- 1. Coinbase: A Top Global Exchange, Available in Europe

- 2 - Gemini: NYC-Based, Safe Crypto Exchange for Europeans

- 3. Kraken: User-Friendly & Powerful Crypto Exchange

- 4. Bitpanda: Suitable For Buying Several Crypto Assets

- 5. FTX: Best For Diversifying Your Portfolio

- Other Crypto Exchanges in Europe to Consider

- Final Thoughts: What Crypto Exchange Suits You Best?

The FinTech regulatory landscape in the European Union is subject to constant changes, and Europeans might have a difficult time buying cryptocurrencies in their respective countries.

Today, we’ll be looking at the top 6 of the best exchanges currently available in Europe, and whether they may be right for you.

1. Coinbase: A Top Global Exchange, Available in Europe

Coinbase is a leading cryptocurrency exchange co-founded by Brain Armstrong in 2012. It’s the most popular exchange in the United States, and also allows users from the UK, Italy, Ireland, and several other European countries to buy, sell and trade cryptocurrencies, including various DeFi tokens and stablecoins.

Coinbase currently supports more than 100 tradable cryptocurrencies and its interface is user-friendly. For more professional and institutional traders, the exchange offers Coinbase Pro, which has a more advanced charting interface and all the necessary tools and resources for high-level trading.

If you want to use Coinbase on the go, the exchange also has a mobile version for iOS and Android devices where you can easily manage your portfolio and buy and sell digital assets.

Additionally, Coinbase offers a hot storage wallet: Coinbase Wallet, where besides storing your crypto funds, you can also save your NFT (Non-Fungible Token) assets and explore a broad selection of decentralized applications (dApps).

Pro tip: use Coinbase Pro for lower fees. It’s the same functionality, just a different interface with a wider array of assets.

Pros & Con of Coinbase:

Pros:

- User-friendly

- Secure platform with 2FA verification

- Advanced charting and trading tools for professional traders

- High liquidity

- Has a mobile app

Cons:

- Fees are usually high compared to competitors

- Poor customer support

CoinCentral readers can earn a sign-up reward upon creating a new Coinbase account.

2 – Gemini: NYC-Based, Safe Crypto Exchange for Europeans

Gemini is always a popular mention when it comes to security. The exchange was founded in 2014 by Cameron and Tyler Winklevoss, the popular twins who shared classes at Harvard with Mark Zuckerberg. Gemini currently supports a broad selection of 100+ cryptocurrencies, including DeFi, NFT, and gaming tokens.

Beginners might find Gemini’s interface is user-friendly, with simple buy and sell options. It also has a support page with answers to common questions and customer support is relatively decent. Professional traders might want to switch to Gemini’s ActiveTrader platform, which has a more advanced charting platform and features multiple order options and margin and derivatives trading.

One of the primary focuses of Gemini is user security, allowing users to enable 2FA, pin codes, and Face ID for iOS and Android users. Additionally, Gemini offers two wallets: one is a hot storage wallet for individual accounts and a cold storage wallet for institutional accounts.

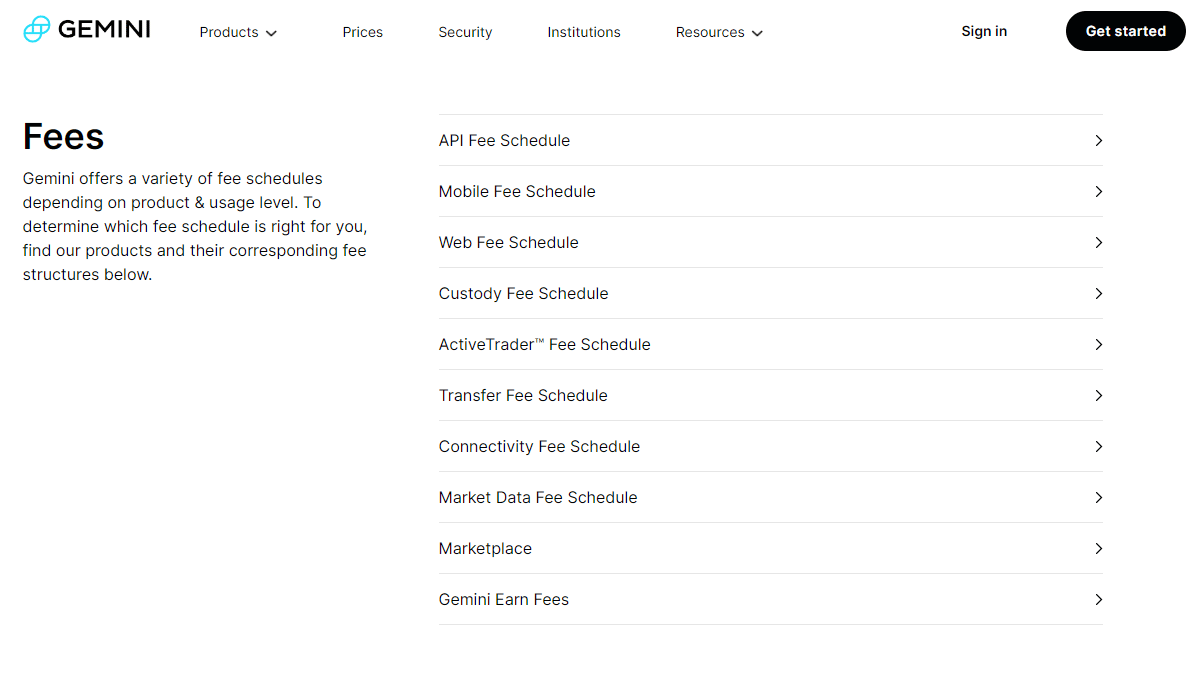

Gemini has expensive fees, however, and you should also note that Gemini’s fee structure is rather complicated compared to competitors. If you check out Gemini’s Fee Schedule page, you’ll find 10 different sections talking about the different fees for each product or service on the exchange, which looks something like this:

Pros & Cons of Gemini

Pros:

- Offers trading education for beginners and a help section

- Allows staking and lending

- User-friendly

- Highly secure

- Supports several crypto-related products

Cons:

- Complicated fee structure

- Expensive fees

CoinCentral readers can earn a sign-up reward upon creating a new Gemini account.

