Uphold has developed a unique exchange for trading both digital and physical assets since its official launch in 2015. It’s one of the few crypto exchanges that also supports commodity and forex trading. It’s also one of the first financial service companies to share its reserve holdings in real-time publicly.

Our Uphold review explores everything you need to know about the company’s history, the exchange’s utility, how to best use the exchange, a signup bonus, and more.

Uphold Exchange Key Information

| Project Type | Cryptocurrency Exchange |

| Beginner Friendly | Yes |

| Mobile App | Yes |

| Company Location | United States |

| Availability | 184+ countries, 30+ currencies |

| Company Launch | 2015 |

| Cryptocurrencies Supported | 250+ |

| Fees | Above Average |

| Community Trust | Great |

| Site | Visit Uphold |

About the Uphold Company: Diving into the Cryptocurrency Exchange’s History

Launched in 2014 under the name Bitreserve as a Bitcoin trading platform, Uphold has established its reputation as a scandal-free functional exchange through multiple bull and bear cycles. It shares this standing with exchanges like Kraken (founded 2011), Coinbase (founded 2012), and Gemini (founded 2015).

However, Uphold is a relatively lesser-known exchange compared to its graduating class, which strikes us as strange given the resume of its founder, Halsey Minor.

Halsey Minor is best known for also founding CNET, an early blog covering computers and software largely considered a pioneer in profitable blogging. Between 1995 and 2000, CNET was one of the top fifteen largest websites in the world based on traffic and generated billions of dollars in revenue. Minor is also credited with foundering or co-founder companies such as Salesforce, Google Voice, OpenDNS, E! Online, NBCi, and Vignette.

In addition to Uphold, Minor launched cryptocurrency companies like Live Planet and Vivid Labs, both of which involve tokenizing computing power, video, and NFTs. We interviewed Minor in 2018 about Live Planet and his thoughts on cryptocurrency.

Minor is no longer with Uphold in an employment capacity today; the current CEO is Simon McLoughlin.

Uphold currently boasts over 10 million users.

The company is based in 80 East Sir Francis Drake Blvd., Ste. 3D, Larkspur, CA, north of San Francisco.

About the Uphold Exchange

The Uphold website exchange interface offers a clean, minimalistic UI– closer to the simplicity one would expect from Coinbase and less so from the more complex trading screens on Kraken.

Uphold excels from the cryptocurrency exchange pack in that it also offers four commodities: precious metals: Gold (XAU), Platinum (XPT), Palladium (XPD), and Silver (XAG).

Users can trade over 250+ cryptocurrencies.

Uphold sign-up bonus: Uphold currently offers a $50 BTC sign-up bonus when you trade at least $600.

Uphold’s mobile app is available on both Android and iOS. Out of over 4,300 reviews on the Apple App Store, Uphold has a rating of 3.6 stars. The Uphold app is rated 4.2 stars with 15,260 reviews on Google Play.

Uphold Fees: Deposits, Trades, Withdrawals

Since Uphold supports all sorts of fiat and cryptocurrency options, its fee structure can be complex for newer traders.

Opening an account and holding funds on Uphold is free. It’s also free to fund an Uphold by depositing cryptocurrency or from another Uphold account. This means that all member-to-member transactions are free.

Uphold also doesn’t charge any fees for bank deposits or withdrawals for U.S. users using ACH.

Debit cards come with a 2.49% fee, and credit cards have a 3.99% fee.

Uphold makes money on the spread (difference between the bid and ask) on transactions– it claims its spread is typically between 0.8% to 1.2% on BTC and ETH. The spread can be higher for lower-liquidity cryptocurrencies– Uphold urges users to check rates at the Preview confirmation screen before trading.

Spreads for other trading assets and commodities range from 0.65% to 3.95%.

Precious metals are a 3% spread, in addition to the bid-ask spread charged by Uphold’s supplier.

Fiat currency trading comes with a 0.2% spread.

There is a $1 transaction fee when the amount transacted is under $1.

Uphold’s debit card comes with a $9.95 one-time fee, and each withdrawal costs $2.50.

A complete updated list of Uphold’s fees can be found on its fee page.

