TLDR

- Tron’s daily active addresses reached a record 5.7 million on Tuesday, with the network processing 12.6 million transactions, the highest daily count in two years.

- Active Tron addresses increased 69% week-over-week to 11.1 million, marking the largest weekly change among major blockchains.

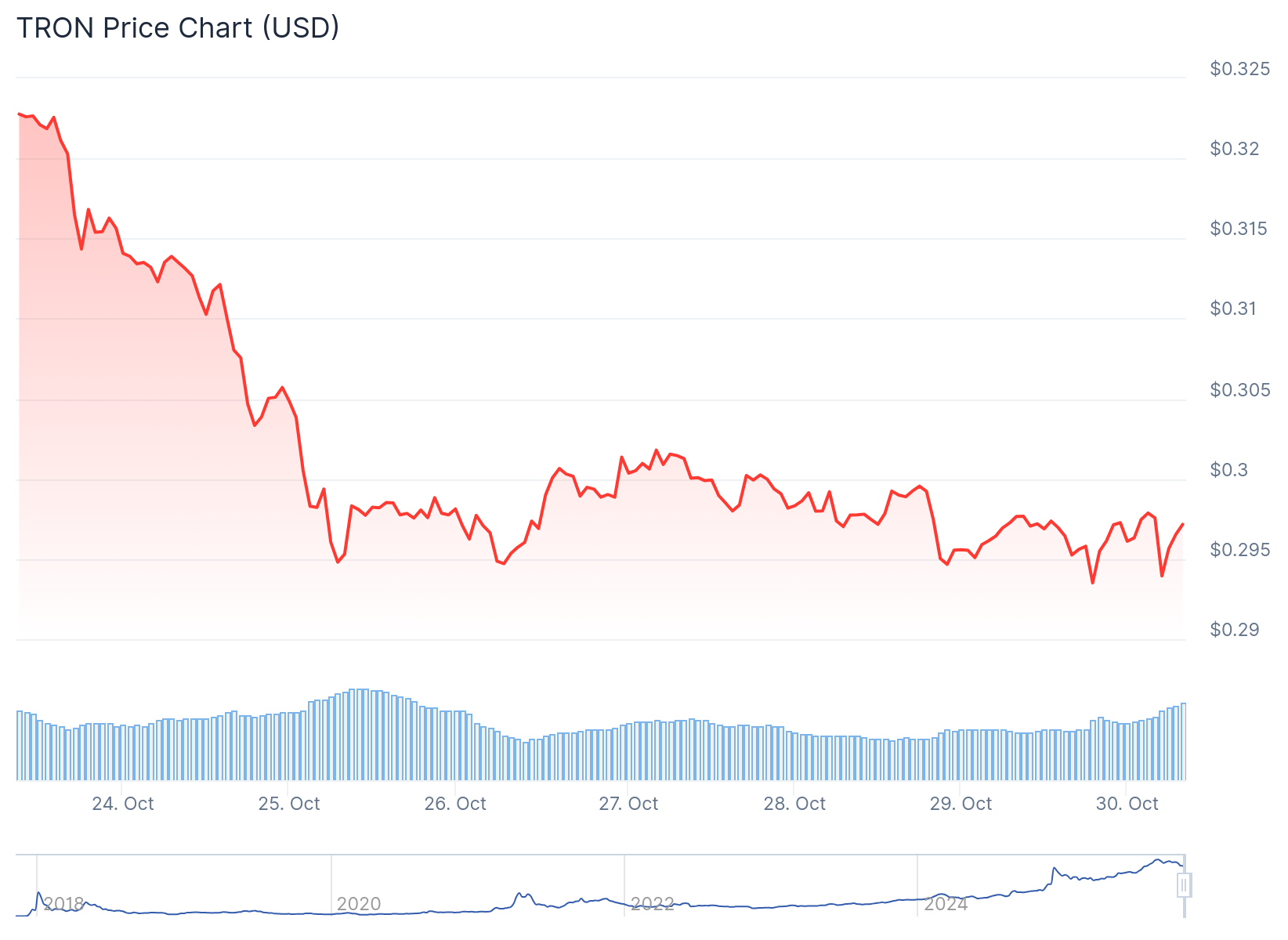

- TRX is currently trading at $0.2966, down 0.69% in 24 hours and 7.28% over the past week, while trading below its 200-day moving average.