3. Kraken: User-Friendly & Powerful Crypto Exchange

Kraken is a widely trusted cryptocurrency exchange, suitable for both beginners and advanced traders. While it boasts a user-friendly interface, it also provides a powerful charting platform and trading tools to take your trading to the next level. Compared to Coinbase, Kraken has a slightly bigger margin of supported cryptocurrencies —over 120, including DeFi tokens and stablecoins.

Like its peers, Kraken also has a mobile version available for iOS and Android devices and Kraken Pro, which is a more advanced platform for trading a variety of instruments, including margin trading and derivatives, such as futures and perpetual contracts. It also has lower fees compared to the regular platform.

Kraken also offers a built-in digital wallet so users can store their funds. As a fun fact: the exchange prompts its customers to store their funds off exchanges and keep them in cold storage for better security.

Pros and Cons of Kraken

Pros:

- Supports an extensive selection of cryptocurrencies

- Highly secured platform

- Has a mobile app

- Relative low fees

- User-friendly

Cons:

- No credit/debit card deposits

- Customer support is rather slow

- Slow verification process

4. Bitpanda: Suitable For Buying Several Crypto Assets

BitPanda, an Austria-based broker, was one of the first Bitcoin exchanges to be established in Europe in 2014. The exchange now boasts a massive list of over 1000 cryptocurrencies, so if you’re looking for a diversified library of digital assets, Bitpanda is a good option.

As of February 2022, BitPanda has been the host for more than 3 million active users on its platform, which is easy to navigate, and the trading interface is suitable for beginners. Of course, for professional traders, there’s Bitpanda Pro which, as you might have guessed by now, features a more advanced charting platform where you can place multiple order options and trade traditional and crypto derivatives.

The exchange also offers BitPanda Go —a service that allows users to buy crypto directly with cash. It’s quite ideal if you’re an Austrian customer, as you can buy coupon codes using cash at a local post office and then redeem them for crypto. However, keep in mind BitPanda Go fees, currently at 3%

Like its competitors, BitPanda features a mobile version for iOS and Android users, which is available for download on the exchange’s website. There you can easily buy, sell, hold and trade cryptocurrencies seamlessly.

Pros & Cons of BitPanda

Pros:

- Secured, trusted platform

- Wide range of tradable cryptocurrencies

- Mobile version available

Cons:

- High fees compared to other exchanges

- Additional costs for deposits

- Doesn’t support staking or lending

5. FTX: Best For Diversifying Your Portfolio

Founded by Sam Bankman-Fried, CEO and also the founder of Alameda Research, FTX is one of the biggest centralized exchanges by trading volume. FTX offers a wide range of financial instruments for all of its customers, from simply buying and selling stocks or digital assets to trading derivatives products, forex, commodities and more.

There are over 300 cryptocurrencies available on FTX, including high-market cap assets like Bitcoin, Ethereum and DeFi, gaming, NFT tokens and stablecoins. The exchange also has its own NFT marketplace and NFT wallet.

Trading fees on FTX are relatively low, but you should expect deposits/withdrawal fees as well. One downside of the exchange is that its customer support is quite limited —you can only contact support via tickets, while phone support and live chat are not available.

Pros & Cons of FTX

Pros:

- Extensive selection of financial instruments

- Wide range of cryptocurrencies supported

- Secured and trusted platform

- Supports staking, NFTs, and leverage trading

- Fees are relatively low

Cons:

- Limited customer support

- Not user-friendly

Other Crypto Exchanges in Europe to Consider

You may be thinking, what about Binance?

Binance is one of the leading cryptocurrency exchanges by trading volume in 2022. However, it has had a rough time offering its services in Europe due to the regulatory landscape, which is quite a disaster by now. The good news is that Binance is stepping up its plans to enter the European scene, as it recently received approval from the Organismo degli Agenti e dei Mediatori (OAM) to open an office in Italy and expand its services across the country.

Another country that recently gave the green light to Binance is France, which granted full permission to the exchange to offer its services within the country. The crypto community has seen these last two news as a step forward in bringing digital assets into the European Union.

Final Thoughts: What Crypto Exchange Suits You Best?

There are a handful of crypto exchanges offering a wide array of products for European users. In the meanwhile, the European Union is yet to define a proper regulatory framework for the cryptocurrency industry.

Whether you want to make a passive income through staking, lend your crypto assets, or simply purchase and sell cryptocurrencies, it’s optimal to compare the available exchanges and decided which one suits best for you.

As a final note: remember you should only invest capital you can afford to lose. Cryptocurrencies are volatile and thus subject to massive price swings, so as the old saying goes, don’t put all your eggs in one basket.

Never Miss Another Opportunity! Get hand selected news & info from our Crypto Experts so you can make educated, informed decisions that directly affect your crypto profits. Subscribe to CoinCentral free newsletter now.