Uphold Competition and Alternatives

Uphold is considered one of the top ways to buy cryptocurrency, but there are always other options for various desires:

Maybe you prefer a different fee structure? Coinbase, Kraken, and Gemini all offer comparable fee structures and are typically a hair under those of Uphold.

You may want a different mobile trading experience. Robinhood offers a clean mobile trading experience, albeit with higher costs per trade.

Maybe you just fear hot air balloons, and Uphold’s logo terrifies you. Whatever you do, do not look up the hot air balloon festival in Cappadocia, Turkey.

How Do I Open an Account on Uphold?

Begin by visiting the Uphold website. Snag that $50 in BTC bonus when you trade at least $600– if you want.

Creating an account is a seamless experience and takes less than fifteen clicks from registration to purchase for individuals. You must go through the standard KYC and AML identity verification processes, such as submitting your ID.

You can also open a business account on Uphold, a unique offering, as most popular cryptocurrency exchanges only focus on individuals. However, creating a business account may take longer, requiring a more substantial verification process.

Security: Is Uphold Safe?

Overall, Uphold has a strong security track record, and its users are content with the security of the service. The exchange checks all the boxes you’d expect for a modern and compliant cryptocurrency exchange:

- Two-factor authentication (2FA) is the default for all accounts

- It has a bug bounty program

- It claims 90% of cryptocurrency is kept offline in cold storage

One minor security incident in November 2018 saw Uphold temporarily suspend BTC withdrawals– a third-party mail account was compromised, not Uphold’s existing inbound mail system; hackers tricked users by sending a phishing email that said anyone could send between 0.1 and 50 BTC to a specified address and get back 15 percent more. The hackers made away with just $2,200 from two transactions.

Security is a paramount concern for cryptocurrency exchanges.

Regarding a 2018 QuadrigaCX exchange scandal, where the founder Gerald Cotton allegedly died with private keys to $190 million, prior UpHold CEO JP Thieriot commented:

“While it’s certainly suspicious that an exchange would allow one man to hold $190 million, we can’t be sure that this was not the case. With all due sensitivity to the situation, an exchange’s cold storage being vulnerable in this way is bound to invite speculation of malfeasance. A fact pattern including $22m in frozen funds by the CIBC is also not encouraging.

Unfortunately, schemes like this are not new to the space, and continue to tarnish the reputation of exchanges, and discourage new investors. If we want to make the leap to the mass market, we have to take steps to prevent issues like these from becoming commonplace.

Universal Protocol has alluded to the systemic problem by offering recoverability of private keys, though we never contemplated an event of this scale. While this may be potentially bullish for BTC, the bigger focus is on how these events impact the industry in the long run as we collectively aim for mass adoption.”

Can You Trust Uphold?

Uphold has a very catchy tagline in the wake of cryptocurrency industry chaos… Sometimes boring is better…

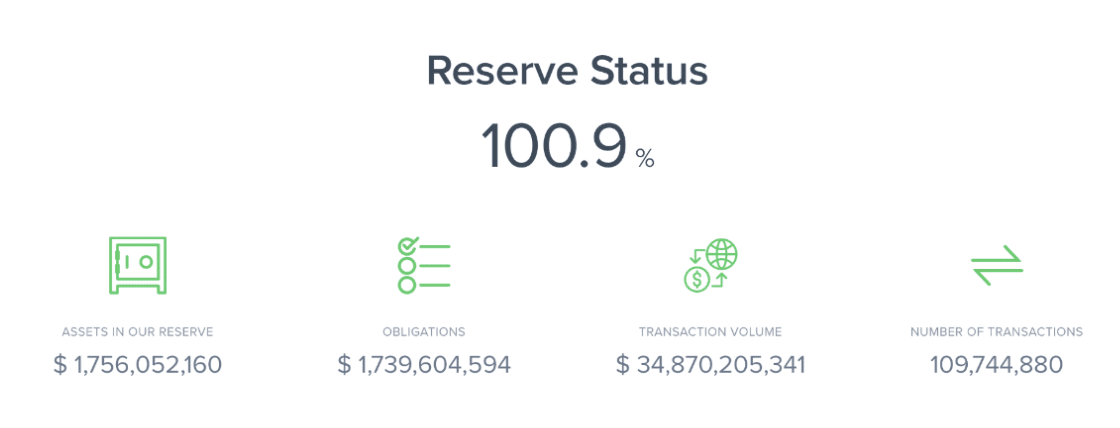

Uphold claims that its funds have always been and always will be 100% reserved, and it never lends out your cryptocurrency, so it’s always available to withdraw.

