Bitcoin Layer-2s have trailed Ethereum’s for years, and there’s a pretty clear reason. Bitcoin is built like a fortress – ultra-secure, intentionally rigid. Without smart contracts on the Layer-2, devs can’t verify complex logic on-chain, so they’ve defaulted to sidechains that feel more like workarounds.

Tight block space is another issue, and the culture is conservative by design. Many “Bitcoin Layer-2s” end up centralized enough to make purists concerned – that goes against the whole ethos of crypto.

But momentum is creeping back into the space. Bitcoin Hyper (HYPER) is a Layer-2 solution getting lots of attention, raising $13.5 million already as it gears up for a big end to 2025. Could HYPER be the next crypto to explode?

How Does Bitcoin Hyper Plan to Supercharge Bitcoin?

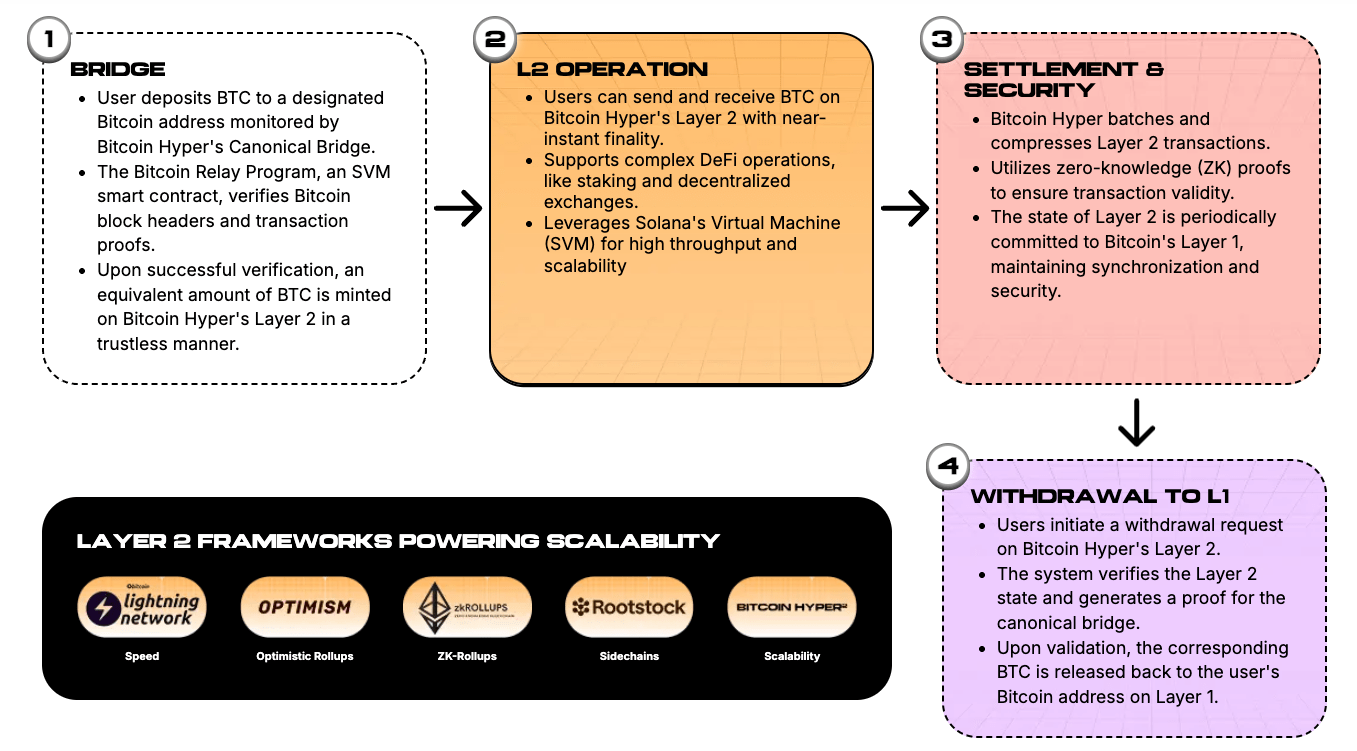

Bitcoin Hyper aims to be a “true” Bitcoin Layer-2 that brings speed and programmability without abandoning Bitcoin’s security. Under the hood, it runs an SVM-style execution layer, so transactions can be processed in parallel and confirmed in seconds rather than waiting on 10-minute blocks.

You bridge your BTC to a canonical address, receive a 1:1 wrapped version on Bitcoin Hyper, and use it for payments, DeFi, games, meme coins, and dApps. Then, you withdraw your BTC back to the mainnet when you’re done.

This setup means activity zips along on Bitcoin Hyper’s Layer-2, while final settlement gets batched and anchored to Bitcoin. That’s the rollup-style pitch – bundle transactions, post proofs, and inherit BTC’s security.

In practice, it means things you expect on Ethereum or Solana – DEX swaps, lending, micro-tipping, and on-chain games – are suddenly doable with BTC as the primary asset. That’s what makes Bitcoin Hyper stand out right now, especially for traders who want speed without letting go of Bitcoin’s base-layer assurances.

What Does HYPER Do and Why Is the Presale Going Viral?

HYPER is the network’s utility and governance token. It’s the gas for transactions and smart contract calls, it’s stakable for rewards, and it’s slated to carry voting rights as the network decentralizes. In other words, if apps and volume grow, token demand should mirror that growth because every on-chain action requires HYPER.

Most of the buzz today is around the HYPER presale. Since launching in May, Bitcoin Hyper’s team has raised more than $13.5 million, with inflows reportedly near $1 million per week. Right now, HYPER tokens can be bought for just $0.012845 each.

Presale contributions are accepted in ETH, USDT, BNB, SOL, USDC, and even fiat, plus a “buy and stake” option offers high APYs before HYPER even goes live on exchanges. YouTuber Crypto Tech Gaming has already highlighted this staking setup, believing it could create a supply squeeze after listing.

Crucially, none of this comes at the expense of security. Bitcoin Hyper’s code has been audited by Coinsult and SpyWolf – both of whom gave the project a clean bill of health.

Could Bitcoin Hyper Be the Next Crypto to Explode?

Could Bitcoin Hyper explode this year? The upside case starts with simple math. At its current presale price, HYPER’s fully diluted valuation sits near $269 million. For a Bitcoin-aligned Layer-2, that’s a low starting point, and provides lots of runway for upside.

Early Ethereum Layer-2s grew from similar valuations as liquidity, TVL, and apps stacked over time. As an example, Optimism’s native OP token now boasts a market cap of over $1.2 billion.

Macro tailwinds help. Ethereum Layer-2s hit record TVL above $51 billion after the Dencun upgrade went live. Plus, mature rollups keep improving throughput and tooling, and there’s also a growing appetite for low-latency infrastructure that powers AI agents.

Meanwhile, Bitcoin’s Layer-2 space is heating up as devs chase “BTCFi” and broader programmability that the OG blockchain simply can’t provide at scale. But could Bitcoin Hyper capitalize on that trend?

It could – if the tech lands successfully, developers show up, and liquidity follows the narrative. That’s the bet that presale investors are making right now, and if they’re right, HYPER might not stay at this low price for long.

Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.