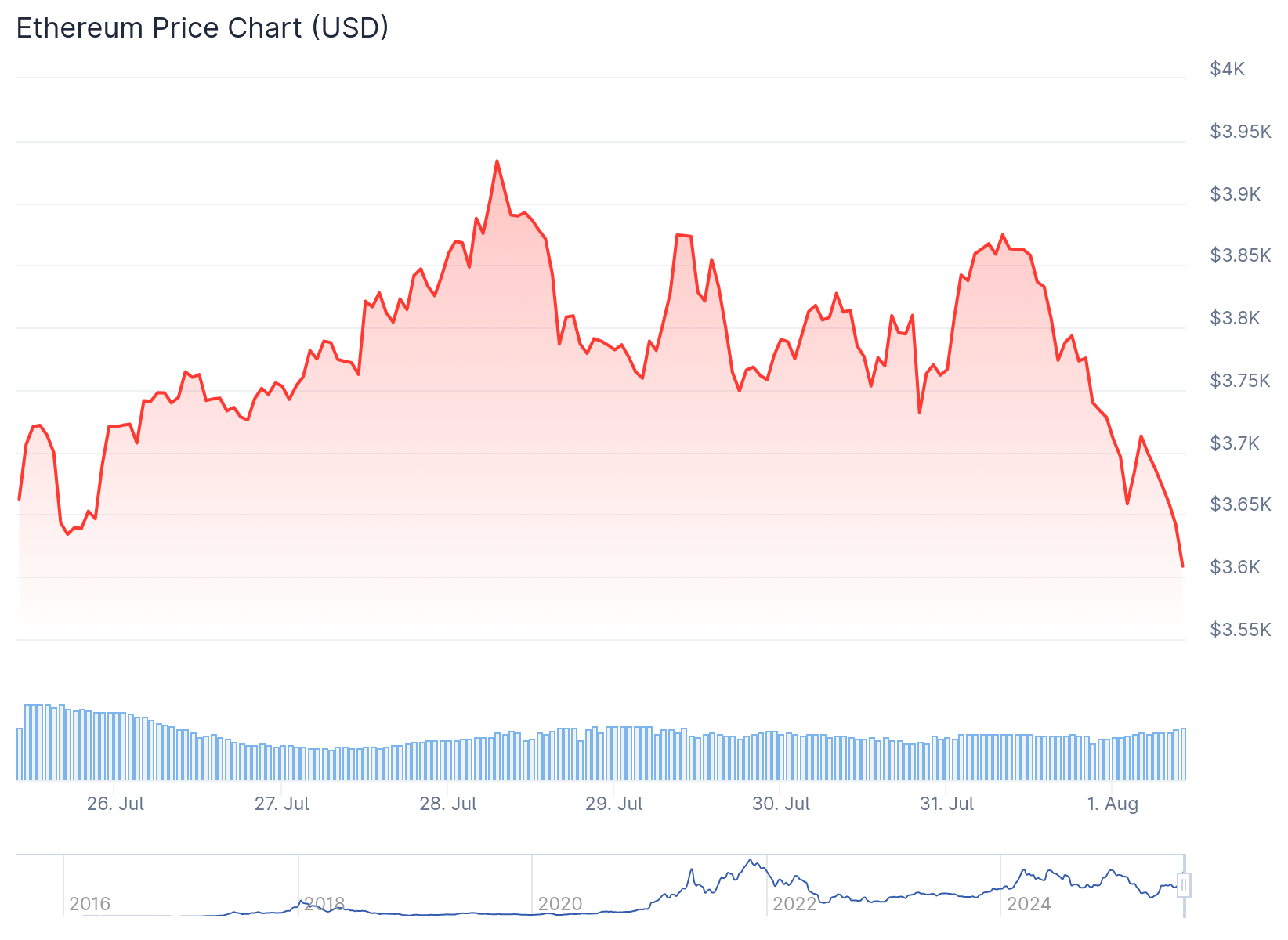

Ethereum Powers Smart Contract Ecosystem

Ethereum maintains its position as the leading smart contract platform powering decentralized finance, NFTs, and decentralized applications. The network continues attracting institutional adoption, strengthening its fundamental value proposition.

Market predictions suggest Ethereum could approach $7,000 by the fourth quarter of 2025. The forecast is based on continued ETF activity, network demand, and sustained investor inflows.

A recent whale purchase of $250 million in ETH following a market dip demonstrates institutional confidence in the token’s recovery potential. The large-scale acquisition occurred during a temporary price decline, suggesting strategic accumulation.

Ethereum’s current price range of $3,800 to $3,900 reflects growing Layer-2 adoption and staking yields. The network’s transition to proof-of-stake continues providing additional income streams for holders.

