TLDR

- Ubiquiti stock rockets 26% on record $2.6B revenue and $500M buyback plan

- Strong earnings and tax gains fuel Ubiquiti’s 26% stock surge to $492

- Ubiquiti wows Wall Street with record revenue, margins, and dividends

- $2.6B in sales and $500M buyback boost Ubiquiti stock to new heights

- Ubiquiti stuns with Q4 surge: tax wins, fat margins, big capital returns

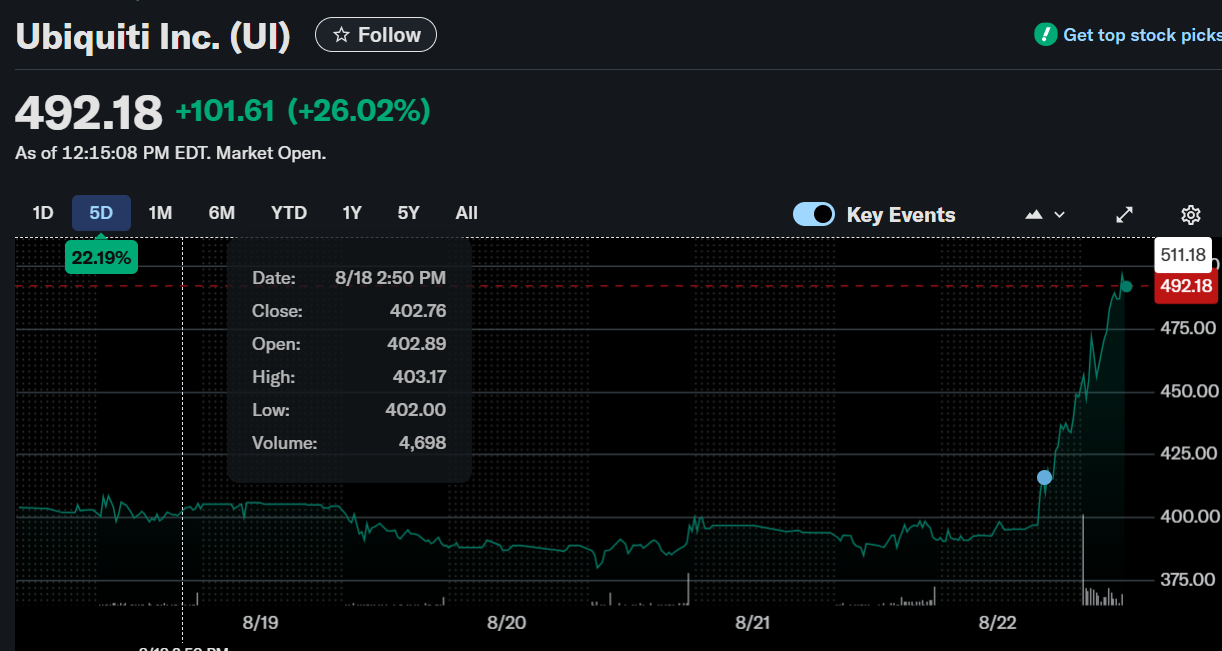

Ubiquiti(UI) shares jumped 26.02% to $492.18 as of 12:15 PM EDT, marking a sharp intraday surge.

The move followed strong earnings results and aggressive capital return plans. Ubiquiti posted record revenue, robust margins and a tax-related windfall, lifting confidence in its outlook.

Record $2.6 Billion in Revenue Drives Stock Surge

Ubiquiti reported $759.2 million in revenue for the fourth quarter, up 14.3% from the prior quarter. Full-year revenue for fiscal 2025 hit $2.6 billion, a 33.4% jump from fiscal 2024. The gains stemmed mainly from strong performance in the Enterprise Technology segment.

Gross margin improved to 45.1% in Q4, reflecting better product mix and reduced inventory charges. Full-year gross margin stood at 43.4%, up from 38.4% last year. The company offset higher tariffs with lower shipping and operating costs. GAAP net income for the quarter rose to $266.7 million, while non-GAAP net income reached $214.4 million. Ubiquiti’s earnings per share also surged, reaching $4.41 GAAP and $3.54 non-GAAP.

$500 Million Buyback and Dividend Lift Sentiment

Ubiquiti authorized a $500 million stock repurchase program to return value to shareholders. This move complemented a $0.80 per share dividend declared for September 8, 2025. The board signaled intentions to continue similar payouts in fiscal 2026.

Ubiquiti Inc., $UI, Q4-25. Results:

📊 Adj. EPS: $3.54 🟢

💰 Revenue: $759.2M 🟢

📈 Net Income: $266.7M

🔎 Record quarterly revenue driven by strong Enterprise Technology growth and favorable tax benefit. pic.twitter.com/IURyZBlJvU— EarningsTime (@Earnings_Time) August 22, 2025

The company aims to sustain quarterly dividends, although it will review conditions each period. The combination of buybacks and dividends signals confidence in long-term cash flow. Ubiquiti’s board continues to prioritize shareholder returns in its capital allocation.

These announcements followed a positive fourth-quarter earnings surprise. Investors reacted swiftly to the stronger outlook and capital return strategy. Ubiquiti’s stock price reflected the sharp upward momentum throughout the session.

Tax Windfall and Lower Expenses Support Profit Growth

Ubiquiti reported an $8.5 million tax benefit in Q4 linked to intangible asset transfers. The move unlocked a deferred tax asset worth $53.7 million under GAAP rules, significantly boosting quarterly net income figures.

Interest expense dropped to $3.2 million in Q4, helped by lower borrowings and interest rates. For fiscal 2025, interest and other costs fell to $30.6 million from $75.2 million. Foreign exchange gains in Q4 also improved year-over-year results.

Research and development spending rose to $47.5 million in Q4, up slightly from prior periods. Full-year R&D reached $169.7 million, driven by employee costs and software expenses. SG&A expenses also climbed, led by marketing and webstore-related fees.

Ubiquiti’s sharp focus on operational efficiency, improved margins, and strategic tax planning fueled this earnings surge. With strong fundamentals and an ambitious buyback plan, Ubiquiti delivered one of its strongest quarters in recent history.