TLDRs;

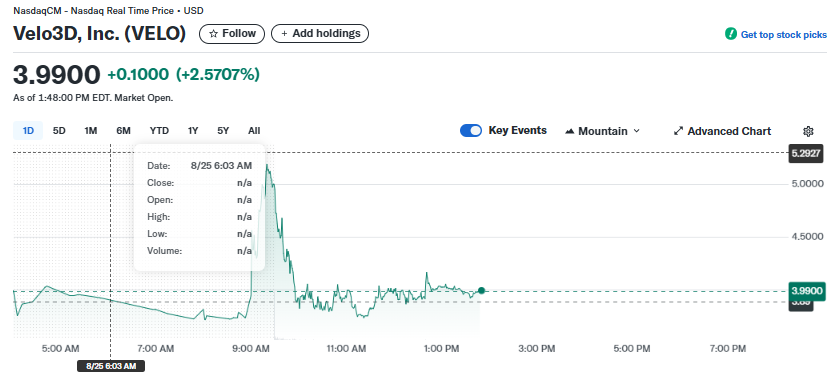

- Velo3D (VELO) stock jumped over 2% after joining a U.S. Army-funded defense manufacturing initiative with RTX and Raytheon.

- The partnership focuses on advanced aluminum additive manufacturing to support missile defense modernization and system readiness.

- Recent Nasdaq relisting and $17.5M public offering strengthen Velo3D’s financial position for future growth opportunities.

- Investors see renewed confidence as Velo3D aligns with defense priorities and expands its role in supply chain resilience.

Velo3D, Inc. ( VELO) shares soared 2.5 % on Monday after the additive manufacturing firm announced a new collaboration with RTX and the Raytheon Technologies Research Center.

The partnership, backed by U.S. Army funding, is designed to push forward aluminum-based additive manufacturing processes that could reshape the future of defense production.

The surge comes just days after Velo3D completed a $17.5 million public offering and secured a fresh listing on the Nasdaq Capital Market, signaling a strong comeback following its delisting from the New York Stock Exchange earlier this year.

Army-Backed Project Sparks Investor Optimism

The U.S. Army Combat Capabilities Development Command Aviation & Missile Center (DEVCOM AvMC) and its Manufacturing & Sustainment (M&S) program selected Velo3D’s advanced metal additive manufacturing platform to develop a high-throughput laser powder bed fusion (L-PBF) process for Aluminum CP1.

The effort supports the Army’s broader Integrated Air and Missile Defense modernization priorities, including enhanced affordability, agility, and readiness across multiple systems.

Dr. Arun Jeldi, CEO of Velo3D, emphasized that the company’s integrated platform was chosen for its ability to overcome long-standing limitations of legacy L-PBF systems.

“Our approach combines factory tool matching, in-situ monitoring, standardized process parameters, and centralized data systems. This ensures consistent, repeatable outcomes across sites and machines,” Jeldi said.

Strategic Alignment With Defense Modernization

Industry leaders argue that additive manufacturing is quickly becoming a cornerstone of the defense industrial base. For the Department of Defense, the initiative aims to establish an Installation and Operational Qualification (IOQ) framework, replacing outdated point-qualification models.

Such a system could create a scalable, distributed manufacturing approach across both military and supplier ecosystems, critical for ensuring rapid deployment and maintenance of advanced defense systems.

The collaboration signals the Army’s intent to accelerate innovation through public-private partnerships, while also bolstering domestic industrial capabilities.

Market Momentum Reinforced by Nasdaq Listing

Velo3D’s surge in stock price comes shortly after its relisting on Nasdaq following a $17.5 million public offering. Shares were priced at $3.00 each, with Lake Street Capital Markets serving as the sole book-running manager. The company also executed a 1-for-15 reverse stock split earlier this year to stabilize its capital structure.

Proceeds from the offering are expected to fund working capital, capital expenditures, and general corporate initiatives, providing financial flexibility as the company pursues large-scale defense and aerospace contracts.

With prior partnerships already established with Momentus and Ohio Ordnance Works, the new RTX-backed collaboration further validates Velo3D’s technology in critical sectors.

A Turning Point for Velo3D?

The dual catalysts of Nasdaq re-entry and U.S. Army funding have positioned Velo3D as a prominent player in the defense manufacturing ecosystem.

Investors appear to be betting that the company’s specialized capabilities in metal additive manufacturing will unlock long-term opportunities, especially as defense agencies shift toward resilient, decentralized production.

Although challenges remain, including stiff competition in the additive manufacturing space and the need to prove scalability, Velo3D’s latest partnership signals renewed momentum.