Visa, the world’s second-largest card payment company, is very selective in how it selects partnerships. So, when Digitap ($TAP), an emerging “omni-bank” platform, confirmed the launch of Visa-backed debit cards that allow users to spend crypto like cash, investors took notice.

Digitap’s partnership with Visa is unique, as it provides real-world utility to everyday consumers. By contrast, Ripple (XRP), the crypto giant built for payments, can’t claim to be a Visa partner and is now reduced to billion-dollar mergers and acquisitions deals for software companies to spur growth.

Meanwhile, Solana (SOL) was named by Visa as a “good candidate” to assist in Visa’s stablecoin settlement pilot, but its focus is elsewhere. This clears the way for Digitap to best leverage its relationship with Visa and drive potentially incredible returns for tokenholders.

Digitap’s App Is Live: Visa Cards Link Crypto And Fiat For Daily Use

Digitap aims to be an all-in-one digital bank for the modern era, combining both crypto and fiat. The platform combines multi-currency wallets, international transfers, and spending through prepaid Visa cards. Digitap’s app is now live and functional, supporting Apple Pay and Google Pay.

To take advantage of the Visa card, users simply need to hold fiat or crypto in their account and load their card with their preferred method. If there are no funds at the time, Digitap’s AI-powered platform will automatically determine which source to draw from at the time of the transaction.

Currently in its presale round, Digitap has already rewarded early investors after successfully raising $1.2 million. The first round had its native $TAP token priced at $0.0125. Now in the third round, $TAP is selling for $0.0268, giving early investors who invested in one of the hidden crypto gems a more than 144% paper profit.

Digitap’s $20 Case: Volume, Take Rate, And Buybacks In Plain Math

Digitap’s strong presale gains might mark just the beginning of a sustainable multi-year run to $20 a token. If Digitap’s consumers transact around $600 billion a year through its Visa card, Digitap’s profit take with Visa is likely half a percent per dollar (a reasonable discount based on Wise’s disclosed take rate to account for Digitap’s smaller size), or $2.7 billion in revenue.

Current fintech and payment companies are valued between 10 times and 20 times revenue. Using a middle 15x multiple implies a $40 billion valuation for Digitap, or $20 per token based on the total supply of 2 billion tokens.

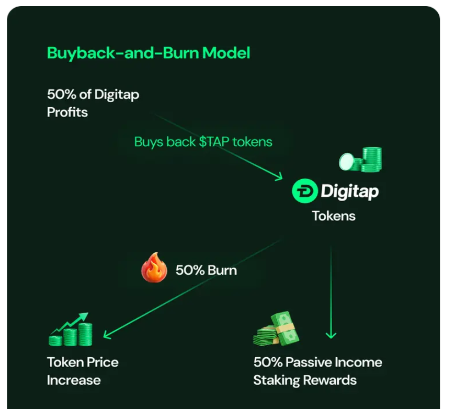

But Digitap allocates 50% of profits toward token buybacks, so the math behind one of the best ICO presales gets easier to justify as the company scales in size. The larger the user base and transactions, the fewer tokens exist, thereby artificially driving up the value of each coin due to scarcity.

Source: Digitap

No Near-Term Catalyst for XRP; Sellers Still Control The Tape After 14% Slide

After years of attempts to land a major payment processor partner, XRP’s real-world adoption lags behind expectations. It’s integrated into some bank systems, but in practice, its ledger is barely used for settlement.

Many had hoped for XRP to work closely with Visa. However, Visa’s decision on Oct. 29 to focus on stablecoins to speed up cross-border payments leaves XRP in the shadows.

Currently trading at around $2.44, XRP is much closer to the support level of around $2.20 than the resistance level of $3.10. Given the overall weakness in the crypto market, XRP is at risk of testing the $2.20 level. If investors don’t show up to scoop up the token, it risks falling back to the $2.00 level where it traded in June.

XRP doesn’t have any immediate catalysts to support an upside movement. Given the token is already down 14% over the past month, the selling pressure is likely to continue.

Solana’s Growth Surges; Price Still Fails To Clear $200 This Month

A 2023 report published by Visa named Solana a “good candidate” for Visa’s stablecoin settlement project. The report said Solana is an ideal candidate to help power mainstream payment flows due to its speed, scalability, and low transaction costs of less than $0.001.

However, Solana likely decided to stick to what it does best. Since the 2023 Visa report, Solana has seen its total value locked surge from less than $500 million to over $11 billion today. Active daily users have also skyrocketed from less than 100,000 to 2.5 million today.

Solana isn’t doing anything wrong; it is seeing impressive growth metrics within its core business model. However, a Visa partnership could have been the catalyst to drive the token toward $300.

Instead, Solana’s token has failed to trade above the $200 level on multiple occasions. However, it has found strong support between $170 and $180, so the Solana near-term price outlook is likely to remain range-bound.

Visa Deal Validates Digitap’s Model In Real-World Payments At Scale

Digitap’s Visa partnership validates its business model and provides confidence that a startup is worthy of integration with one of the world’s largest payment networks.

The partnership also signals that crypto is no longer on the outside looking in; rather, it is a core component of the global financial infrastructure. This adds credence to what some call a lofty $20 Digitap price target. Still, in reality, it is justified from a very small piece of a multi-trillion-dollar pie, making Digitap one of the more attractive crypto presales with real utility.