TLDR

- Veteran trader Peter Brandt says Bitcoin should peak this week based on its historical four-year cycle pattern

- Sunday marked 533 days after the April 2024 halving, matching the 533 days from the 2022 low to the halving

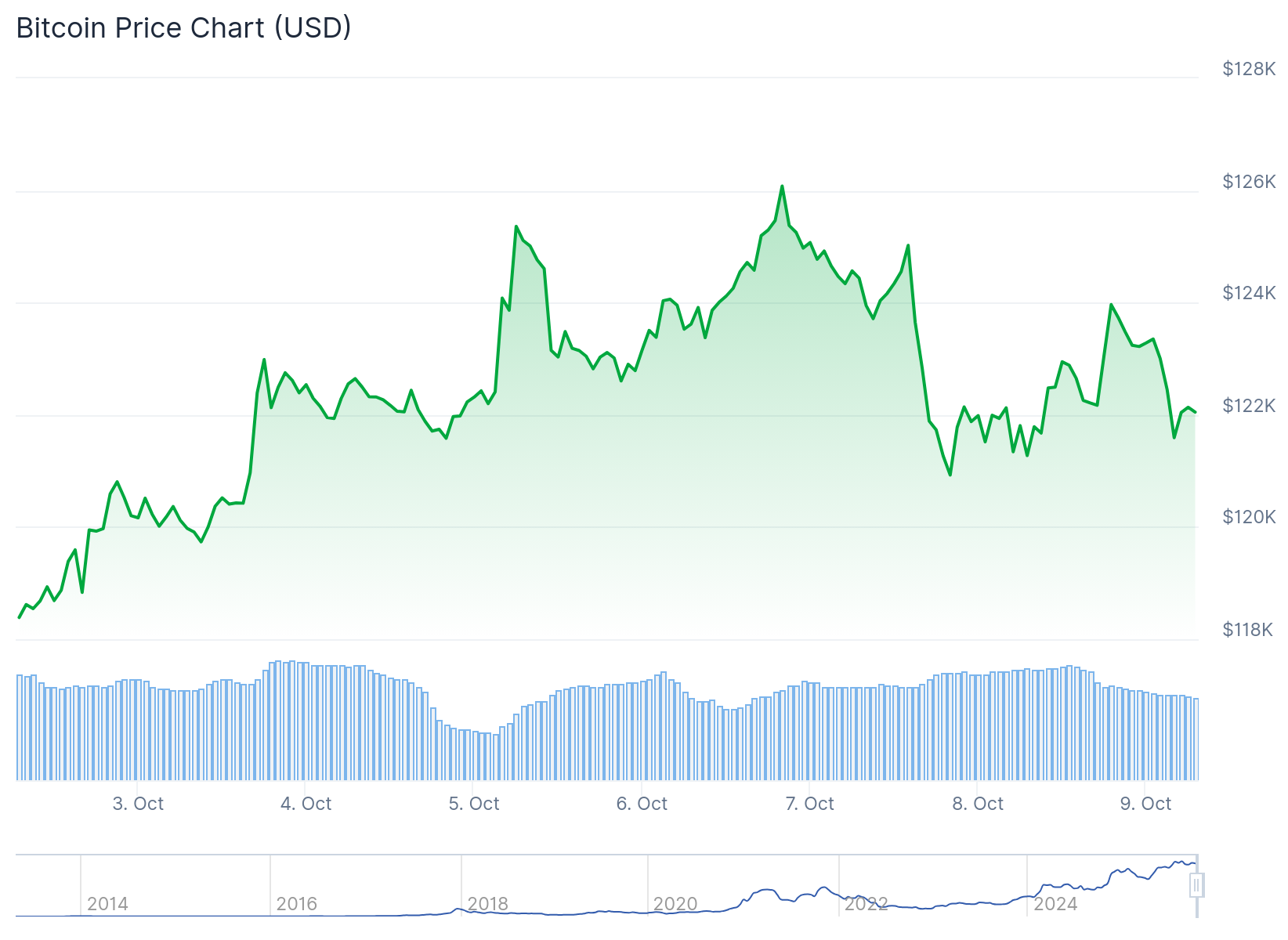

- Bitcoin hit a new all-time high above $126,100 on Monday, one day after the predicted cycle top

- Brandt sees a 50/50 chance of either a cycle top now or a break above $150,000 if the pattern fails

- Quantum computing concerns have emerged as a potential long-term risk to Satoshi Nakamoto’s estimated 1.1 million Bitcoin holdings

Bitcoin reached a new all-time high above $126,100 on Monday. The move came just one day after a date that veteran trader Peter Brandt identified as a potential cycle peak.

Brandt told Cointelegraph that Bitcoin’s current cycle follows a clear mathematical pattern. The cryptocurrency hit its cycle low on November 9, 2022, which was 533 days before the April 20, 2024 halving.

The pattern suggests Bitcoin should peak 533 days after the halving. That calculation points to this past Sunday as the target date.

Historical Pattern Faces Test

Bitcoin has followed this cycle structure in all three previous market cycles. Each cycle has shown equal distances from low to halving and halving to high.

Brandt says the pattern has a perfect three-for-three record. The current cycle marks the fourth test of this theory.

The trader maintains a neutral stance on whether the pattern will hold. He assigns a 50/50 probability to either outcome.

If the cycle breaks this time, Brandt expects “dramatic” price action. He projects Bitcoin could reach between $150,000 and $185,000 in that scenario.

Bitcoin currently trades at $122,070, up 9.74% over the past 30 days. The price briefly topped $126,100 on Monday before pulling back.

The debate over Bitcoin’s four-year cycle has intensified in recent months. Crypto analyst Rekt Capital said in July that the market would likely peak in October if following the 2020 pattern.

Institutional adoption has changed market dynamics compared to previous cycles. The introduction of spot Bitcoin ETFs and corporate treasury adoption represent new factors.

Gemini’s head of APAC region Saad Ahmed says market cycles stem from people getting excited and overextending themselves. The pattern then corrects to an equilibrium after a crash.

Price Predictions Vary Widely

Economist Timothy Peterson estimates a 50% chance Bitcoin ends October above $140,000. His projections use simulations based on the past decade of data.

BitMEX co-founder Arthur Hayes projects Bitcoin could reach $250,000 by the end of 2025. Unchained’s director of market research Joe Burnett shares this long-term target.

Peter Brandt has also identified quantum computing as a potential risk to Bitcoin. He called Satoshi Nakamoto’s estimated 1.1 million Bitcoin holdings the “ultimate risk” to the cryptocurrency.

The concern centers on quantum computers potentially breaking Bitcoin’s encryption. Capriole founder Charles Edwards recently raised questions about this threat.

Some experts believe quantum computing risks are overblown. F2Pool co-founder Chun Wang says the necessary technology remains decades away.

Satoshi’s Bitcoin holdings have remained untouched for approximately 15 years. The coins are spread across multiple wallets that have never moved.

Galaxy CEO Mike Novogratz believes Satoshi is dead. This theory would explain why the massive fortune has never been accessed.

Bitcoin’s price action over the coming weeks will provide clarity on whether the four-year cycle remains intact. Brandt says he will remain bullish and hopeful for a break above the historical pattern.