However, instead of publicly lying about the safety of its assets *cough* Alex Mashinsky. Celsius Network *cough* Uphold publishes its reserve status live.

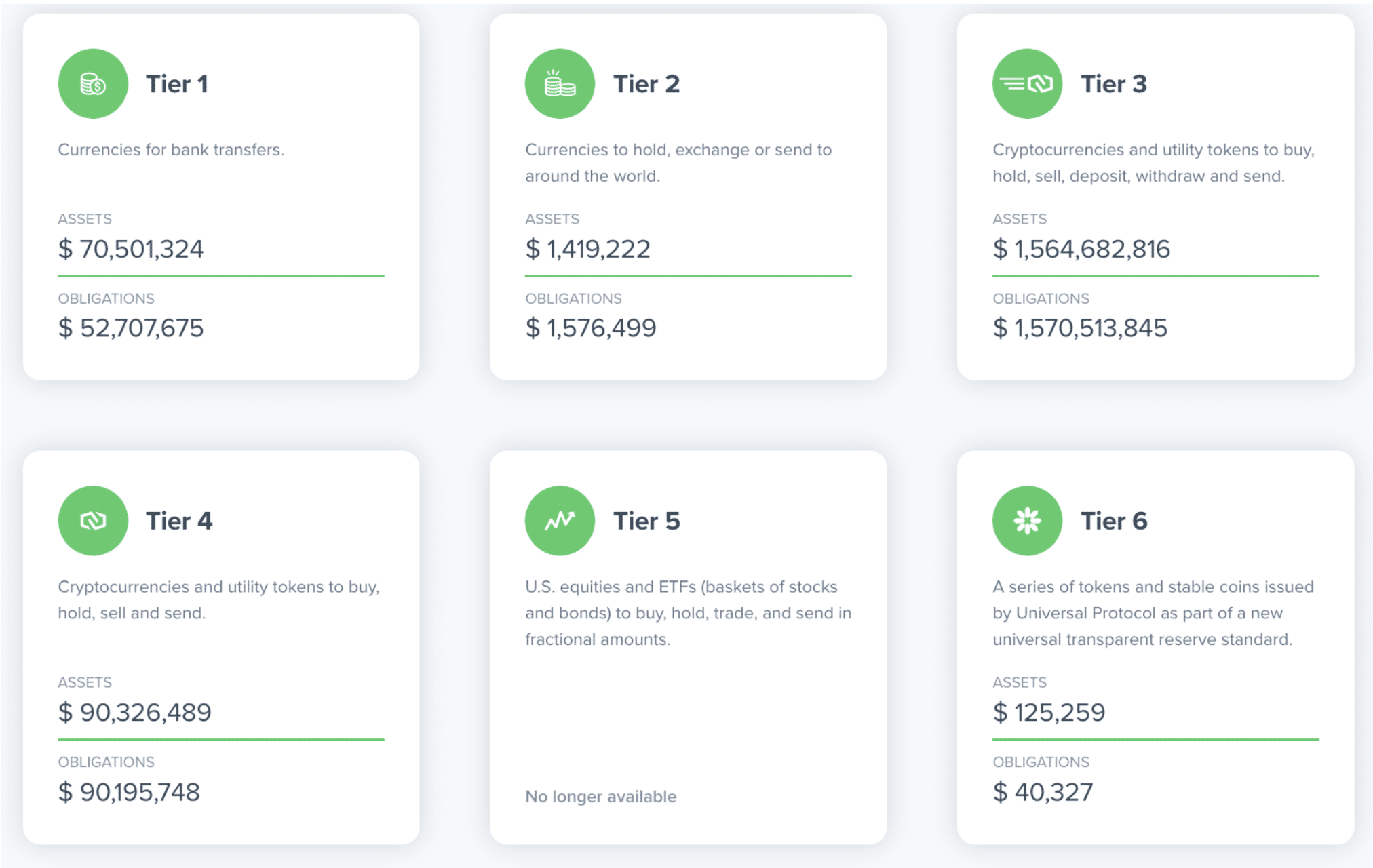