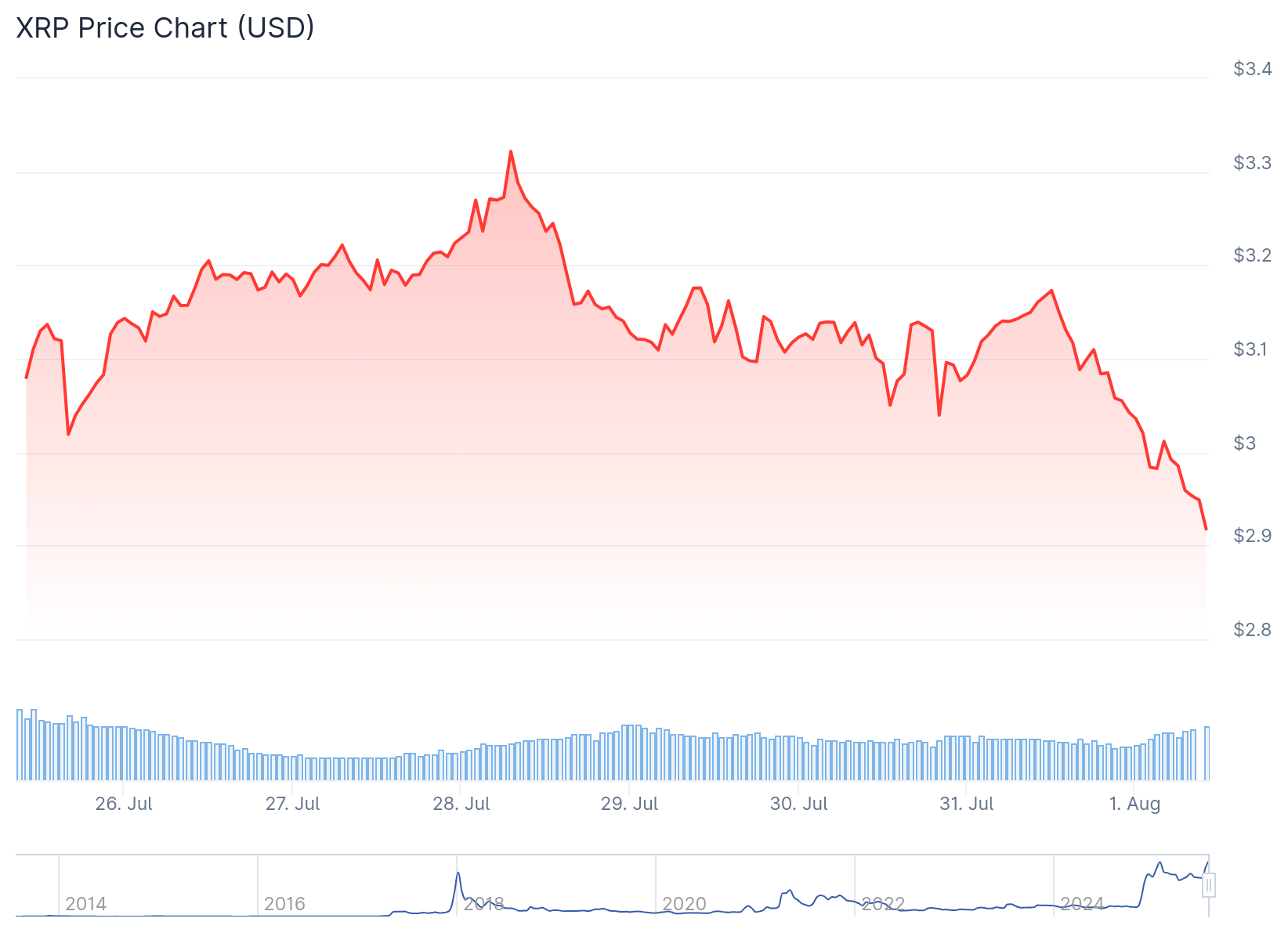

XRP Benefits from Strategic Reserve Status

XRP has gained momentum through its inclusion in the U.S. strategic crypto reserve announced in March 2025. The designation provides regulatory credibility and increased institutional demand for the cross-border payment token.

The token shows impressive performance with approximately 381% year-to-date gains. XRP’s recent trading range of $3.20 to $3.47 reflects renewed investor confidence following resolved regulatory pressure.

Multiple institutional partnerships with banks including Santander and Bank of America enhance XRP’s real-world utility for cross-border transactions. These partnerships provide practical use cases beyond speculative trading.

The regulatory clarity surrounding XRP has made it attractive to risk-aware investors seeking exposure to digital assets with defined legal status. This clarity contrasts with the uncertain regulatory environment facing many other cryptocurrencies.

