The crypto market is heating up, but one project is clearly stealing the spotlight. While Ethereum aims for a steady 2x climb, Mutuum Finance (MUTM) is capturing attention with its ambitious 15x potential. As investors scan the horizon for the next big mover, MUTM is quickly emerging as the standout contender in this fast-paced race.

Ethereum (ETH)

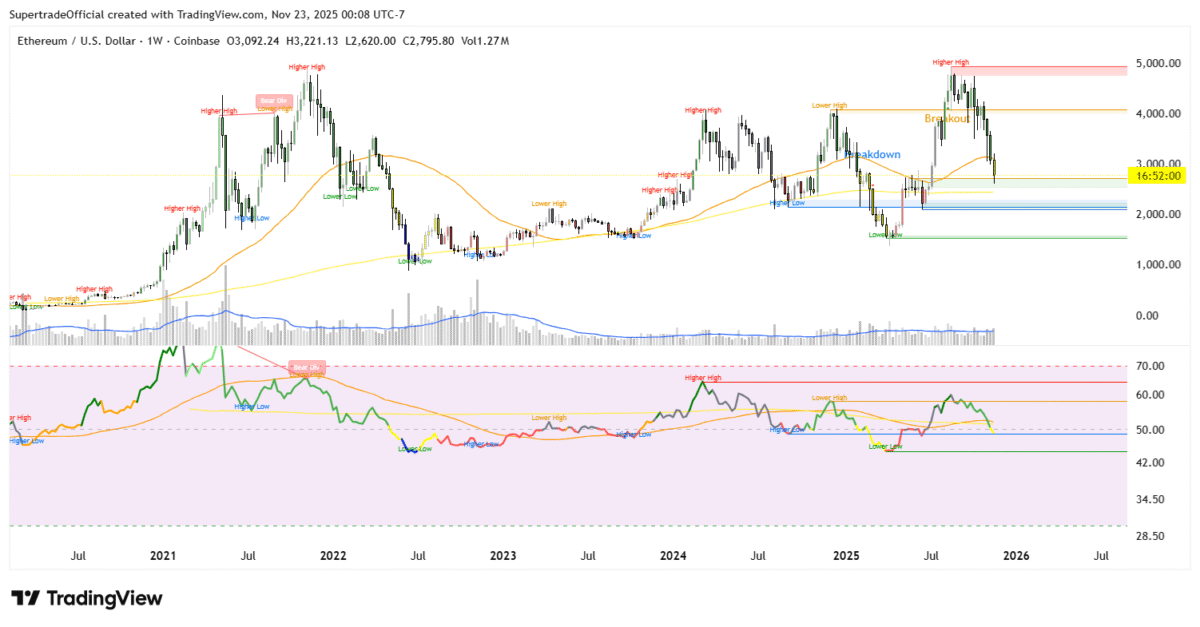

Ethereum’s outlook remains limited as several negative factors weigh on its growth potential. The past week saw $689 million in outflows, contributing to $3.2 billion withdrawn from crypto funds over three weeks, signaling declining institutional confidence. ETH has also dropped to a four-month low, down 19% in 2025, as investors shift away from risk assets. Sentiment weakened further after Aerodrome Finance reported a DNS hijacking attempt aimed at draining ETH, raising security concerns across the ecosystem. With fading inflows, stiff competition, and trust issues, Ethereum is unlikely to see explosive gains and may realistically achieve only a maximum 2X rise over the next 2–3 years.

Mutuum Finance (MUTM) Presale Momentum

Mutuum Finance (MUTM) is capturing attention at a price of $0.035 during presale Phase 6. Rapid adoption and high demand are driving interest as the presale has already raised about $19 million. With over 18,200 holders participating in all phases and 95% of the 170 million tokens in Phase 6 almost sold, investors now find urgency to join. Early buyers can secure short-term gains of 2 to 4X by launch and long-term returns up to 15X the current price. The next presale phase is projected to increase by 15% to $0.040, creating strong presale momentum making it one of the discounted windows to join the platform.