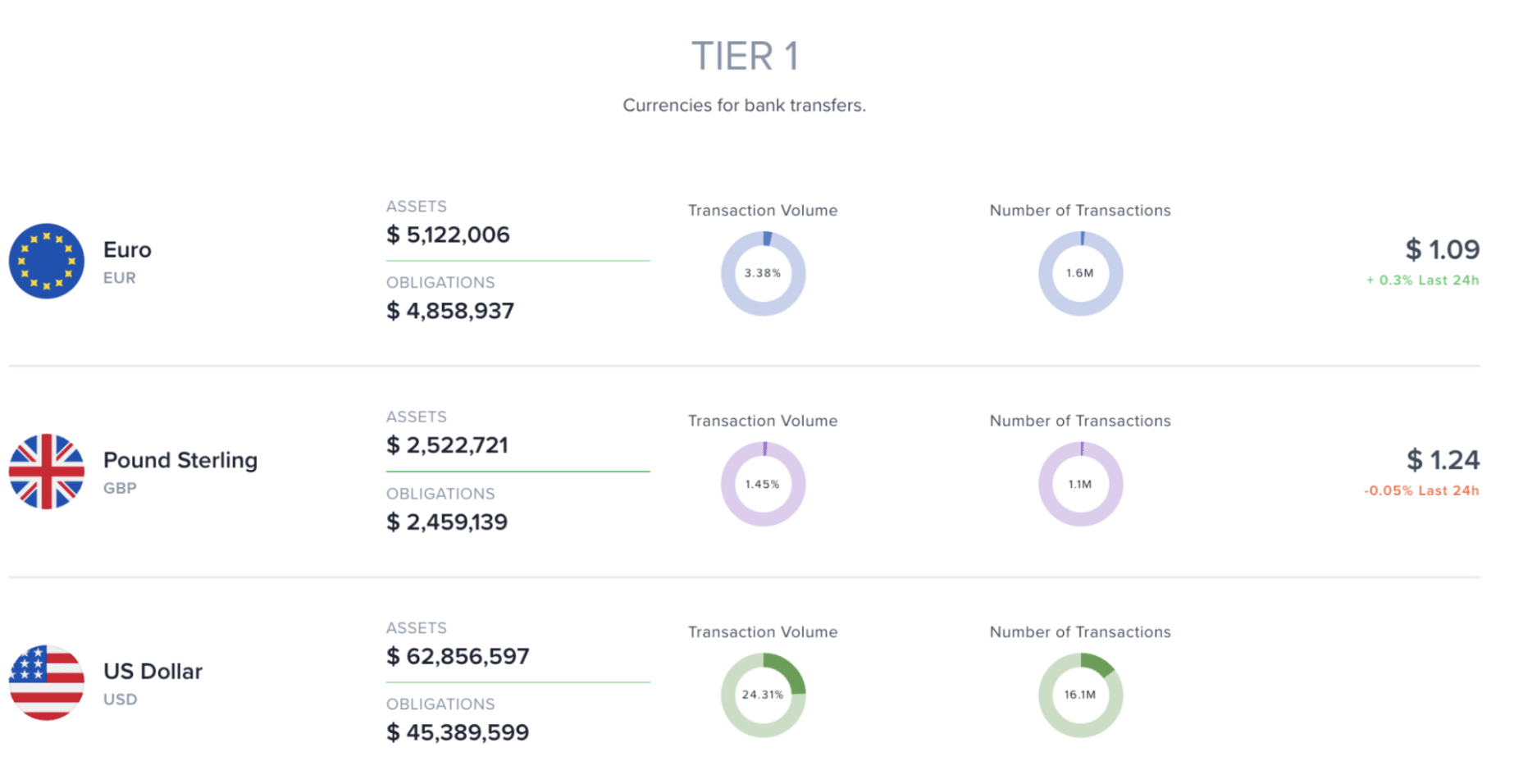

Anyone can see all of Uphold’s assets, obligations, transaction volume, and number of transactions on Uphold’s site– updated live.