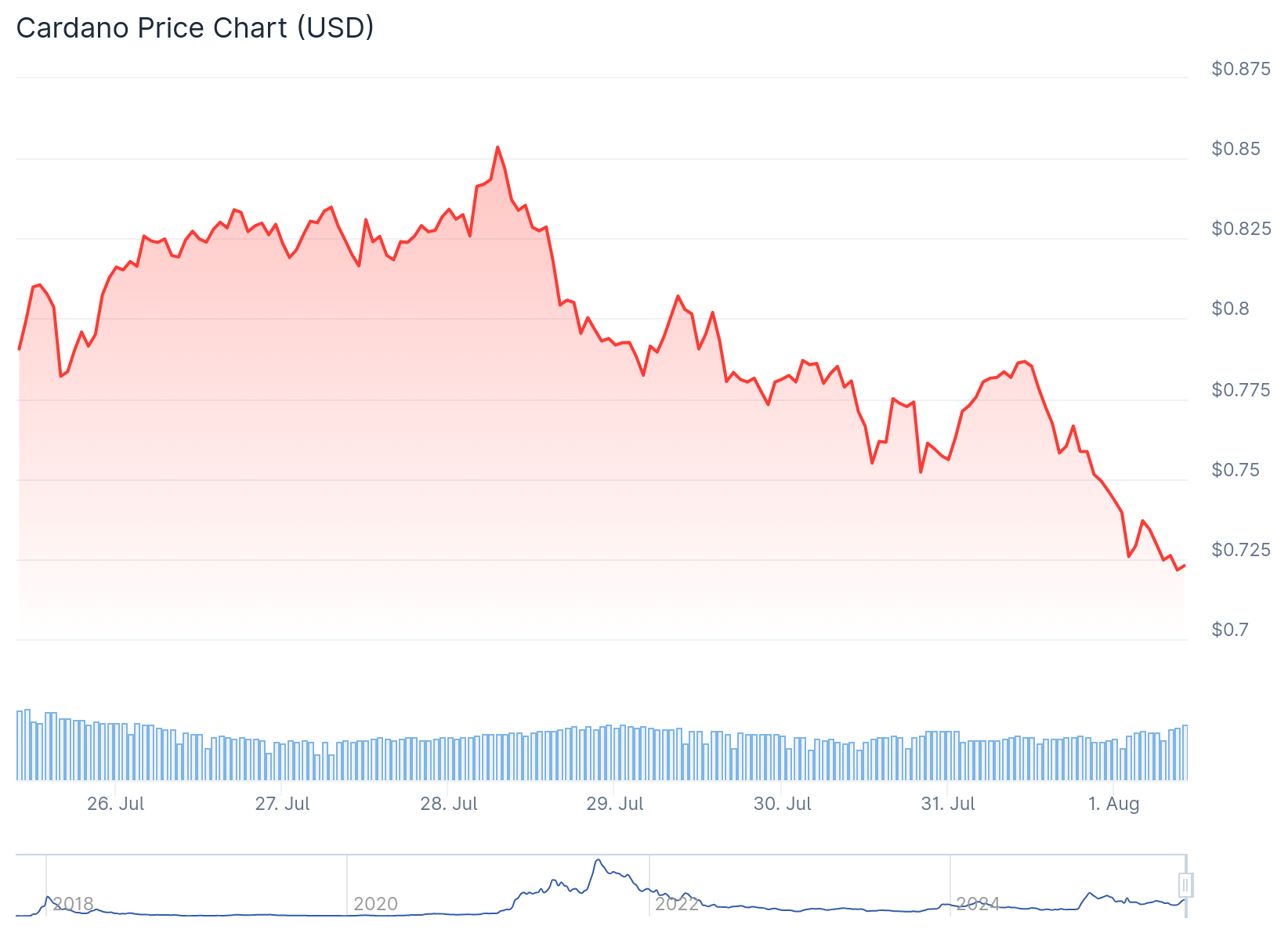

Cardano Shows Strong Development Activity

Cardano benefits from strong fundamentals and growing developer activity, with upcoming privacy sidechain development supporting bullish price targets toward $3 per token. The network’s technical roadmap continues attracting developer interest.

The network’s inclusion in the U.S. strategic reserve list provides additional regulatory validation. This government recognition enhances Cardano’s credibility among institutional investors seeking compliant digital assets.

Cardano’s proof-of-stake consensus mechanism offers energy efficiency advantages over traditional proof-of-work systems. The environmental benefits align with growing corporate sustainability requirements for digital asset investments.

The development team continues working on scalability improvements and smart contract functionality. These technical advances position Cardano for increased adoption in decentralized finance applications.

Solana Maintains Ecosystem Growth

Solana continues demonstrating strong developer and institutional interest due to its high throughput and low transaction costs. Trading around $182, Solana maintains its position as one of the fastest-growing blockchains in active users and projects.

The network’s ability to process thousands of transactions per second at minimal cost makes it attractive for high-frequency applications. This technical capability supports growing decentralized finance and NFT ecosystems on the platform.

Solana has weathered market volatility better than most altcoins during recent market corrections. The relative stability demonstrates investor confidence in the network’s long-term prospects despite broader market uncertainty.

Developer activity on Solana continues expanding with new projects launching regularly across gaming, DeFi, and social media applications. This ecosystem growth provides fundamental support for the token’s valuation beyond speculative trading.

The cryptocurrency market in August 2025 shows Bitcoin and Ethereum leading through institutional ETF adoption while XRP and Cardano benefit from regulatory recognition and Solana maintains strong technical fundamentals.

Final Thoughts

The top cryptocurrencies to buy in August 2025 are being defined by institutional flows, regulatory backing, and real-world utility. Bitcoin, Ethereum, XRP, Cardano, and Solana each offer a compelling case for long-term growth in this evolving market.