Mutuum Finance (MUTM) offers innovative dual lending models that will redefine how defi crypto lending works. The Peer-to-Contract (P2C) model will allow pooled assets including ETH and BTC in audited smart contracts. Borrowers will provide over-collateralized collateral, and depositors will earn variable interest rates based on pool utilization. An investor lending $15,000 will receive mtUSDT 1:1 and earn 15% APY, generating $2,250 in passive income annually. These mtTokens will be used as collateral for borrowing other assets, creating multiple layers of earning opportunities.

The Peer-to-Peer (P2P) lending model will serve riskier tokens like DOGE and SHIB. Participants will negotiate loan terms directly, allowing higher returns for those willing to take on more risk. This flexibility will give investors control over strategy while maximizing returns.

Community incentives now play a major role in Mutuum Finance (MUTM) adoption. The platform runs an ongoing $100,000 giveaway with 10 winners receiving $10,000 each in MUTM. The top 50 leaderboard provides bonus incentives, and the first-rank user will earn $500 daily, resetting every 24 hours. A dashboard will let participants track their holdings, ROI, and leaderboard position. These features will strengthen engagement and encourage more users to join the platform.

Road to 15X, The Key Demand Drivers

Mutuum Finance (MUTM) announced through its official X page that the V1 build of its protocol is expected to go live on the Sepolia Testnet in Q4 2025. This early deployment will activate the project’s foundational elements, including the liquidity pool, the mtToken and debt token models, and an automated liquidator bot designed to guard user positions and keep the system functioning efficiently. In this phase, users will be able to lend, borrow, and use ETH or USDT as collateral.

Releasing V1 on the testnet gives the community hands-on access before the mainnet launch. This phased rollout improves transparency, brings users into the development process, and helps the team gather real feedback to refine the protocol. As more testers interact with the features and the ecosystem gains visibility, interest in Mutuum Finance may continue to grow, supporting long-term confidence in the MUTM token.

Secondly Mutuum Finance (MUTM) will also introduce real utility through over-collateralized stablecoins pegged to $1. These stablecoins will be minted using approved collateral like ETH, SOL, and AVAX. Every minting and repayment transaction will generate demand for the token, increasing its real-world use. As lending, borrowing, and staking functions expand, MUTM’s utility will continue to grow organically. Each new feature will create transactional activity and build long-term value.

Stable Interest Rate, Collateral, Liquidation and Market Volatility

The platform will maintain a stable interest rate model for predictable earnings. When users borrow, the initial rate will lock based on the weighted average of the variable rate. Higher starting rates will compensate for the reduced risk of future rate hikes. Rebalancing mechanisms will adjust rates if variable rates rise above the stable rate by a predefined margin. Volatile or low-liquidity tokens will be excluded to maintain system stability and protect investors’ funds.

Collateral and liquidation mechanisms will safeguard all participants. Loans will be over-collateralized, and the stability factor will measure collateral adequacy. If collateral falls below a threshold, liquidators will repurchase debt at a discount, protecting liquidity and preventing systemic risks. These measures will create a safe environment for both lenders and borrowers, even during periods of market volatility.

Market volatility and liquidity management will also protect users. Loan-to-value ratios and liquidation thresholds will adjust depending on asset volatility. Low-volatility assets such as stablecoins and ETH will allow up to 95% LTV with 95% liquidation thresholds. Riskier assets will have lower LTVs to maintain platform safety. Reserve factors of 10–55% will ensure sufficient liquidity for smooth liquidation processes and minimize slippage during market fluctuations.

Final Words

Phase 6 is nearly sold out, with 95% of allocated tokens already claimed. The projected 15% increase in the next phase to $0.040 adds urgency for investors. With dual lending models, real utility, stablecoin-backed structure, and community incentives, MUTM will create strong demand and attractive returns. Compared to ETH’s expected 2X growth, Mutuum Finance (MUTM) will stand out as a unique investment offering 15X potential gains. Immediate participation in the presale will secure early advantages and maximize profits as adoption continues to grow.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance