TLDR

- TSMC’s record Q3 fueled by surging AI and HPC chip demand.

- Earnings soar 39% as TSMC boosts its 2025 growth forecast.

- AI boom drives TSMC’s record margins and strong revenue mix.

- TSMC raises capex, bets big on future chip demand surge.

- Global expansion fortifies TSMC’s lead in advanced nodes.

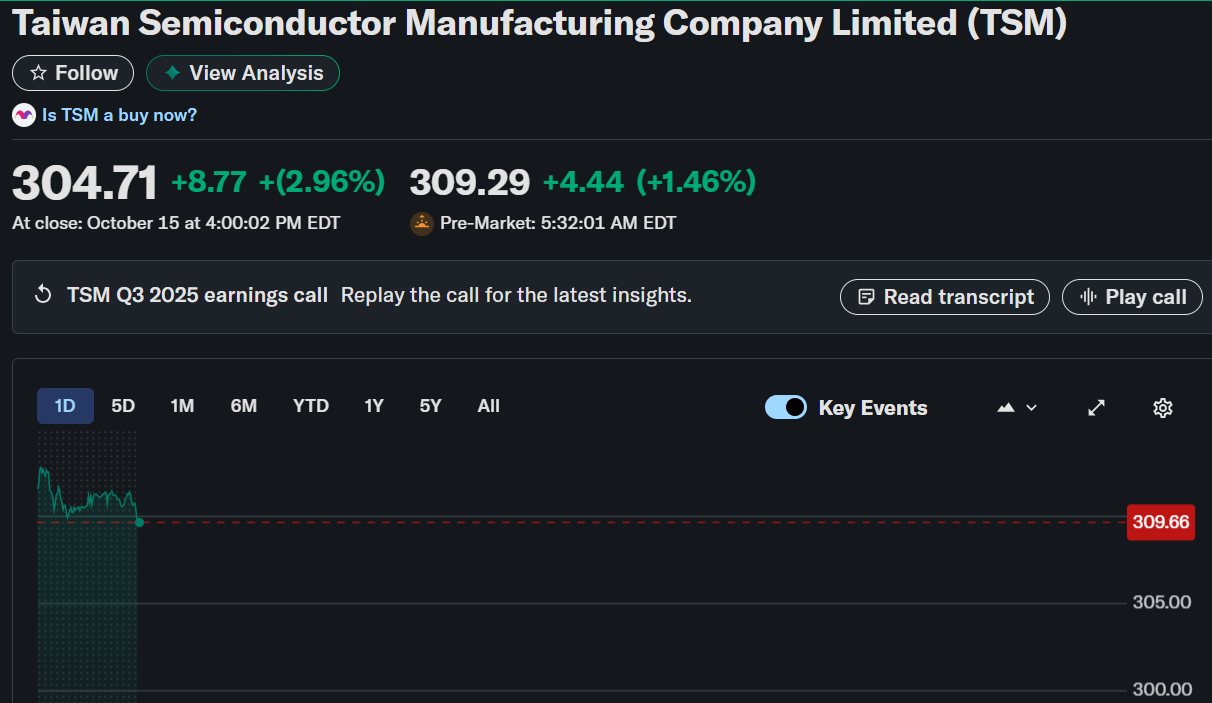

TMSC(TMC) stock advanced after the firm posted record quarterly earnings supported by strong chip demand. The company’s shares closed at $304.71, marking a 2.96% rise, and gained 1.46% in pre-market trading.

The consistent rise underscored continued confidence in the company’s leadership in advanced semiconductor production.

TSMC reported consolidated revenue of NT$989.92 billion for the third quarter ended September 30, 2025, reflecting a 30.3% year-over-year increase. Net income climbed 39.1% to NT$452.30 billion, with diluted earnings per share reaching NT$17.44, or US$2.92 per ADR. Revenue in U.S. dollars totaled $33.10 billion, up 40.8% from a year earlier and 10.1% from the previous quarter.

The company achieved a gross margin of 59.5%, an operating margin of 50.6%, and a net profit margin of 45.7%. Its revenue mix showed that 3-nanometer chips contributed 23%, while 5-nanometer accounted for 37%. Advanced technologies, defined as 7-nanometer and smaller, represented 74% of total wafer revenue.

AI-Driven Demand Strengthens Growth Outlook

TSMC attributed the surge in profitability to robust demand for high-performance computing and artificial intelligence chips. The high-performance computing segment, which includes AI and 5G applications, contributed 57% of total quarterly revenue. This performance emphasized the company’s strong position in next-generation chip fabrication.

The company has raised its full-year 2025 revenue growth forecast to the mid-30% range, surpassing its earlier projection of 30%. Management also lifted its annual capital expenditure floor to $40 billion from $38 billion, reflecting confidence in sustained demand. The expansion aims to enhance capacity and maintain the company’s competitive advantage in leading-edge process technology.

TSMC projects fourth-quarter 2025 revenue between $32.2 billion and $33.4 billion, supported by continued demand for advanced nodes. It expects a gross margin between 59% and 61% and an operating margin between 49% and 51%. These projections highlight the firm’s operational efficiency and pricing discipline amid global chip competition.

Global Expansion and Market Resilience

TSMC’s global expansion strategy continues to strengthen its market resilience and mitigate regional policy risks. The company is investing heavily in U.S. manufacturing facilities to reduce potential exposure to tariff-related uncertainties. This diversification supports long-term stability and aligns with international technology supply chain priorities.

Despite macroeconomic headwinds, TSMC’s 38% year-to-date stock gain reflects consistent performance and investor confidence in its growth trajectory. Its dominance in advanced chip manufacturing remains a key driver of profitability and market leadership. Moreover, the rising demand for AI processors and premium smartphone platforms continues to reinforce its revenue momentum.

With strong earnings, strategic expansion and advanced process leadership, TSMC remains a cornerstone of global semiconductor innovation. The company’s record third-quarter results reaffirm its role as a critical enabler of the AI and high-performance computing revolution. Its consistent execution and forward outlook signal sustained strength heading into 2026.