- Tron facilitates 15-20 million USDT stablecoin transfers weekly, with $78.7 billion in USDT circulating on the network, second only to Ethereum.

- Technical indicators show RSI near oversold at 36.93 and negative MACD readings, while open interest declined 1.32% to $327.48 million.

Tron’s network activity reached new heights this week as daily active addresses hit a record 5.7 million on Tuesday. The previous record of 5.4 million was set just one day earlier, according to TRONSCAN data.

The network processed more than 12.6 million transactions on Tuesday. This marks the highest daily transaction count since June 12, 2023.

.@trondao just clocked 12.6M transactions in a day.

No headlines. No hype. Just raw throughput.

That’s top-tier activity with zero fanfare. pic.twitter.com/J0rqFZN8Vu

— Nansen 🧭 (@nansen_ai) October 29, 2025

Blockchain analytics platform Nansen called the activity “top-tier” with “zero fanfare” in a Wednesday post. The firm noted the raw throughput was happening without major headlines or market hype.

Data from Nansen shows daily active Tron addresses jumped 69% over the past week to nearly 11.1 million. This represents the largest week-over-week change among major blockchains.

The price action tells a different story. TRX is currently trading at $0.2966, down 0.69% in the last 24 hours. The token has fallen 7.28% over the past week.

Trading volume increased 18.8% to $812.36 million despite the price decline. This suggests traders remain active even as the price faces downward pressure.

USDT Transfers Drive Network Growth

Tron facilitates between 15 and 20 million Tether USDT stablecoin transfers each week. This makes it one of the most common token and chain payment combinations in crypto.

The network is widely used in Africa, Asia, and South America. Users in these regions benefit from high-speed, low-cost US dollar-pegged token transfers where access to real US dollars is often limited.

Tether reached 500 million USDT users on October 21. CEO Paolo Ardoino called this “likely the biggest financial inclusion achievement in history.”

USDT remains the largest stablecoin with a market cap of $183.2 billion and a 58.8% market share, according to CoinGecko. Ethereum hosts the most USDT at $83.4 billion, while Tron comes in second with $78.7 billion, per DefiLlama data.

Technical Indicators Point to Continued Weakness

Analyst Umair Crypto noted that TRX has fallen below its previous wick low, a negative technical signal. The coin is trading below its 200-day Simple Moving Average, showing continued bearish control.

$TRX

Unlike most other major coins, TRX didn’t drop as much during the crash, but unlike them, it has now fallen below its previous wick low, which isn’t a good sign at all.The chart currently sits below the 200D SMA, showing weakness, though there’s a small bullish divergence… pic.twitter.com/1zu8U3l0Nh

— Umair Crypto (@Umairorkz) October 29, 2025

A minor bullish divergence has emerged, suggesting possible short-term relief. However, any rebound needs confirmation with a daily close above $0.2983.

The Relative Strength Index sits at 36.93, approaching oversold territory with a lower bound at 32.15. This indicates sellers maintain control, though downward momentum may be slowing.

The Moving Average Converging Divergence indicator remains bearish. The MACD line is at -0.0077 and the signal line at -0.0017, keeping the histogram negative.

Open interest dropped 1.32% to $327.48 million, showing reduced speculation in the derivatives market. Trading volume rose 4.51% to $229.55 million, indicating active but defensive trading behavior.

The Tron OI-weighted funding rate is -0.0014, reflecting a short bias among derivatives traders.