TLDRs:

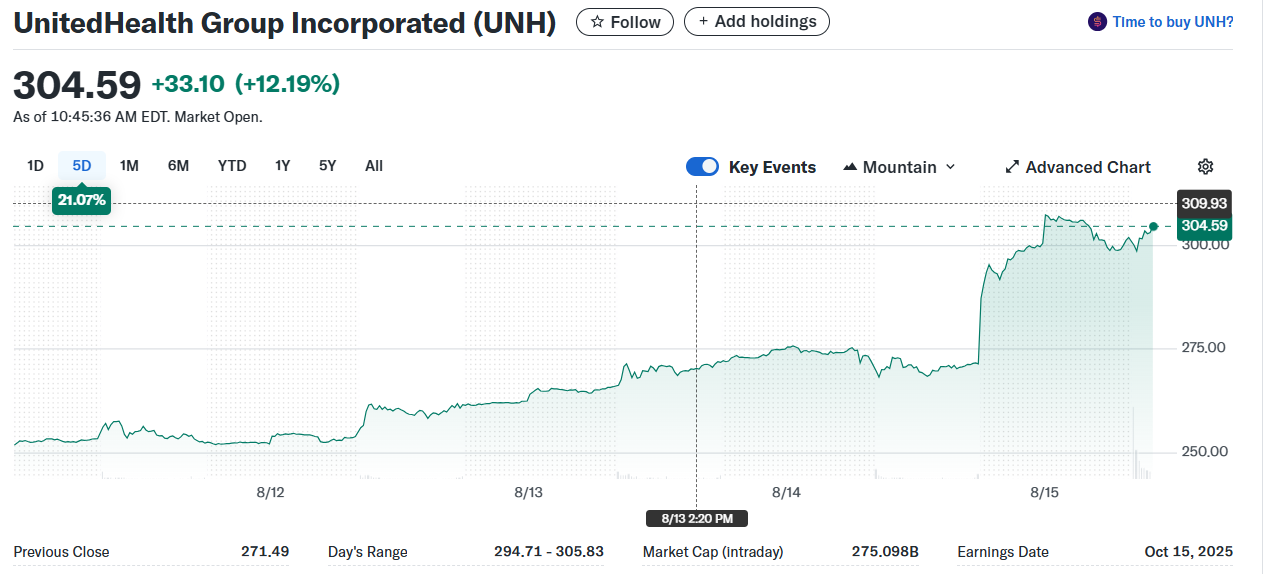

- UnitedHealth shares soared 12% Friday after Berkshire Hathaway disclosed a $1.6 billion investment.

- Buffett’s move marks a rare healthcare bet amid UnitedHealth’s recent challenges and market volatility.

- Berkshire reduced its Apple stake by 20 million shares, signaling portfolio diversification.

- Cash reserves hit $344.1 billion as Berkshire maintained a defensive stance for 11 consecutive quarters.

UnitedHealth Group’s stock surged 12% on Friday after Berkshire Hathaway revealed in an SEC filing that it had taken a new $1.6 billion stake in the U.S. healthcare giant.

The announcement sparked a wave of investor optimism, pushing shares sharply higher in one of the company’s best single-day performances this year.

The move comes as a surprise to many market watchers, given UnitedHealth’s recent struggles with rising medical costs, regulatory scrutiny, and fallout from a major cyberattack. Yet, for Warren Buffett’s conglomerate, this appears to be a textbook contrarian play, buying into a sector leader during a period of uncertainty.

Buying on the Dip

According to the filing, Berkshire purchased its UnitedHealth stake during the second quarter of 2025, when shares were trading at multi-year lows. The Omaha-based conglomerate, which operates nearly 200 businesses spanning insurance, railroads, energy, and retail, saw a clear long-term value opportunity.

UnitedHealth $UNH shares are up 12% after Berkshire Hathaway revealed a new stake in the health insurer.

Last quarter, Warren Buffett’s Berkshire bought over 5 million shares of UnitedHealth worth about $1.6 billion in June.

Berkshire also revealed that it added stakes in… pic.twitter.com/MLcem3rlxI

— Schwab Network (@SchwabNetwork) August 15, 2025

Buffett’s decision aligns with his well-known principle of being “greedy when others are fearful.” Despite the challenges, UnitedHealth remains the largest U.S. health insurer, processing more than $1.7 trillion in medical payments annually and maintaining a diversified customer base across commercial, Medicare, and Medicaid plans.

Market reaction was swift, the stock’s 12% rally added billions to UnitedHealth’s market capitalization and underscored how Buffett’s moves can influence sentiment.

Berkshire’s Bold Moves

The $1.6 billion investment in UnitedHealth came alongside significant portfolio adjustments. Berkshire trimmed its Apple holdings by 20 million shares, bringing the total down to 280 million.

It also initiated or expanded positions in DR Horton, Allegion, Lamar Advertising, Nucor, and Lennar, while reducing stakes in Bank of America and exiting its position in T-Mobile.

In total, Berkshire sold $3 billion more in stocks than it bought during the quarter, marking its 11th consecutive quarter as a net seller. This defensive positioning is reflected in its record $344.1 billion in cash and equivalents — a sum that gives it unmatched flexibility to make future acquisitions or investments when valuations align with Buffett’s criteria.

Market Confidence Returns

Industry analysts say the UnitedHealth move demonstrates Berkshire’s willingness to bet on long-term fundamentals over short-term turbulence.

“Buffett’s entry often signals a market bottom for the stock in question,” said one Wall Street healthcare analyst. “This is a validation of UnitedHealth’s ability to weather current headwinds and emerge stronger.”

UnitedHealth’s management has indicated that it is working to offset rising medical costs through premium adjustments and operational efficiencies. With Berkshire now in its corner, the company is likely to face renewed investor interest.

For now, the market is treating Berkshire’s stake as more than just a financial transaction. It’s a vote of confidence that, despite a cautious broader strategy, Buffett still sees select opportunities worth seizing.