The transparency section of the site highlights different views in several asset tiers and various fiat holdings.

Uphold Fiat Currency Options and Trading Limitations

The exchange supports 28 fiat currencies. This is an area where Uphold excels over the vast majority of exchanges. Most major fiat-to-crypto exchanges don’t support currencies outside of USD, EUR, GBP, and CNY.

It also supports over 250+ cryptocurrencies, including BTC, ETH, DASH, LBA, LTC, BAT, BCH, BTG and XRP.

An early Uphold innovation was the innovative things about Uphold: the ability to use email to send Bitcoin (BTC) to people in over 150 countries– a feature launched in 2018.

Access is available in every nation except for the Central African Republic, Cuba, Iran, Libya, North Korea, Somalia, Sudan, and Syria.

Uphold requires the standard AML and KYC verification processes to use the exchange. During registration, the exchange collects info like date of birth and phone number. To become a verified member, you need to provide the following three items: current residential address, government-issued ID (passport, national ID card or driver’s license), and a clear photo of your face.

Customer Service Experiences

Uphold boasts an overall rating that is generally better than many exchanges, according to third-party review sites like TrustPilot.

While Uphold excels in many areas, the negative reviews mostly focus on issues related to customer service requests. Account locks after filling out verification information or depositing funds appear to be common. Some users have reported that they have talked with multiple customer service representatives over periods of days or weeks and have not been able to resolve their issues.

Still, many complaints listed in reviews are unfair. For example, some users gave bad reviews for long and/or inconsistent ACH transfer wait times. For the most part, this issue is outside of the control of Uphold or any other exchange.

In most scenarios, this has more to do with the processing capabilities of an individual’s bank.

Uphold Staking Updates

Uphold offers its staking program everywhere it operates except the United States.

The exchange suspended its staking services in the United States following SEC guidance– similarly, exchanges like Coinbase, Kraken, and Gemini were beckoned to do the same.

The SEC considered Staking-as-a-Service providers as offering securities, which is a notion currently being challenged in courts. As per proof-of-stake blockchain programming, staking essentially helps validate transactions and secure a blockchain network– which is different from the context implied by offering securities.

However, rules are rules, and Uphold is playing ball.

If the argument is successfully challenged, uphold plans to reintroduce staking in the United States.

Uphold does offer its crypto-staking service everywhere else in the world. It offers ten popular staking-enabled cryptocurrencies, such as:

- Ethereum (ETH)

- Cardano (ADA)

- Polkadot (DOT)

- Solana (SOL)

Final Thoughts: Is Uphold Legit

Overall, Uphold boasts some features that should qualify it as a top exchange choice for any beginner to intermediate.

The exchange’s history since 2014 has so far been anticlimactic, which is an excellent quality in an industry still dazed by the likes of FTX, Celsius Network, Voyager, and BlockFi.

However, it’s worth noting that Uphold, like all other centralized exchanges, takes custody of your private keys and assets, which is one significant layer of control away from being fully decentralized and in control of your funds.

By most cryptocurrency exchange grading systems, Uphold is a perfectly good (thankfully, boring) exchange that is running in accordance with all regulatory guidelines. What really sells us on the exchange is its public publishing of assets and obligations that showcase the exchange isn’t lending out your assets ever.

The fees are reasonable, and the exchange has offered periodic no-trading fee periods to encourage new user sign-ups.

Uphold is right for you if:

- You want a simple, straightforward exchange with a clean user interface that you can trust to keep your cryptocurrency safe, given you take the proper user precautions.

- You want to access and spend your cryptocurrency online and in stores using the Uphold debit card.

- You want to dabble in fiat currency exchanges and commodities in a single platform.

Ultimately, the decision to make an account on Uphold is up to you– it offers a $50 BTC sign-up bonus when you trade at least $600.

If your experience with the exchange or company is different from what we’ve described above, please reach out to us and let us know.

“Uphold Disclaimer: Assets available on Uphold are different per region. All investments and trading are risky and may result in the loss of capital. Cryptoassets are largely unregulated and are therefore not subject to protection“